Forex market players zoned in on Chinese data and U.S. inflation figures this week as these tend to strongly affect monetary policy expectations and sentiment. These reports signaled potential slowing inflation and growth conditions on net, spurring traders to balance narratives like calls for additional stimulus from China, a peak in the Fed rate hike cycle, as well as mixed Fed speak throughout the week.

Missed the major forex headlines? Here’s what you need to know from last week’s FX action:

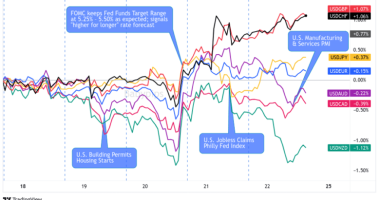

USD Pairs

Overlay of USD vs. Major Currencies Chart by TV

Despite jitters ahead of the July U.S. CPI release, the dollar started off on a positive note, as risk aversion came in play early in the week.

As it turned out, China’s trade activity took major hits recently and the lack of clarity on additional stimulus kept investors wary of a potential global recession.

The Greenback paused from its climb midweek as traders probably eased up on their long positions ahead of the highly-anticipated inflation report. A bit of consolidation ensued, followed by a kneejerk UpSD selloff upon seeing weaker than expected annual CPI.

Dollar bulls were quick to get back on their feet, though, as U.S. bond yields brushed off the subpar data and market watchers likely focused on how the monthly headline and core CPI came in line with estimates, and likely bullish on hawkish comments from Fed Governor Daly.

The Dollar was able to hold onto its gains on Friday thanks to a better-than-expected PPI update countering a surprise weaker consumer confidence read from the University of Michigan.

? Bullish USD Headline Arguments

Federal Reserve Governor Michelle Bowman said during the weekend that more interest rate hikes may be needed

U.S. Trade Balance for June: -$65.5B (-$65.1B forecast; -$68.3B previous)

San Francisco Fed Chief Daly says Fed still has more work to do on controlling inflation and that Thursday’s CPI numbers came out largely as expected

U.S. Producer Price Index change for July: 0.3% m/m (0.2% m/m forecast; 0.0% m/m previous)

? Bearish USD Headline Arguments

Philadelphia Fed President Harker suggested that the Fed may be at the end of the current hiking cycle, adding later on that they have reached a point where they can hold interest rates steady then start cutting rates next year

Moody’s downgraded 10 mid-size regional U.S. banks and put six other lenders on notice under review

U.S. IBD/TIPP economic optimism index fell from 41.3 to one-year low of 40.3 in August vs. 43.0 forecast

U.S. Weekly Initial Jobless Claims: 248.0k (229.0k forecast; 227.0k previous)

U.S. Consumer Prices Index change for July: 3.2% y/y (3.3% y/y forecast; 3.0% y/y previous); Core CPI at 4.7% y/y (4.8% y/y forecast/previous)

University of Michigan U.S. Consumer Sentiment Index for August: 71.2 (71.3 forecast; 71.6 previous)

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TV

Euro pairs moved mostly sideways for the first half of the week as there were no major reports on deck. Instead, the shared currency functioned mainly as a counter currency against its rivals with catalysts lined up, and likely benefited from some risk aversion vibes this week.

A relatively upbeat eurozone inflation outlook likely allowed it to end up in the green versus majority of its forex peers, except against the U.S. dollar, chalking up notable gains against the yen and commodity currencies.

? Bullish EUR Headline Arguments

Sentix Investor Confidence for August: -18.9 (-23.4 forecast; -22.5 previous); sentiment for Germany hits -30.7, the lowest level since Oct. 22

Germany Final CPI for July: 6.2% (6.2% forecast; 6.4% previous); “the development of food prices continues to have an upward effect on inflation. In addition, the increase in energy prices was again somewhat larger than in the two previous months.”

ECB Economic Bulletin: Governing Council still sees inflation remaining too high for an extended period of time

? Bearish EUR Headline Arguments

German industrial production slowed by 1.5% m/m in July vs. estimated 0.4% decline and previous 0.1% dip

Consumer inflation expectations for the Euro area in the next 12 months fell in June to 3.4% from 3.9%, according an ECB survey

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TV

Sterling was also off to a good start for the week but started falling back within range over the next couple of days, possibly due to broad risk aversion vibes.

Volatility picked up right around the release of the U.S. CPI figures where the British currency took a bearish lean, likely on U.S. dollar strength and broad risk-off vibes.

But the tide turned on Friday after a surprisingly positive U.K. GDP update for the second quarter, a number telling traders that the BOE’s job to control inflation ain’t done yet. This seems to have been enough to draw in enough buyers to put the British pound in the second spot for the week just behind the Greenback.

? Bullish GBP Headline Arguments

U.K. economy records surprise growth, up by 0.2% q/q in Q2 (vs. 0.1% in Q1, 0.0% expected), aided by growth across manufacturing, computer programming, and hospitality

U.K. Manufacturing Production for June: 2.4% m/m (0.2% m/m forecast; -0.1% m/m previous)

? Bearish GBP Headline Arguments

U.K. house prices fell 0.3% m/m in July vs. expected flat reading and earlier 0.1% dip, according to Halifax

RICS House Price Balance for July: -53.0% (-52.0% forecast; -48.0% previous); “tighter lending environment continues to weigh heavily on home buyer activity”

BRC Retail Sales Monitor for July: 1.8% (3.8% forecast; 4.2% previous);

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TV

The Swiss economy also had a relatively light schedule in terms of news events, with only the jobless rate and SNB foreign currency reserves data on the docket early on.

Most franc pairs tossed and turned within a relatively tight range for the most part of the week, before CHF/JPY and NZD/CHF broke away from the rest of the pack on Thursday.

? Bearish Headline Arguments

Swiss jobless rate ticked higher from 2.0% to 2.1% in July vs. projected 2.0% reading

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

Aussie pairs were off to a slow start as traders seemed on edge ahead of top-tier Chinese economic releases, and likely on the recent shift in sentiment that the RBA will hold off of further rate hikes for now.

The commodity currency sold off upon seeing the downbeat underlying components of an otherwise upbeat headline Chinese trade balance, notably on the slump in imports and exports due to weaker demand conditions.

After a bit of a reprieve midweek, the higher-yielding AUD caught another wave lower on China’s PPI miss and the lack of stimulus details from the country’s central bank and government.

A muted inflation outlook for the Land Down Under likely contributed to bearish pressure, but the real selling came during the Thursday U.S. session, correlating with the broad risk-off move after Fed officials reiterated a lean towards further rate hikes ahead.

? Bullish AUD Headline Arguments

Australia’s ANZ job advertisements picked up by 0.4% m/m in July vs. earlier 2.7% slump (downgraded from initially reported 2.5% drop)

NAB business confidence index improved from downgraded -1 figure in June to +2 in July, reflecting slightly better conditions

? Bearish AUD Headline Arguments

Australia’s Westpac consumer sentiment index fell by 0.4% in July in response to RBA pause, following earlier 2.7% uptick in June

Chinese trade surplus rose from $70.6 billion to $80.6 billion in July vs. $70.8 billion forecast, as exports fell 14.5% y/y while imports slipped 12.4% y/y

Chinese headline CPI down by 0.3% y/y in July vs. estimated 0.4% decline and previous flat reading, headline PPI down by 4.4% y/y vs. previous 5.4% slump and expected 4.0% fall

Australia’s MI inflation expectations fell from 5.2% to 4.9% in July, suggesting weaker price pressures over the next 12 months

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

Consolidation was also the name of the game for the Loonie at the beginning of the week as bulls tried to shrug off bearish vibes from Canada’s weak jobs release on Friday.

However, a combination of risk-off flows from weak Chinese trade data, a drop in Canada’s exports, and a downgrade of several U.S. lenders dragged the commodity currency south on Tuesday.

It managed to pull slightly higher before getting beat down again when China’s inflation figures missed the mark, before most CAD pairs (except CAD/JPY and NZD/CAD) settled back in ranges.

? Bullish Headline Arguments

Canada Building Permits for June: 6.1% m/m (-1.3% m/m forecast; 12.6% m/m previous)

? Bearish Headline Arguments

According to the EIA, the U.S. will output a record of 12.8M barrels a day in 2023, countering OPEC output cuts

Canada Trade Balance for June: -C$3.7B (C$410M forecast; -C$2.68B previous); exports fell 0.4% in real terms, while real imports were up 0.9%

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

Just like the Aussie, the Kiwi started the week in tight consolidation, as traders likely held out ahead of China’s trade balance and inflation releases.

The commodity currency picked up on strong bearish vibes on Tuesday, when Chinese exports and imports reflected steep declines, barely taking advantage of the slight uptick in quarterly inflation expectations for New Zealand.

Another round of consolidation followed over the next couple of days before volatility ticked higher right around the U.S. CPI release, causing most NZD pairs to form fresh intraweek lows with the exception of NZD/JPY.

? Bullish Headline Arguments

New Zealand quarterly inflation expectations ticked higher from 2.79% to 2.83% q/q, suggesting a potential pickup in price pressures over the next two years

? Bearish Headline Arguments

Chinese trade surplus rose from $70.6 billion to $80.6 billion in July vs. $70.8 billion forecast, as exports fell 14.5% y/y while imports slipped 12.4% y/y

Chinese headline CPI down by 0.3% y/y in July vs. estimated 0.4% decline and previous flat reading, headline PPI down by 4.4% y/y vs. previous 5.4% slump and expected 4.0% fall

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TV

The Japanese yen is trailing far behind its peers, following a couple of massive drops on Tuesday and Thursday.

Bearish pressure was already present early in the week, before the selloff accelerated when Japan printed weaker than expected earnings and spending data. Risk-off flows on weak Chinese trade data propped it briefly, but the negative lean quickly resumed ahead of the U.S. CPI report.

The yen stabilized on Thursday, correlating with U.S. inflation updates and hawkish rhetoric from Fed officials. With no major news from Japan, it can be argued that the yen returned back to its ‘safe haven’ tendencies as Fed rate hike speculation returned with Fed speak signaling higher odds of more rate hikes ahead.

? Bullish Headline Arguments

Japan’s Economy Watchers Sentiment index improved from 53.6 to 54.4 in July vs 54.0 consensus

? Bearish Headline Arguments

Japanese leading indicators dipped from 109.2% to 108.9% in June as expected, suggesting weaker economic activity

Japanese average cash earnings up 2.3% y/y vs. 3.0% forecast in June, household spending slumped 4.2% y/y following earlier 4.0% decline

Japanese producer prices rose by 3.6% y/y in July vs. projected 3.5% gain, slower than earlier 4.3% increase and marking its seventh consecutive monthly dip