We’ll get the latest U.K. inflation update on Wednesday, which is often a market mover for the British pound. Check out all of the important data to consider before putting together your latest trade idea on Sterling!

Event in Focus:

U.K. Inflation updates: Consumer Prices, Producer Prices

When Will it Be Released:

April 19, 2023, Wednesday: 6:00 am GMT, 7:00 am London, 2:00 am New York, 3:00 pm Tokyo

Expectations:

U.K. CPI annual rate: 10.2% y/y forecast vs. 10.4% y/y previous

U.K. CPI monthly rate: 0.3% m/m forecast vs. 1.1% m/m previous

U.K. core CPI annual rate: 6.0% y/y forecast vs. 6.2% y/y previous

U.K. PPI Input annual rate: 12.2% y/y forecast vs. 12.7% y/y previous

U.K. PPI Output annual rate: 11.2% y/y forecast vs. 12.1% y/y previous

Relevant Data Since Last Event/Data Release:

The tick lower in expectations is likely fueled by recent U.K. manufacturing PMI survey data, which signaled further easing input costs and selling prices.

But according to the services PMI survey responses for March, prices remain stubbornly high in the services sector, which raises the level of uncertainty with the upcoming data.

Previous Releases and Risk Environment Influence on the British Pound

Mar 22, 2023

Action / results:

U.K. headline CPI jumped from 10.1% to 10.4% year-over-year in February vs. estimated dip to 9.9%, U.K. core CPI up from 5.8% to 6.2% year-over-year in February vs. estimated drop to 5.7%

The British pound jumped roughly between 0.05% to 0.50% against the majors on the event, a relatively tame reaction, likely due to traders taking quick profits or repositioning for the Bank of England statement that was to come just a day after.

Risk environment and intermarket behaviors:

Risk sentiment was broadly positive this week, generally a reaction to positive news (e.g., UBS takes over Credit Suisse, central banks shore up U.S. dollar liquidity) on the negative banking sector events that dominated headlines in March. Risk assets were up while the Dollar and gold spent most of the week in the red.

Feb 14, 2023:

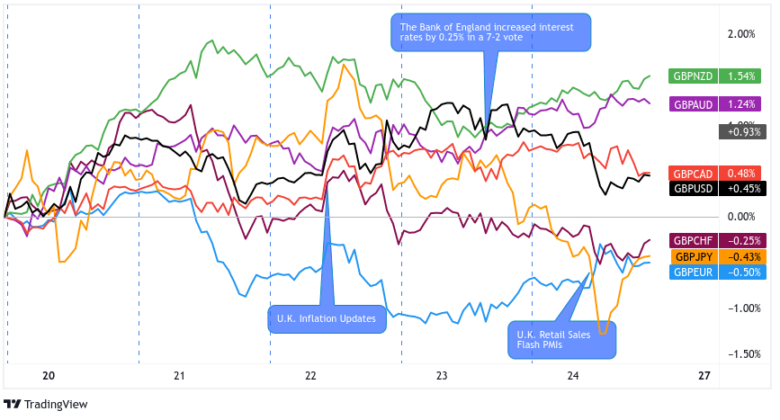

Overlay of GBP Pairs: 1-Hour Forex Chart

Action / results:

U.K. inflation rates fell more than expected as the headline CPI read was down from 10.5% y/y in December to 10.1% y/y in January. GBP fell roughly between 0.50% to 1.10% against the majors before finding a bottom on the session

Risk environment and intermarket behaviors:

Intermarket price action and broad risk sentiment was mixed during this week. Traders started off cautious but then quickly adapted to higher-than-expected CPI reads from the U.S./hawkish Fed rhetoric. Individual asset stories also played a factor to the unusual relative behavior of the week.

Risk Sentiment Scenario Probabilities Ahead:

Unless we see big surprises with the global inflation updates, it’s probably not until Friday (barring any major surprises) that we may see a strong broad directional market opinion.

That’s when we get the latest round of global flash PMIs, which will give us the latest picture of how prices and employment data is trending.

Also, if global inflation updates come in below expectations / previous reads on net, it’s possible risk sentiment/behavior may begin to lean more risk-on as traders price in rising probabilities of central banks lowering or pausing the pace of monetary policy tightening.

British Pound scenarios:

Base Scenario:

GBP volatility is likely to rise with this event, and if U.K. inflation data generally comes inline or slightly below expectations, probabilities rise that the British pound may see selling pressure.

Again, in the current environment, falling inflation means less pressure for the Bank of England to keep tightening monetary policy, or at the very least, it reduces the risk of the BOE over tightening policy.

Probabilities of a strong downside move rise if GBP rises ahead of the U.K. inflation event, a possible scenario IF broad risk sentiment leans positive and/or U.K. employment data updates on Tuesday lifts Sterling higher.

In this scenario, short GBP opportunities should be looked further into with GBP/AUD, and possibly with GBP/CAD if Canadian CPI comes in hot.

Alternative Scenario:

If U.K. inflation data generally comes inline or slightly above expectations, probabilities rise that the British pound may see some buying pressure as expectations rise that the Bank of England will keep monetary policy tight.

Probabilities of a strong upside reaction rises more if GBP falls ahead of the U.K. inflation event. This is a possible scenario IF broad risk sentiment leans negative on Tuesday and/or U.K. employment data updates on Tuesday disappoints and brings Sterling lower before the inflation update.

In this range of scenarios, do further work on GBP/JPY & GBP/NZD to find potential long Sterling opportunities.

This post first appeared on babypips.com