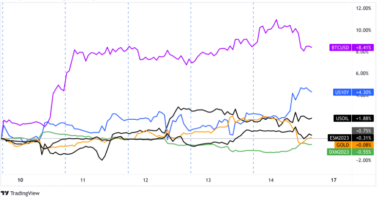

Mixed week for the British pound, but finishing arguably net positive as sentiment on a Brexit deal seemed to be more optimistic than not for most of the week. Counter currency flows were also an influence given unusual strength in CAD, EUR, and CHF this week.

United Kingdom Headlines and Economic data

Monday:

Confidence in UK housing market cooled in November – Halifax House price sentiment tracker fell to 51.6 from 52.4 in October.

‘Deal can be done in days’ says Dominic Raab as breakthrough looms

U.K. Set to Be First to Clear Pfizer-BioNTech Covid Vaccine – The shot was 95% effective in a clinical trial of almost 44,000 people, with no significant safety problems so far.

EU negotiator Barnier says Brexit trade negotiations are an ongoing process

Irish foreign minister says fishing could sink EU-UK trade talks

UK mortgage approvals jump again to 13-year high – Mortgage approvals for house purchase hit 97,532, up from 92,091 in September and higher than a median forecast of just under 84,500 in a Reuters poll of economists.

Tuesday:

U.K. Manufacturing sector growth improves but consumer

goods industry remains in doldrums – “The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index rose to a 35-month high of 55.6 in November, up from 53.7 in October. ”

UK’s Gove says: there’s a chance of a no-deal Brexit

Barnier Voices Caution as Brexit Negotiators Race to a Deal

Wednesday:

Covid-19: Pfizer/BioNTech vaccine judged safe for use in UK from next week

UK becomes first country to approve Pfizer’s Covid-19 vaccine, first shots roll out next week

UK has lowered demands on fish catches, says EU

Barnier Tells EU Envoys Three Main Brexit Issues Unresolved – The British pound soured on the session on this news that the level playing field for businesses, access to British fishing waters and agreement enforcement are still holding back a final deal.

Thursday:

EU envoys urge Britain to compromise to secure Brexit trade deal

France Floats Veto Threat on Brexit Deal as EU Feels Strain – “France is leading a group of countries worried that Barnier will surrender too much access to British fishing waters and back down on conditions designed to prevent U.K. businesses getting an unfair competitive advantage.”

Renewed downturn in UK service sector activity, but optimism reaches its highest level since February – “IHS Markit/CIPS UK Services PMI Business Activity Index dropped to 47.6 in November form 51.4 in October”

Data sharing confusion four weeks before Brexit completes

Over pizzas, EU-UK negotiators push for deal but outcome uncertain – EU official

Prospect of breakthrough receding’ in UK-EU talks – we begin to see Sterling’s rally stabilize and take a dip during the U.S. session on this development. Enforcement of the new rules seems to be the sticking point at that time.

Friday:

Stronger construction sector growth led by fastest rise in new orders since October 2014 – The index rose to 54.7 in November from 53.1 in October.

Brexit Negotiators Race to Save Trade Deal Amid Spat With France – talks will continue into the weekend with U.K. Prime Minister Boris Johnson and European Commission President Ursula von der Leyen to hold a crisis call. Sterling seems to have taken as step back before the close as a deal still seems far away, and possibly on traders taking some risk off before the weekend.