We’re about to start a brand new trading month, which means central banks like the Reserve Bank of Australia will soon start dropping their July policy statements!

What are traders expecting from the RBA and how could the decision affect AUD’s prices?

I’ve got the important points for ya!

Event in Focus:

Reserve Bank of Australia (RBA) Monetary Policy Statement

When Will it Be Released:

July 4, 2023 (Tuesday): 4:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- RBA to raise its interest rates by another 25 basis points to 4.35%

- RBA’s statement may emphasize that further tightening may still be required depending on economic and inflation data

Relevant Australian Data Since the Last RBA Statement:

? Arguments for Tighter Monetary Policy / Bullish AUD

S&P manufacturing PMI rose from 48.4 to three-month high of 48.6 in June as production shrank at its slowest pace since February

The unemployment rate dipped from 3.7% to 3.6%, net employment +75.9K (vs. 18.6K expected, -4.0K previous) on increased vacancies and high demand for skilled labor

Melbourne Institute: Inflation expectations unchanged at 5.2% in June, wages are expected to grow by 1.6% over the next 12 months

? Arguments for Looser Monetary Policy / Bearish AUD

May CPI slumped from 6.8% to 5.6% year-over-year vs. an estimated dip to 6.1%

S&P services PMI fell from 52.1 to 50.7 even as businesses continued to hire additional staff in June

Westpac-Melbourne leading index further declined from -0.78% to -1.09% in May, the tenth consecutive negative print for the index

Previous Releases and Risk Environment Influence on AUD

June 6, 2023

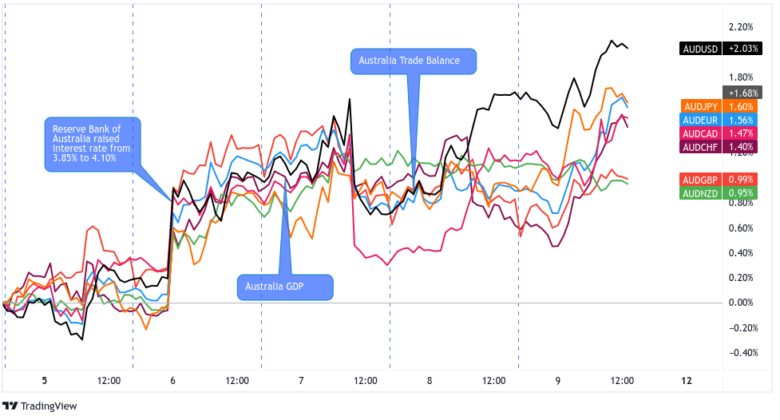

Action / results: Instead of keeping its interest rates steady at 3.85%, the RBA shocked the markets with a 25bps rate hike to 4.10%.

In addition to that, the official statement also shared that “further tightening of monetary policy may be required.”

Not surprisingly, AUD spiked broadly on the news. It also helped the commodity-related currency that traders were optimistic on speculation that Chinese regulators could possibly soon provide support to the housing sector.

The RBA’s hawkish rate hike pushed the Aussie to new intraday highs and stayed within the areas until the next day’s Asian session trading.

Risk environment and Intermarket behaviors: Traders started the week on an optimistic note thanks to a resolution to the U.S. debt ceiling drama over the weekend, a strong NFP release on Friday, and a surprise output cut by OPEC+.

Speculations that the Chinese government would prop up its shaky housing sector also helped push equities and “risk” assets like crude oil, AUD, NZD, CAD, and GBP higher even before the RBA dropped its decision.

May 2, 2023

Overlay of AUD vs. Major FX: 1-Hour Forex Chart by TV

Action / results: AUD was trading inside its U.S. session ranges when the RBA surprised forex traders with a 25-basis point interest rate hike to 3.85% in May.

It turned out that the RBA thought a 7% inflation rate is still “too high” and that it would take YEARS for it fall to the central bank’s target range at the current rate of slowing.

In its statement, the RBA also noted that further tightening “may be required” to return inflation rates to its target “in a reasonable timeframe.”

The surprise tightening bumped AUD by more than 1.0% higher than its major counterparts.

Risk environment and Intermarket behaviors: Unfortunately for risk takers (like AUD bulls), banking contagion concerns dominated the day’s London and U.S. session trading.

Risk assets including U.S. equities, bitcoin, and commodity-related currencies crashed. AUD, in particular, dipped to new intraday lows and didn’t let up its downswings until near the end of the week.

Price action probabilities

Risk sentiment probabilities: Hawkish speeches by Fed, ECB, BOE, and BOJ head honchos seem to have taken center stage so far this week to influence risk sentiment.

Many of them recognize that their policies are currently already restrictive, but they also noted that inflation rates remain relatively high. So it’s no surprise that most see the probability that further rate hikes are still high, but future decisions will remain data dependent and on guidance will remain on a per meeting basis.

Based on broad risk-on vibes since the ECB‘s central bank forum, it looks like traders aren’t too concerned about future rate hikes, likely still thinking that we’re closer to a rate hike cycle peak rather than the beginning and probably on the idea that probability of recession isn’t as high as we think.

But these risk-on vibes could be derailed on Monday ahead of RBA statement with the next set of Global PMI updates, with many countries surveyed projected to show further weakness. Keep in mind that this round is the final read so the reactions may not be big, but it’s something to be aware of before making your risk sentiment forecast.

Australian Dollar scenarios

Base case: Based on the economic data above and the RBA’s June statement saying that further tightening “may be required,” it’s more likely that Governor Lowe and his team will raise interest rates by another 25 basis points to 4.35% next week.

But based on the recent downtrend in the Aussie, it seems that not a lot of traders are convinced of another rate hike, though, which means that the outcome certainty for this event is pretty low. Low certainty also means that the odds are high for another volatile AUD reaction that could last until the U.S. session trading.

Like in the June decision, RBA’s July event will happen on a Tuesday. So, depending on the overall risk sentiment on late Friday and/or early Monday, AUD’s price reaction to the RBA’s rate hike could make or break an uptrend for that week.

A “hawkish RBA rate hike” scenario (where RBA focuses on relatively high inflation/persistent job strength rate rather than slower CPI rate) may draw in AUD bulls against fellow comdolls like NZD and CAD and safe havens like JPY and EUR, especially if positive risk sentiment is dominating.

Alternative Scenario: A “hawkish pause” is another scenario to consider, where the RBA decides to keep its rates at 4.10% but signals further hikes ahead. There’s a possibility that the slow down in CPI in May and falling business conditions may have spooked the RBA into thinking it’s time for a pause.

Now, since AUD has been under pressure since mid-June, the reaction may not be straight forward in that we could actually see a “buy-the-rumor, sell-the-news” scenario play out, where Aussie bears who have been expecting a pause takes profits (i.e., buy back their shorts).

If that’s the case and risk sentiment is positive, look for top tier technical setups in the Aussie against the yen, euro and Canadian dollar for short-term bounces before considering your risk management plan.