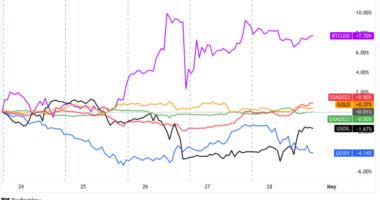

Continued inflation fears and its negative affect on economic activity was the likely main driver this week as safe havens generally outperformed.

The British pound was the outlier among the major currencies in this environment, ranking number one almost all week as the latest inflation and employment updates further supported rate hike speculation.

Notable News & Economic Updates:

IEA forecasts relief from high oil prices if U.S. global supply rebounds, and if demand wanes in Europe as covid-19 cases surge

Lots of commentary from Fed officials this week; broadly say that high inflation is weighing on consumers and needs to be controlled

U.S. asks Japan, China, others to consider tapping oil reserves; China releasing some oil from strategic reserves after U.S. invite

Turkish lira hits all-time low (USD/TRY breaks above 11.00) after central bank cuts interest rates from 19% to 15%

Uber policy dove Charles Evans says the Fed may need to raise interest rates in 2022

UK inflation rises to 10-year high of 4.2%, much higher than expectations and the previous read of 3.1%

U.S. House passes $1.75 trillion Biden plan; heading for a Senate vote in December

US lawmakers introduce a bipartisan bill on Thursday to modify a crypto tax provision in Biden’s infrastructure deal

U.S. reported a 7-day average of nearly 95K new Covid infections on Thursday, up 31% over the past two weeks

Intermarket Weekly Recap

The broad financial markets were a mixed bag this week as there wasn’t a major news headline or economic event to spark uniform one way sentiment moves. Inflation fears was arguably the biggest market driver once again, and this week’s data did support the high inflation environment that many are arguing would lead to a slowdown in global economic activity.

This week we also saw a rise in covid-19 cases, likely contributing to risk aversion fears, especially in Europe as lockdown protocols are currently being considered by Germany and a full lockdown was enacted by Austria.

We saw these risk-off catalysts play out with some of the broad risk assets like oil and crypto, but it wasn’t the only factor pulling in some of the sellers. The dip in oil prices sped up on Wednesday on news that the U.S. asked several countries to tap into oil reserves, with China agreeing to work on a release. The bearishness in crypto markets was likely fueled by both the strong U.S dollar, and the passing of the U.S. infrastructure bill, which contained crypto tax provisions that some viewed would push the crypto industry out of the U.S. if ever fully passed.

Equity markets escaped the broad risk aversion sentiment, likely driven more on positive earnings releases from some of the largest companies like Walmart, Home Depot and Nvidia. This week’s reports showed that U.S. consumers remained strong this past quarter and will likely remain strong for the holiday season.

In the currency space, we saw glimpses of the usual price action in a risk-off environment with the U.S. dollar and Japanese yen outperforming this week. Again, the British pound was the big winner as this week’s hot inflation read (a 10-year high rate at 4.2%) and improved employment data from the U.K.

The Australian dollar and the euro battled it out for the bottom of the rankings, with the former falling after RBA Governor Lowe talked down the probabilities of a rate hike in 2022 for Australia, and the latter likely finding additional sellers on rising covid-19 cases in Europe and commentary from ECB President Largade reiterating that the high inflation environment will be transitory.

USD Pairs

NY Empire State Manufacturing survey: 30.9 in Nov. vs. 19.8 in Oct.

Fed’s Kashkari expects higher inflation continuing over next few months

U.S. Retail sales rose 1.7% in October, both for all items and excluding autos.

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) homebuilder sentiment rose to 83; current sales conditions rose 3 points to 89.

Purchase mortgage applications increased 6% on a seasonally unadjusted basis from September to October, data from the Mortgage Bankers Association showed.

U.S. Housing starts fall 0.7% in October; Building permits rise 4.0%

NY Fed’s Williams says inflation increases becoming broader based

Philly’s Fed District Manufacturing Activity rose to 39.0 in November from 23.8 in October

GBP Pairs

The average UK house rose in price by 1.8% in October

Bank of England Governor Bailey uncertain on inflation outlook; furloughed workers situation prompted surprising rate hold at last meeting; Bank of England Haskel says too early to declare success on employment situation; Brexit uncertainty also a contributor to postponing rate hike

U.K. Unemployment rate at 4.3% in October; annual growth in average total pay was 5.8%

UK inflation rises to 10-year high of 4.2%

The Conference Board Leading Economic Index for the U.K. increased 0.1% in September 2021 to 81.2

GfK: U.K. consumer confidence rises in November after three months of decline

UK Retail sales in October: +0.8% vs. 0.0% in September

EUR Pairs

ECB’s Lagarde sees inflation below 2% target in medium term

Euro area international trade in goods surplus €7.3B; €0.5B surplus for EU

GDP up by 2.2% and employment up by 0.9% in the euro area in the third quarter of 2021

ECB must be ready to act on inflation if proves to be more durable than expected: ECB board member Schnabel

Germany’s seven-day covid-19 incidence rate hit record levels of 336.9 cases per 100K people

ECB Panetta expects an early version of digital euro some time in 2023

German October producer prices rose 18.4%, the most since 1951

Bundesbank president Jens Weidmann contradicts the ECB party line on easy policy ahead of December meeting

CHF Pairs

Swiss imports fell 1.4% and imports by 2.3% in October 2021

CAD Pairs

Canada Manufacturing sales declined 3.0% to $58.5B in September

Canadian wholesale sales grew 1.0% in September to $71.3B

No rate increases until economic slack is absorbed: BOC Governor Tiff Macklem

Bank of Canada deputy governor Lawrence Schembri says rate hike may not come as soon as many expect

Canadian inflation rate: 4.7% in October vs. 4.4% in September, an 18-year high and likely to keep rising

Canada added 39.4K jobs in October; September revised up to 41K from 9.6K – ADP

Canada flash retail sales estimate for October: +1.0% vs. -0.6% in September

New home prices in Canada increased by 0.9% in October, slightly above the previous four month average

NZD Pairs

BusinessNZ Performance of Services Index (PSI) falls to 44.6 in October vs. 46.9 in September

NZ producer input price increases ease from 3.0% to 1.6%, output price increases down from 2.6% to 1.8% in Q3 2021

New Zealand inflation expectations up from 2.27% to 2.96% in Q3; pushes up odds of rate hike at end of Nov.

AUD Pairs

RBA Lowe reiterates that date and forecasts do not warrant increase in cash rate in 2022; first increase still not likely until 2024

AU Q3 wage price index hits pre-pandemic rates but still short of RBA rate hike-inducing levels

AU MI leading index improves from -0.02% to 0.16% in October

JPY Pairs

Resurgence of COVID-19 cases drags Japan’s economy by another 0.8% (3.0% annualized) in Q3 2021

Pledging to retain stimulus, BOJ’s Kuroda projects inflation near 1% mid-next yr

Japan September core machinery orders flat from previous month

Japan’s exports snapped seven months of double-digit growth in October due to slowing car shipments

Japan PM Kishida unveils ¥56T ($490B) stimulus package

Higher energy costs caused Japanese consumer prices to edge up by +0.1% for a 2nd month in a row in October