Borrowing costs rose and shares tanked yesterday as investors sold UK assets after record wage growth fuelled fears that interest rates will keep rising.

On a bruising day for investors, London’s FTSE 100 Index fell 1.6 per cent, or 117.51 points, to 7389.64, its lowest level for more than a month.

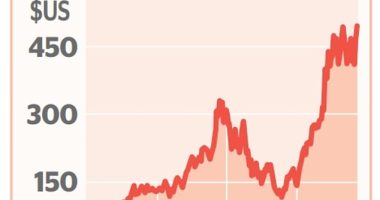

Government borrowing costs pushed higher with the yield on 10-year bonds climbing to just under 4.7 per cent, while the two-year gilt yield rose above 5.1 per cent.

The sell-off was sparked by Office for National Statistics (ONS) data showing average weekly earnings rose by 7.8 per cent in the three months to June compared with a year earlier.

That was the highest rate since records began and beat all economists’ expectations.

Government borrowing costs pushed higher with the yield on 10-year bonds climbing to just under 4.7%, while the two-year gilt yield rose above 5.1%

The figure is likely to have alarmed the Bank of England, which is worried about the prospect that higher wages could help push prices higher, creating a dangerous spiral that entrenches inflation.

It cemented expectations that the Bank will hike interest rates from 5.25 per cent to 5.5 per cent next month, with markets pricing in a near-90 per cent chance of the move.

The chances of rates rising to 6 per cent by the end of the year have also risen sharply.

Higher interest rates will hurt mortgage holders and business borrowers, threatening to drag on the UK’s economic recovery.

The prospect that rates will rise also boosted the pound, which climbed by nearly a cent to just over $1.275 against the US dollar before paring some of those gains. It also rose against the euro towards €1.17.

All eyes will be on the ONS again today when inflation figures for July are published. They are expected to show a sharp fall from 7.9 per cent to 6.8 per cent.

Henk Potts, market strategist at Barclays Private Bank, said that despite some signs of inflation pressures falling, the Bank of England is ‘not yet on a position to declare a cessation of hostilities’ in its battle to bring it down to its 2 per cent target.

Economists at Nomura said: ‘Increasingly, it looks like wage growth is a problem that the Bank of England cannot shift.’

They pointed out that private sector wage growth, a key metric for the Bank, accelerated to 8.3 per cent in June while there were upward revisions to prior months.

And the fact that wages grew in real terms for the first time since 2021 – meaning they rose by more than inflation – also poses a headache for policy makers as they try to keep a lid on demand.

Russ Mould, investment director at AJ Bell, said the wage figures meant that ‘alarm bells are ringing on UK inflation once more’.

Mould said: ‘This builds pressure on the Bank of England and has prompted an increase in sterling and gilt yields, as well as a big fall in UK stocks, as it suggests inflation is becoming increasingly entrenched in the economy.

However, it is a fine balance. Other elements of the ONS data show signs the labour market could be cooling, with an increase in unemployment and a drop in the number of vacancies.

‘It all adds up to a very tricky situation for the brains trust in Threadneedle Street which might only be further complicated by the inflation release today.’