MILLIONS of households will benefit from extra support with their energy bills following today’s Spring Budget.

Jeremy Hunt announced several measures aimed at helping to ease the burden of spiralling energy bills.

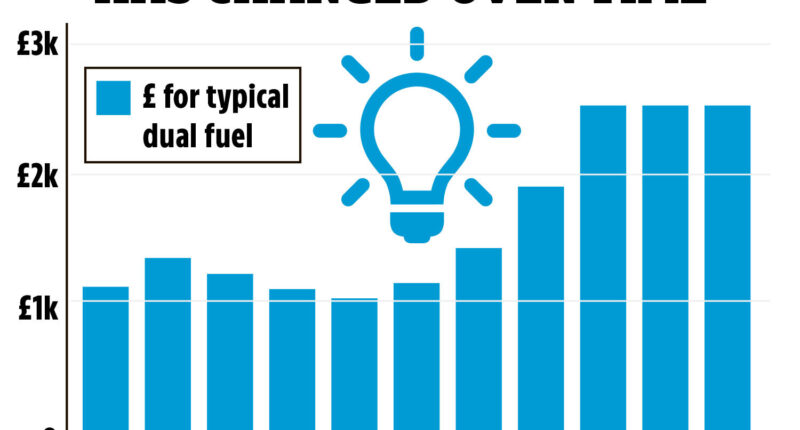

The Chancellor announced plans to scrap a planned rise to the Energy Price Guarantee (EPG) to £3,000 a year on average, up from £2,500.

This will save the average household around £160, the government said.

The Treasury also vowed to stop energy companies from charging customers extra fees if they use pay-as-you-go meters.

The average prepayment meter customer pays an extra £45 a year.

It follows a national outcry over companies using debt collectors to force people to have the rip-off meters installed.

Spring Budget at a glance

Households could save up to £205 a year based on measures announcement in today’s budget.

Many could still be entitled to a raft of cash support worth thousands of pounds on top of the latest help with bills.

The amount of financial help you’ll be eligible for depends on your circumstances.

Most read in Money

If you are struggling to pay your energy bills, it is best to first call up your supplier to discuss your options as you may be entitled to a cash grant.

Here we explain all the energy bill support announced in today’s budget and what it means for you.

We also look at all the financial support on offer to households right now.

Energy Price Guarantee extended

The current Energy Price Guarantee will be extended for another three months – meaning average bills will stay capped at £2,500 until June 30.

It will save the typical household £160.

However, the cap is just on what firms can charge customers. Bills could still be higher, based on energy usage.

The lower than expected borrowing has left room for the cap on gas and electricity costs to be extended.

Then in July, when the price guarantee ends, it’s expected bills will fall to £2,000.

Chancellor Jeremy Hunt said: “With energy bills set to fall from July onwards, this temporary change will bridge the gap and ease the pressure on families, while also helping to lower inflation too.”

Changes to pre-payment meters

The Treasury has already confirmed that energy firms will be barred from charging four million families who use prepayment meters more for their energy.

The average prepayment meter customer pays an extra £45 a year for their energy compared to those who pay by direct debit.

But the move means that from April 2024, the prepaid price will be the same as that for customers on Direct Debits.

The new rule will effectively ban this prepayment meter premium and ensure that those on prepayment meters pay no more than those paying by direct debit.

Money saving expert Martin Lewis tweeted that the the difference will be paid by the state and the cut will be equivalent to a 3% price reduction for those on prepayment meters.

A ban on the forced installation of pre-payment meters by energy companies will be extended beyond the end of March, energy regulator Ofgem confirmed.

Jonathan Brearley, the chief executive of Ofgem, said energy suppliers will not restart the practice of force-fitting prepayment meters when the hiatus was meant to finish.

Billpayers who fall into debt with energy providers can be forced on to pay as you go meters.

It means they have to top up for their gas or electricity, rather than being billed for it later on, to avoid building up more debt.

But it can often be a more expensive payment method and can leave customers without gas and electricity if they can’t afford to add credit

The Sun called for a temporary ban on moving customers onto prepayment meters this winter.

What other energy bill help is available?

A £900 payment will be going to millions on means-tested benefits and Universal Credit this year.

To be eligible for the payment, households will need to be claiming at least one of the following:

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Pension Credit

- Tax Credits (Child Tax Credit and Working Tax Credit)

- Housing Benefit

- Council Tax Support

- Social Fund (Sure Start Maternity Grant, Funeral Payment, Cold Weather Payment)

- Universal Credit

Elderly Brits will receive another one-off £300 pensioner cost of living payment.

Those with certain disabilities will also qualify for a further £150 cost of living payment.

Energy suppliers also offer plenty of energy grants and schemes to help you out if you’re struggling. Here’s a list of schemes open right now:

- British Gas Energy Trust Individuals and Family Fund

- British Gas Energy Trust

- EDF Customer Support Fund

- E.ON and E.ON Next Grants

- Octopus Energy Assist Fund

- OVO Energy

- Scottish Power Hardship Fund

There’s also a one-off fuel voucher from your energy supplier if you’re on a prepayment meter.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]