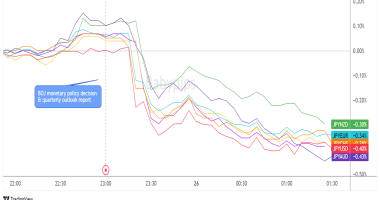

While the Japanese yen was the star of the forex show, the other major asset classes & currencies still chalked up pretty noticeable moves of their own thanks to a busy calendar. Crude oil and bitcoin were notably in selloff mode throughout the week, barely able to regain lost ground, unlike gold and the S&P 500 that managed to pulled higher after the FOMC decision. King Dollar was almost the biggest loser among the major currencies, slightly gaining only against the Loonie, which likely felt the pressure from falling oil prices. Here’s how it all went down!

This Article Is For Premium Members Only

Become a Premium member for full website access, plus get:

- Ad-free experience

- Daily actionable short-term strategies

- High-impact economic event trading guides

- Access to exclusive MarketMilk™ sections

- Plus More!