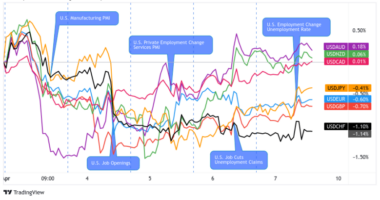

Dollar domination was the main theme early in the week, as bulls carried on with their post-NFP charge.

However, commodity currencies like AUD and CAD took center stage after their central banks announced surprise interest rate hikes.

In addition, the Loonie managed to benefit from the OPEC+ announcement of voluntary output cuts.

USD Pairs

Yet another upside NFP result for May boosted the Greenback against its rivals at the beginning of the week as dollar traders revived hopes for a June Fed hike instead of a “Fed pause.”

These gains were quickly reversed when the ISM services PMI came in weaker-than-expected (market players took note of how the prices component signaled much slower inflationary pressures), followed by increased selling pressure after a weaker-than-expected weekly initial jobless claims update on Thursday.

? Bearish Headline Arguments

ISM services PMI fell from 51.9 to 50.3 in May, reflecting a slower pace of expansion versus the estimated improvement to 52.6

Factory orders posted a 0.4% month-over-month uptick in April versus the projected 0.8% gain and previous 0.6% increase

IBD/TIPP economic optimism index for June ticked higher from 41.6 to 41.7, falling short of 45.2 consensus

Trade deficit widened from 60.6 billion USD to 74.6 billion USD in April, its largest shortfall in six months, as exports slumped 3.6% while imports rose 1.5%

Initial jobless claims for the week ending June 3 came in at 261K, higher than the projected 236K figure and earlier 233K reading

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TV

The lack of top-tier reports kept the euro functioning as a counter currency for the most part of the week, although a general bearish direction likely ensued from the downbeat low-tier data released.

Mid-week broad risk-off vibes momentarily helped the euro see green through mid-Thursday, a lot of which was given back on Friday as the risk mood improved ahead of the weekend.

? Bullish Headline Arguments

German trade surplus widened from 14.9 billion EUR to 18.4 billion EUR in April, as imports fell 1.7% while exports rose 1.2%

? Bearish Headline Arguments

Eurozone producer prices slumped 3.6% month-over-month in April versus estimated 3.0% dip, following earlier 1.3% decline

German factory orders tumbled 0.4% month-over-month in April instead of rising by the estimated 2.7% figure, March reading downgraded to show sharper 10.9% drop

Eurozone retail sales stayed flat in April instead of posting the projected 0.2% uptick, March figure upgraded from a 1.2% slump to just a 0.4% dip

German industrial production rose only 0.3% month-over-month in April instead of the estimated 0.7% increase, March reading upgraded from 3.4% decline to 2.1% decrease

GBP Pairs

There wasn’t much on the U.K. economy’s docket for the week, leaving pound traders to hold out ahead of the BOE decision later this month.

Mid-tier reports came in mostly weaker than expected, particularly when it came to consumer spending and housing, suggesting that the rate hikes continue to take toll on economic activity.

But risk sentiment seems to be the dominant theme for Sterling starting on Wednesday as it closed higher than most of the majors, losing out only to AUD and NZD by the Friday close.

? Bullish Headline Arguments

Construction PMI improved from 51.1 to 51.6 in May, outpacing the forecast at 50.9 to reflect a stronger pace of industry growth

RICS house price balance showed 30% of surveyors reporting a price decline in their area for May, an improvement over the earlier 39% reading

? Bearish Headline Arguments

BRC retail sales monitor slumped from 5.2% year-over-year to 3.7% in May, falling way below 5.2% forecast and reflecting a sharp decline in spending

Halifax HPI showed no change in house prices for May instead of posting the projected 0.2% uptick, still noting an improvement over the earlier downgraded 0.4% decline

CHF Pairs

The franc was an odd one this week, spending a lot of the time in the green against most of the majors, likely benefiting from some traders out there staying focused on recession speculation.

It did begin to lose its mojo on Thursday, but fortunately for franc bulls, hawkish comments from Swiss National Bank Chair Jordan signaling more interest rate hikes ahead saved the day.

? Bullish Headline Arguments

Swiss CPI came in line with estimates of a 0.3% monthly uptick in May after staying flat in the previous month

? Bearish Headline Arguments

Swiss jobless rate ticked higher from 1.9% to 2.0% in May instead of holding steady, as the number of unemployed increased by 88K

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

The RBA surprised the markets with another 0.25% interest rate hike this month instead of holding steady as expected.

Although the Aussie also drew some support from the upbeat Chinese Caixin PMI released earlier on, the higher-yielding currency gave up ground on Wednesday, likely due to broad risk-off flows. It’s possible that traders wanted to unload some risk as the Global PMI updates, Australian Q1 GDP and Chinese trade data all disappointed.

But Aussie bulls were able to take the reins by Thursday and Friday, possibly reacting to fresh positive Chinese banking rate news, likely fueling speculation of further interest rate rises ahead.

? Bullish Headline Arguments

MI inflation gauge jumped from 0.2% month-over-month to 0.9% in May to reflect stubborn price pressures

ANZ job advertisements posted a 0.1% monthly uptick in May, suggesting a rebound in hiring after three consecutive monthly declines

Chinese Caixin services PMI rose from 56.4 to 57.1 to reflect stronger pace of industry growth in May instead of estimated decline to 55.2

RBA hiked interest rates from 3.85% to 4.10% in June policy statement, citing indicators that suggest inflation is persisting

? Bearish Headline Arguments

Australia’s Q1 GDP came in at 0.2% versus estimated 0.3% growth figure, previous period’s reading upgraded from 0.5% to 0.6% expansion

Chinese trade surplus shrank from $90.2 billion to $65.8 billion, as exports plunged 7.5% in May while imports fell 4.5% year-over-year

Australian trade surplus narrowed from 14.82 billion AUD to 11.16 billion AUD in May vs. projected 13.65 billion AUD figure, as exports slipped 5.0% while imports rose 1.6%

CAD Pairs

The Canadian dollar was off to a running start for the week, thanks to the OPEC+ surprise announcement of voluntary output cuts, but pulled lower later on Monday as weaker-than-expected PMI data fueled risk-off bets, especially in oil price expectations.

Later on, the Loonie got a big boost when the BOC announced a 0.25% interest rate hike and signaled willingness to keep hiking until inflation returns to target. But the volatility didn’t stop there as CAD bears jumped in once again as oil prices dropped on Thursday on rising recession bets once again after a weak U.S. employment data point.

Fortunately for the bulls, CAD was able to recover somewhat on Friday as risk sentiment improved on positive Chinese banking rate news, closing the week mixed but arguably net positive.

? Bullish Headline Arguments

BOC hiked rates from 4.50% to 4.75% in June policy decision, citing that inflation remains stubbornly high and that monetary policy isn’t sufficiently restrictive yet

Canadian trade surplus widened from 0.2 billion CAD to 1.9 billion CAD vs. 0.5 billion CAD estimate in April, as exports rose 2.5% while imports dipped 0.2%

? Bearish Headline Arguments

Ivey PMI tumbled from 56.8 to three-month low of 53.5 in May, reflecting slower pace of industry growth vs. estimated improvement to 57.2

Building permits slipped 18.8% month-over-month in April vs. estimated 4.3% decline, erasing most of earlier 12.3% gain

Canada Employment Report: -17.3K net jobs loss in May (+40K forecast); unemployment rate rose from 5.0% to 5.2%

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

The Kiwi was on steady footing, marching higher early in the week despite last week’s news of the RBNZ‘s shifting to a less hawkish interest rate stance.

There wasn’t much on deck from New Zealand either, leaving the Kiwi to take cues mostly from market sentiment and China’s data points, which was enough to give the bulls profits at the end of the week as it was the second best performing currency by the Friday close.

? Bullish Headline Arguments

ANZ commodity prices rebounded by 0.3% month-over-month in May thanks to higher dairy prices, following earlier 1.7% slump

? Bearish Headline Arguments

New Zealand quarterly manufacturing sales tumbled 2.8% in Q1, following earlier downgraded 1.0% decline from initially reported 0.4% dip

JPY Pairs

With a lack of major Japanese catalysts, the yen was also a mixed bag as the Japanese currency appeared to be taking cues from overall market sentiment and counter currency movements discussed above.

After a net positive start to the week, it closed as a big net loser thanks to a positive shift in risk sentiment, and likely do to demand for comdolls after a couple of interest rate hikes from the RBA and BOC this week and positive Chinese news developments.

? Bullish Headline Arguments

Economy Watchers Sentiment index improved slightly from 54.6 to 55.0 to reflect stronger optimism vs. estimated 55.1 figure

Japan’s final GDP revised sharply higher from 1.9% to 2.7% y/y in Q1 2023 on upward revisions to capital spending and private and domestic demand

Japan’s overall bank lending accelerated from 3.2% to 3.4% y/y (vs. 3.1% expected) in May

The au Jibun Bank Japan Services PMI revised to 55.9 vs. initial reading of 56.3 and April’s reading of 55.4

? Bearish Headline Arguments

Average cash earnings slowed from 1.3% to 1.0% year-over-year in April vs. estimated 1.7% gain, despite wage increases from labor talks

Household spending slumped 4.4% year-over-year in April vs. estimated 2.2% dip and earlier 1.9% increase