Can the European Central Bank REALLY hike rates by 0.75% this week?

Here’s a quick rundown of what happened in their previous statement and what market watchers are expecting.

What happened last time?

- ECB hiked rates from 0.00% to 0.50% vs. 0.25% forecast

- Governing Council agreed on Transmission Protection Instrument (TPI)

- Lagarde: No recession under baseline scenario

- Lagarde: Prior guidance for September no longer applies

Everyone and his momma knew that an ECB hike was coming in July, but policymakers took the markets by surprise when they raised interest rates by twice as much as expected.

This marked the ECB’s first rate hike in 11 years, so they probably wanted to start off with a bang. Besides, the central bank really needed to keep inflation from surging out of control.

According to their official statement, “[t]he Governing Council judged that it is appropriate to take a larger first step on its policy rate normalization path than signaled at its previous meeting.”

Even more interesting was their decision to refrain from giving any forward guidance for future meetings, which means that their announcements will mostly be based on how data turns out.

During the Q&A, Chairperson Lagarde expressed eagerness to move out of negative rate territory now that there are safeguards in place for monetary transmission a.k.a. the TPI and the flexible reinvestments in the PEPP.

*cue Chris Pine astral projecting to the Swiss alps*

What’s important for euro traders to remember is that she also mentioned that they will be accelerating rate hikes but not changing the final level of interest rates.

What’s expected this time?

- ECB to hike rates by 0.75bp from 0.50% to 1.25%

- No forward guidance likely

- Lagarde to reiterate their plan to proceed on month-by-month basis

Market junkies are anticipating an even more aggressive move from the ECB this September, as many expect the central bank to hike rates to 1.25%.

And why wouldn’t they?

In their August flash CPI report, the eurozone reported a jump from 8.9% to 9.1% for headline inflation and an increase from 4.0% to 4.3% for core price pressures, both beating expectations.

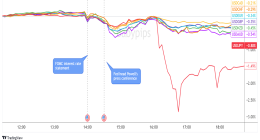

To add to that, the euro has been weakening like crazy over the past couple of months, particularly against the dollar.

This depreciation of the local currency could bring even more inflationary vibes down the line, so the ECB really needs to put its foot down.

This was exactly what ECB Board Member Schnabel pointed out during her Jackson Hole speech, noting that the ECB needs to “act forcefully” to “bring inflation back to target quickly.” Sources close to the ECB also hinted that a “strong majority” of the Council support a 0.75% rate hike.

But with the bar set so high for the ECB this week, coming up short might mean more downside for the shared currency. Besides any cautious comments from Lagarde in an attempt to downplay a big hike could also keep euro gains in check.

In any case, don’t forget to check out the average volatility of EUR pairs if you’re planning on trading this event!