RBA Signals a Possible Pivot, Aussie Gets Hammered

Hey forex fam! The Reserve Bank of Australia (RBA) finally gave traders something to chew on besides those bland rate holds. They kept the cash rate steady at 4.35%, just like everyone expected,

[embedded content]

But what got the markets buzzing was a sneaky little change in their statement. Remember how they used to say “more rate hikes are possible”?

Well, they kinda backtracked on that, while keeping the option open with the shift from saying “a further increase in interest rates cannot be ruled out” in February to the “Board is not ruling anything in or out” at this statement .

As expected with the tone shift, traders pounced on that like a pack of hungry sharks, smelling hints of potential rate cuts down the line if the data warrants it.

Why the Sudden Shift?

Seems like the RBA’s starting to see some signs of inflation cooling off. But don’t get too excited just yet – they’re still worried about prices staying high, especially with all the uncertainty floating around the global economy.

Things in Australia aren’t looking too hot either, with folks spending less and the whole growth thing slowing down. Plus, China’s economy remains a big ol’ question mark.

The Takeaway

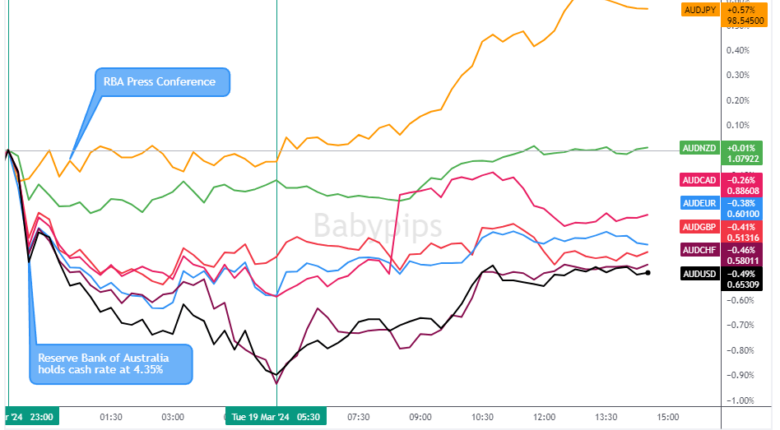

While inflation remains a pain, the RBA ain’t gonna rush those rate cuts until they see those numbers fall a lot more. Governor Bullock tried to play it cool during her press conference, but traders didn’t buy it – literally — as the Aussie continued to move net weaker through the early London session!

AUD Pairs After the Event

Overlay of AUD vs. Major Currencies 15-min Forex Chart by TradingView

If you’d like to see more in depth fundamental and technical analysis to potentially help you get to high quality strategy ideas and make the processes easier, check out our content at BabyPips Premium to see if it’s right for you!