The spotlight was on the FOMC decision this week, but the ECB and BOJ policy shifts did their part to spark wild rides, along with a few other market surprises from China and Australia.

A busy earnings calendar also allowed U.S. equities to hold their ground while crude oil extended its gains for another week.

Feeling lost in this week’s swirling sea of big time catalysts? No worries, we’ve got you covered! Brace yourself, ’cause here come the juiciest headlines first!

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

On Tuesday, PBOC intervened in FX market to strengthen the yuan, setting USD/CNY at 7.1406 vs. 7.2044 expected

China promised more stimulus, including rate cuts, tax cuts, debt resolution, real estate policy tweaks and fee reductions, according to state-sponsored media

U.S. Q2 advanced GDP pointed to stronger growth of 2.4% q/q vs. estimated 1.8% GDP reading and earlier 2.0% figure, which was upgraded from the initially reported 1.1% reading

U.S. durable goods orders surged by 4.7% m/m vs. 1.3% forecast and 1.8% previous, core durable goods orders up by 0.6% vs. projected 0.1% uptick

U.S. Core PCE for June: 0.2% m/m as expected vs. 0.3% m/m previous

University of Michigan Consumer Sentiment Index for July: 71.6 vs. 64.4 previous

? Broad Market Risk-off Arguments

French flash manufacturing PMI slipped from 46.0 to 44.5 to signal sharper contraction vs. estimated 46.1 figure, services PMI dipped from 48.0 to 47.4 vs. 48.5 forecast in July

German flash manufacturing PMI tumbled from 40.6 to 38.8 in July to reflect faster pace of contraction vs. 40.9 consensus, services PMI down from 54.1 to 52.0 to indicate slower growth

U.K. S&P Global flash manufacturing PMI for July came in at 45.0 vs. 46.5 previous, as employment rose for the fourth month in row but at a slower pace

U.K. S&P Global flash services PMI for July slipped from 53.7 to 51.5 vs. 53.1 estimate, reflecting a slower pace of industry growth

German Ifo business climate index fell from 88.6 to 87.3 vs. 88.0 forecast, falling below its long-term average

BOJ core CPI ticked lower from 3.1% year-over-year to 3.0% in June as expected, indicating a dip in underlying price pressures

Australian headline CPI slowed from 1.4% q/q to 0.8% vs. 1.0% expected, annual reading down from 5.6% to 5.4% as expected

FOMC hiked interest rates by 0.25% from 5.25% to 5.50% as expected, kept the door open for future rate hikes as Powell said they’ll go on a meeting-by-meeting basis

European Central Bank raised the deposit rate to 3.75% as expected but signaled that the hiking regime may be nearing the end, with Lagarde suggesting that a hold is on the table for the next meeting

The Bank of Japan kept interest rates steady at -0.10%, but also raised the upper limits of its fixed-rate bond-buying program from 0.5% to within 1.0% of the 0% target,

Global Market Weekly Recap

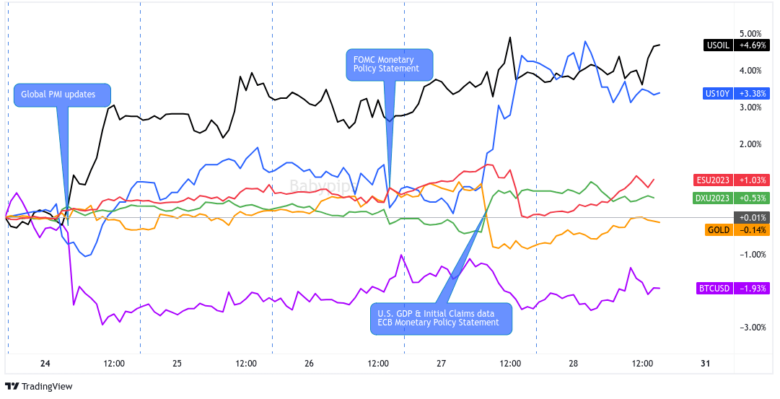

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TV

Market watchers woke up on the wrong side of the bed this week as they were greeted by downbeat global PMI readings.

In particular, dismal figures from the manufacturing and services sectors of Germany, France, and the U.K. dragged European yields lower, but equities and commodities remained surprisingly resilient ahead of the central bank decisions and earnings reports.

Besides that, risk-taking came in play when China‘s Politburo announced that the country will stick to “proactive fiscal policy and a prudent monetary policy” while also keeping the yuan at “generally stable at an appropriate and balanced level.”

The Australian dollar was the main beneficiary of this announcement, along with copper and iron ore. After all, it drove speculations of even more stimulus, which might include rate cuts, tax cuts, debt resolution, real estate policy tweaks and fee reductions. In turn, this could translate to stronger demand for commodities and raw materials for the property sector, which would greatly benefit the Australian economy.

On the other hand, the below-average German Ifo business climate index further weighed on the euro and European equities, as traders probably priced in a less hawkish ECB decision for Thursday.

Later on, U.S. bond yields and equities got an extra boost from stronger than expected CB consumer confidence data, which suggested that Americans are brushing off recession fears. Equities were also on solid footing leading up to Alphabet’s earnings release, thanks to notable gains in the IT and materials sectors.

Softer than expected Australian CPI data printed the next day dashed hopes for future RBA tightening, forcing the Australian dollar to return majority of its recent winnings. However, losses among other commodity currencies and higher-yielding assets were contained, as traders likely lightened up their bets ahead of the highly-anticipated FOMC decision.

As expected, the U.S. central bank increased borrowing costs by 0.25% but what took many by surprise was the stubbornly hawkish stance that kept the door open for more hikes.

Fed head Powell emphasized their data-dependent approach, which means that they are not ruling out another potential rate increase in September, driving the dollar and Treasury yields higher while safe-haven flows resumed.

The reaction among U.S. equity indices was mixed, with the S&P tossing and turning but ending the day mostly unchanged. Meanwhile, the Nasdaq ended up slightly in the red after Microsoft shares tumbled due to slower cloud computing growth figures.

Meanwhile, crude oil returned some of its earlier gains when the EIA inventories report showed a smaller than expected reduction in stockpiles, suggesting that consumption isn’t as strong as predicted. Gold still managed to hold on to its gains, though, as the prospect of higher borrowing costs kept investors wary about a recession.

The ECB decision took center stage the next day, as the central bank delivered on a widely expected 0.25% hike. Head honcho Lagarde dropped quite the bombshell, though, when she toned down their previous hawkish bias during the press conference.

In particular, she noted that “The near-term economic outlook for the euro area has deteriorated owing largely to weaker domestic demand,” suggesting that a pause may be on the table for the next meeting.

Not surprisingly, this triggered another wave lower for European yields, with the German two-year yield initially tumbling as much as 12bps to 3.02% while the 10-year yield fell 8bps to 2.40%. In contrast, U.S. yields were able to benefit from the impressive U.S. advanced GDP reading and lower than expected initial jobless claims figure.

Soon after, it was the BOJ’s turn to steal the show, as traders got wind of rumors that the central bank might tweak its yield curve control policy during Friday’s announcement. As it turned out, a Nikkei report suggested that the BOJ will consider letting long-term interest rates rise above its 0.5% cap by “a certain degree,” spurring a sharp Thursday U.S. session rally for the yen.

It turns out that report hit the nail on the head as the Bank of Japan did in fact lift the upper limits of its fixed-rate bond-buying from 0.5% to within 1.0% of the 0% target. This sparked a spike higher in the yen, which was then reversed during the BOJ press conference. It’s possible Governor Ueda’s insistence that the adjustment to yield curve control policy WAS NOT a step towards policy normalization likely had traders re-thinking it was time for a fresh yen rally to form.

And during the Friday U.S. session, the closely watched U.S. core PCE Price Index update hit the wires, (ticking lower once again to 0.2% m/m vs. 0.3% previous), as well as another strong U.S. consumer sentiment read from the University of Michigan. Both combined were likely contributors to a net positive broad risk-on lean going into the weekend, as well as the Greenback closing net green for the week.