DRINKERS face a huge tax hike when duty rates rise in line with inflation tomorrow.

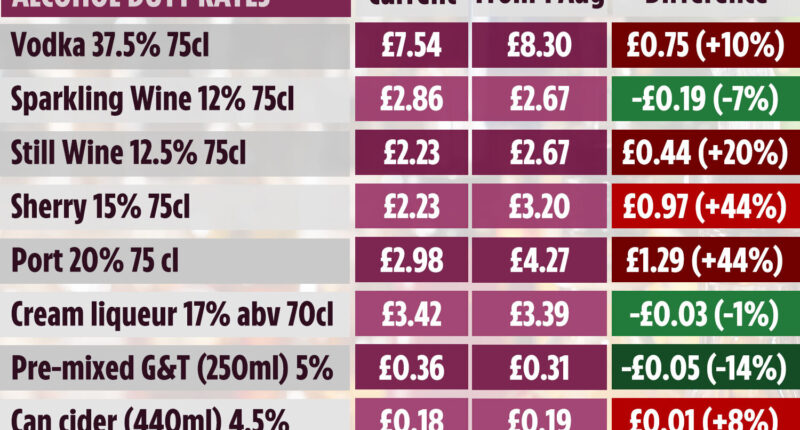

The price of some drinks will creep up by as much as £1.29 while the cost of a bottle of wine will climb by 44p.

Hated alcohol levies were originally due to be hiked on February 1, but Chancellor Jeremy Hunt delayed the move for an extra six months.

This means that alcohol duty rates will now rise by September’s consumer price index of inflation at 10.1% on August 1.

A further change previously announced will see a simplification of the duty that could also add a further 9% added to some drinks from the same date.

This represents the biggest shake-up to duty rates since 1975.

The new system will now tax liquor on its alcoholic strength and consist of six standardised alcohol duty bands.

This differs from the current system which taxes alcohol by the four types of drink.

Right now there are different duties for beer, cider, spirits, and wine.

When the new system comes into place tomorrow, the price of a bottle of wine will go up by 44p, while Port is set to rise by £1.29 a bottle, according to figures from the Wine and Spirit Trade Association (WSTA).

Most read in Money

But other alcoholic beverages could see their duty rates cut.

For example, duty on a bottle of sparkling wine could be slashed by 19p.

The duty on a bottle of cream liqueur like Bailey’s could also fall by 3p and 5p could be shaved off pre-mixed cans of G&T.

Miles Beale, chief executive of the Wine and Spirit Trade Association, said: “Amongst all this pressure the government has chosen to impose more inflationary misery on consumers with the biggest single alcohol duty increase in almost 50 years.

“Ultimately, the Government’s new duty regime discriminates against premium spirits and wine more than other products.

“But it’s not too late to scrap these crippling duty hikes.”

The British Beer and Pub Association has previously said that ending the alcohol duty freeze will cost the industry around £225million.

However, the Chancellor will cut the duty charged on draught pints in pubs across the UK by 11p in August.

The cut will act as a major boost for pubs and draught beer drinkers.

Gareth Davies, exchequer secretary to the Treasury said: “Because we left the EU we can make sure our alcohol duty system works for us. From next month the whole system will be simpler – the duty will reflect the strength of the drink.

“We will also protect pubs and brewers with our Brexit Pubs Guarantee keeping Draught Duty down, and a new Small Producer Relief.”