TODAY marks the start of a raft of money changes including tax hikes and bill rises.

The new tax year begins every April which is normally when rules affecting your finances change.

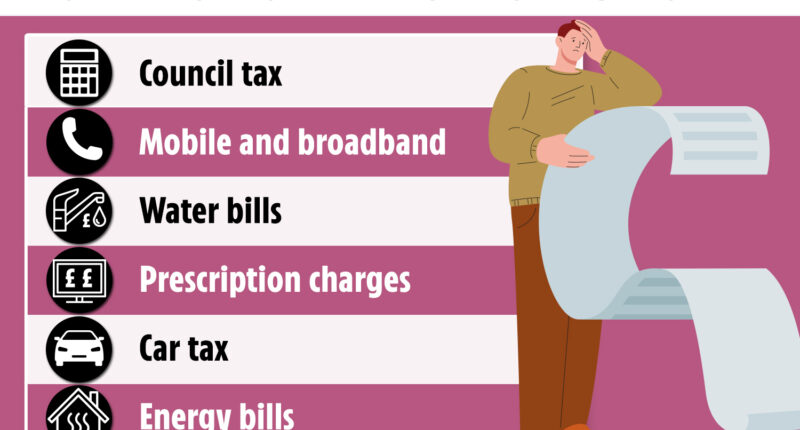

Amongst the shakeups are differences coming to council tax, mobile and broadband and water bills, but we’ve made a handy list to keep you right.

That way you’ll face no surprises and we’ve included a few tips on how to tackle them as well.

Here’s everything you need to know that’s happening today, April 1.

Council tax hikes

Lots of local councils are planning to hike council tax payments this year in order to level out their budgets.

That means three-quarters of councils will hike the tax by 5% from today, according to the County Councils Network (CCN).

A 5% rise to the average Band D council tax bill will force households to fork out an extra £99 every year, for example.

Councils decide how much to increase council tax bills every April, and how much more you’ll pay depends on where you live.

Your council will share its plans with the residents at the beginning of the new financial year in April, so make sure you check its website if the information hasn’t already been uploaded.

Most read in Money

You should check what council tax bracket your home falls under by entering your postcode on the government website.

And you can also use the council tracker tool if you don’t know which your local council is.

But keep in mind people on low incomes or benefits such as Universal Credit may be able to get a discount on their council tax.

This can vary between councils, but you could be exempt from paying any council tax at all.

The schemes are means-tested, and will usually depend on your income and any children or adults living with you.

Single adults living in a property can get a 25% discount on their bill.

This applies to anyone either living alone or with a young person aged under 18.

It’ll also count if you live with someone aged 18 or 19 in full-time education.

Alternatively, a reduction could be applied if there is a disabled person living in the property.

This is known as a disabled person’s reduction and each council has its own criteria.

You may also get 50% off your council tax if you live with someone who is severely mentally impaired.

For more information make sure to browse your local council’s website.

Mobile and broadband hikes

Every year telecom providers will increase their fees based on the rate of inflation plus an extra 3.9%.

This usually happens in April – and today most bills will rise by 14.4%.

But keep in mind not all providers will follow this exactly – some customers have already faced increases, for instance.

Most customers with BT, EE and Plusnet (including broadband, landline, mobile and TV customers) saw a rise yesterday, March 31.

However, BT Home Essentials, EE Mobile Basics, Pay-As-You-Go, BT Basic and Home Phone Saver customers will see their prices frozen through 2023.

The rise will affect customers even if they are signed up to a contract with a fixed price.

You can read more about each provider’s plan to hike bills and how it affects you in our round-up.

But switching contracts when yours is up is the single best way to save money on your telecom bills.

In the weeks before your contract is up, use comparison sites to familiarise yourself with what deals are available.

But as these are mid-contract rises, you will need to check if there is a penalty for leaving a deal early.

It’s a known fact that new customers always get the best deals.

Sites like MoneySuperMarket and Uswitch all help you customise your search based on price, speed and provider.

However, if you do not want to switch and are happy with the service you’re getting under your current provider – haggle for a better deal.

You can still make significant savings by renewing your contract rather than rolling on to the tariff you’re given after your deal.

You could save up to £210 a year on your bills by haggling alone.

To have the best chance at successfully haggling, choose your time wisely.

So if you’re phoning first thing in the morning, for example, you’ll have caught the phone operator bright and early and you won’t have to speak to someone who’s worked tirelessly all day.

It also pays to be polite when getting through to someone on the phone, as representatives are less inclined to help rude or aggressive customers.

Knowing what other offers are on the market can help you to make a case for yourself to your provider.

If your provider won’t haggle, you can always threaten to leave.

Companies don’t want to lose customers and may come up with a last-minute offer to keep you.

Last but not least, it’s worth investigating social tariffs.

These are like gold dust to people receiving benefits because they’re designed specifically to grant them discounts.

So if you’re on Universal Credit, disability allowance or income support you could be eligible.

Around 4.2million households are eligible for these cheaper tariffs but only 55,000 are making use of them.

Prices start from £12.50 a month but your provider will keep you right on what’s available.

Water bill hikes

Companies normally put up water bills each April so you’ll need to be ready to splash out a little more this month.

This year will see the largest hike in annual water bills in nearly 20 years when they rise to an average of £448 a year this spring.

The exact amount your bill will rise from will depend on where you live, how much you’re charged and the rate it’s increasing by.

You’ll have a different water company assigned to you depending on which area you live in.

That company is responsible for setting the costs of bills and the rises for residents.

Unfortunately, you can’t simply switch to another one when you’re unhappy like you can with other utilities.

However, moving to a water meter could help some save a little extra cash.

One mum more than halved her water bill after getting a meter – saving over £200 a year.

Obviously, if you do use a lot of water then it makes no sense to have a meter as your bills could go UP.

The Consumer Council for Water offers a free water meter calculator that’ll tell you if you can save by fitting a water meter.

For example, if you have a big family and more people than bedrooms or simply use lots of water-intensive appliances like washing machines or dishwashers, a fixed fee will be better for you.

Having a water meter doesn’t help with the standard charge that’s based on where you live either, but it can help you cut down the costs of your personal usage at home.

Many water companies also offer free water-saving devices that shave pounds off your bills.

Contact your supplier or check out savewatersavemoney.co.uk to find out what’s on offer.

Prescription charges

If you live in England you’ll still be charged for prescription meds.

Elsewhere in Scotland, Wales and Northern Ireland, the meds have been free for over a decade.

Fees were frozen at £9.35 per item last April to help Brits cope with the cost of living crisis.

But now the Department of Health and Social Care said it will apply an inflationary rate of 3.21%.

So, an NHS prescription will cost £9.65 from today.

The cost of prescription pre-payment certificates (PPCs) will also be increased: three-month PPC increases by £1 to £31.25 and 12-month PPC increases by £3.50 to £111.60.

But if you want to save money you could opt for a prescription prepayment certificate (PPC) as long as you receive 12 or more prescriptions every year.

All your NHS prescriptions can be purchased for a set price and you can buy it on the NHS Business Services Authority website.

Millions of Brits are eligible for free prescriptions, including those over 60, those under 16, and those 16 to 18 in full-time education.

You can also get your prescriptions for free if you’re pregnant or have a medication exemption certificate.

You’re also entitled to free prescriptions if you or your partner (including civil partner) receive, or you’re under the age of 20 and the dependant of someone receiving:

- Income support

- Income-based jobseeker’s allowance

- Income-related employment and support allowance

- Pension credit guarantee credit

- Universal Credit

Car tax rise

Millions of drivers will be facing a car tax rise as of today.

Vehicle Excise Duty will be uprated from now by the rate of RPI for cars, vans and motorbikes – 10.1%.

Vehicle Excise Duty (VED) is an annual tax you have to pay to have your car on the road.

You have to pay the tax when the vehicle is first registered.

You then have to pay the tax from then on to maintain having your vehicle on he road.

But it’s not a total loss – VED rates will be frozen for lorry drivers from today.

Normally the exact amount your VED goes up by every year depends on the vehicle and other factors, including its weight.

It usually depends on when you registered your vehicle too.

If you want to check how much more you will pay from April 1, you can work out the maths yourself.

You just have to go on the Government’s page on Vehicle tax rates and then scroll down to the option that best matches your car, bike or van.

Take the cost, divide it by 100, then multiply that by 10.1%. You then add that figure on to the original figure you would currently pay and you’ve got the new amount.

For example, if you had to pay £150 vehicle tax based on current rates, you will have to pay £165 from April 1.

If you had to pay £230 based on current rates, you will have to pay £253.23 from April 1.

If you’d pay £585 now this will go up to £644 from next month.

To save a but of money, depending on whether your car is in band B or above, you can pay for the whole year up front, every six months or monthly.

But, it’s usually cheaper to pay for the whole year up front.

You’ll save yourself some money by buying a car that runs on alternative fuels such as ethanol.

If you’ve got an electric vehicle, you don’t have to pay tax until April 2025.

With in mind, it might be worth investing in one of those for the time being – well, if you have the cash stored up too.

Energy bill hikes

Yes, the energy price guarantee is frozen until June 30, but bill payers are still facing a decline in bill support.

The energy bill support scheme, which has seen £66 or £67 knocked off all household energy bills since October, has come to an end.

The government’s energy price guarantee (EPG), has frozen average bills at £2,500 a year until June.

Experts are predicting that after this, the average bill could fall below this, to £2,200 from July.

But this isn’t an exact figure – it depends on how much energy you use and all sorts of factors to do with your house size and energy provider.

The best thing we can recommend doing to keep costs at bay is paying attention to vampire appliances and energy-suckers around the home.

For example, switching to different settings on your washing machine or dishwasher could shave off £53 from your yearly bill.

If you’re struggling to pay your bill then you should ask your supplier for help, as they may have a fund that you can apply for to get discounts off your bills or to help pay off debts.

Other hikes

Looking on the bright side, millions who receive National Living Wage will be facing a £1,600 yearly pay increase from today.

The 10% hike sees the wage rise from £9.50 to £10.42 an hour, which is a pay rise for 2.5million Brits.

People on the national living wage will see their pay packets increase by 92p an hour which means an additional £32.20 a week and £1,674.40 a year.

Later in the month – hitting April 25 – the first £301 of the £900 cost of living payment will be dished out to bill payers.

It’s the first of three instalments which are going out to tackle skyrocketing bills and essentials.

The cash will have landed in most people’s bank accounts by May 17.

You can find out more about who gets it and how it will arrive in our guide.

And in another change coming on April 6, the lifetime pension allowance (LTA) will be scrapped in an effort to keep people in work for longer.

The pension lifetime allowance was first applied in 2006, when it was set at £1.5 million.

It currently stands at £1.07million, with savers incurring tax after that personal pension pot threshold has been exceeded.