ENERGY suppliers have the power to set direct debits and decide how often they change which can affect how much your bill is.

At a time when energy costs remain high, this can often cause confusion and might mean that some are left with inaccurate bills, paying more or less than they need to.

If you pay too much and build up a credit, you can claim the money back – but amount you can get back varies depending on who provides your gas and electricity tariffs too.

Direct debits are the cheapest way to pay for your energy. The average household saves £200 a year compared to being billed.

But it’s important to understand not only how they’re set and reviewed, but also how you can ensure your energy direct debit is accurate.

Most providers charge a fixed direct debit where you’ll pay the same amount each month.

Most energy firms will work out the estimated cost of your energy for the year ahead, and then divide it into equal payments.

For instance if you’re expected to use £2,500 worth of energy, your monthly direct debits for a year would be around £208.

With a fixed direct debit you spread the cost over higher use winter months and lower use summer months.

It means you avoid any shock bills in colder weather when the heating is on more, but your bill won’t go down when it gets warmer.

Most read in Money

Typically, people build up credit during the summer months to cover the winter period when their usage is higher.

So if you currently have a small credit on your account it might not be worth getting it refunded as it might leave you short in the colder months.

Households risk inaccurate bills if they don’t regularly submit meter readings unless they have a smart meter which gives them automatically.

Natalie Mathie, energy expert at Uswitch.com, said: “The more frequently your supplier checks that your direct debit matches your usage, the more likely it is that you will be paying the right amount each month.”

We’ve previously explained how to take and submit a meter reading.

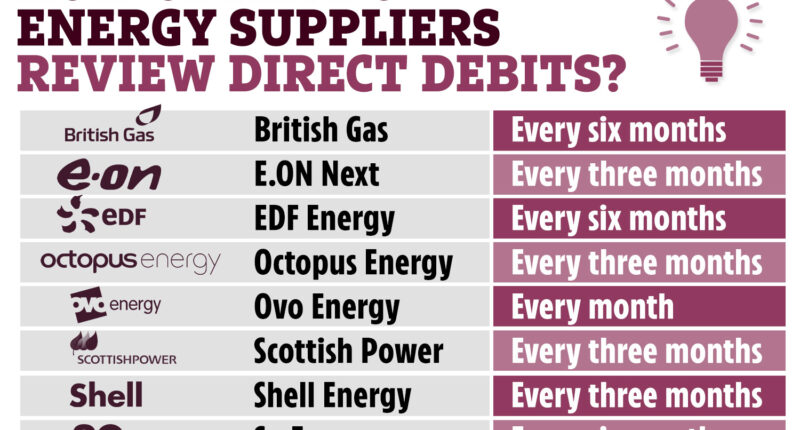

Here we explain how each energy provider sets direct debits – and how customers can request a credit refund if they’re eligible.

British Gas

As standard, British Gas customers are enrolled on a fixed direct debit if this is how they choose to pay.

British Gas will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier then sends customers a statement every six months and at the same time will check to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your British Gas account to ensure your bills are as accurate as possible.

If British Gas wants to change the amount you’re charged by direct debit, it will let you know 10 working days before it’s applied.

How do you ask for a credit refund?

British Gas rules state that it will always hold a £75 energy credit on accounts.

The supplier will only refund you if there’s £5 or more left over after it’s put a £75 credit towards your bill.

Customers can request a refund by logging into their online account.

You’ll then need to click on “View payment plan”, scroll down to “Refunds” – and then check if you can claim some cash back.

You can also request a credit refund through the live chat on the British Gas website or by calling 03330 100 0056.

E.ON Next

E.ON Next will work out the cost of your energy for the year ahead and divide this into 12 instalments.

But some months may be higher than others to take into account seasonal energy usage.

The supplier will then review direct every three months to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your E.ON Next account to ensure your bills are as accurate as possible.

If E.ON Next wants to change the amount you’re charged by direct debit, it will let you know 14 working days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your E.ON Next account and wish to reclaim it, the best way to do so is via email.

Draft an email to [email protected] entitled “Credit Refund Request From Account No. XXX”.

In the email state your name, address, account number and state how much money you want refunded.

It’s also wise to upload and attach photographs of your gas electricity meters if they aren’t smart.

EDF Energy

EDF will work out the cost of your energy for the year ahead and divide this into 12 instalments.

It will review the amount you pay every six months to ensure that your bill is reasonably accurate.

EDF might review your direct debit before this if, for example, you send in a recent meter reading, but this isn’t always guaranteed.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your EDF Energy account to ensure your bills are as accurate as possible.

If EDF wants to change the amount you’re charged by direct debit, it will let you know 14 working days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your EDF account and wish to reclaim it, the best way to do so is by sending your meter readings in.

You can do this on your EDF online account or on the supplier’s app.

Customers can then request a refund by phoning 0333 006 9950.

Octopus Energy

Octopus Energy will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier reviews direct debits every three months to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your Octopus Energy account to ensure your bills are as accurate as possible.

If Octopus wants to change the amount you’re charged by direct debit, it will let you know 10 working days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your Octopus Energy account and wish to reclaim it, the best way to do so is by asking for a refund online or by phoning the team.

If Octopus Energy thinks that you’ve got more credit on your energy account than you need, you’ll be able to request the excess back as long as you’ve had an energy bill based on real meter readings in the last 30 days.

To ask for your credit back, just hit the little button underneath your balance on your online account dashboard.

If you think you’re due a refund but you don’t see an option on your online account, just email [email protected] or talk to the team by calling 0808 164 1088.

Ovo Energy

Ovo Energy will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier reviews direct debits every month to make sure that you’re not paying too much, or too little.

But your payment amount will only change at each three-month direct debit “check-in”.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your Ovo Energy account to ensure your bills are as accurate as possible.

If Ovo Energy wants to change the amount you’re charged by direct debit, it will let you know 10 working days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your Octopus Energy account and wish to reclaim it, the best way to do so is by asking for a refund online.

Ovo Energy customers can request a refund if their credit is at least £25 higher than one month’s direct debit.

After submitting a meter reading to your online account customers should head to the payments page and click apply for a refund.

Scottish Power

Scottish Power will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier reviews direct debits “regularly” and at least every three months to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your Scottish Power account to ensure your bills are as accurate as possible.

If Scottish Power wants to change the amount you’re charged by direct debit, it will let you know 14 days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your Scottish Power account and wish to reclaim it, the best way to do so is by asking for a refund online.

You’ll need to log in to your online account and provide up-to-date meter readings and the supplier will check if your account is eligible for a refund.

If you do require a refund you’ll need to request it by using the live chat function on the Scottish Power website.

Shell Energy

Shell Energy will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier reviews direct debits every three months to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your Shell Energy account to ensure your bills are as accurate as possible.

If Shell wants to change the amount you’re charged by direct debit, it will let you know 14 days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your Scottish Power account and wish to reclaim it, the best way to do so is by asking for a refund online.

If you do require a refund you’ll need to request it by using the live chat function on the Shell Energy website.

Customers can also request a credit refund by calling the firm on 0330 094 5800.

So Energy

So Energy will work out the cost of your energy for the year ahead and divide this into 12 instalments.

The supplier reviews direct debits every six months to make sure that you’re not paying too much, or too little.

If you don’t have a smart meter which automatically sends your supplier meter readings, frequently upload yours manually to your So Energy account to ensure your bills are as accurate as possible.

If So Energy wants to change the amount you’re charged by direct debit, it will let you know five working days before it’s applied.

How do you ask for a credit refund?

If you have a credit on your Scottish Power account and wish to reclaim it, the best way to do so is by asking for a refund online.

The refund needs to be worth at least £30 and you must provide So with an up-to-date meter reading.

Customers can request a refund by emailing [email protected] or by calling 0330 111 5050.

Is there a way to just pay for what I use?

Instead of paying by a fixed direct debit, some customers might be able to opt to pay their energy bills with a variable direct debit instead.

Variable bills let customers pay a varying amount every month or every quarter, depending on the energy they use.

Natalie said: “Some people may prefer a variable direct debit, which is when they only pay for the energy they have used.

“The amount paid each month will fluctuate depending on your actual usage.

“It’s useful to note that variable bills will be much higher in the winter, which can have a big impact on your cash flow during those months.”

What energy bill help is available?

Energy suppliers also offer plenty of energy grants and schemes to help you out if you’re struggling.

Here’s a list of schemes open right now:

- British Gas Energy Trust Individuals and Family Fund

- British Gas Energy Trust

- EDF Customer Support Fund

- E.ON and E.ON Next Grants

- Octopus Energy Assist Fund

- OVO Energy

- Scottish Power Hardship Fund

There’s a one-off fuel voucher from your energy supplier if you’re on a prepayment meter.

Councils are also dishing out hundreds of pounds to hard-up families through the Household Support Fund.