Any chance the RBNZ could resume its tightening cycle soon?

The quarterly jobs report might have some clues!

Event in Focus:

New Zealand Quarterly Employment Report for Q2 2023

When Will it Be Released:

August 1 (Tuesday), 10:45 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Employment change q/q: +0.6% expected vs. +0.8% previous

- Unemployment rate: 3.5% expected vs. 3.4% previous

Relevant Data Since Last Event/Data Release:

- ANZ Business Outlook survey employment intentions fell to negative territory in May, then bounced around mildly negative levels before improving slightly in June

- BusinessNZ services index employment component improved from 50.2 to 52.3 in April to May but dropped to 49.1 in June

- BusinessNZ manufacturing index employment component stayed in contraction from April to June

- NZIER business confidence index for Q2 2023 showed a “continued decline in those reporting finding labour as their primary constraint” and that a “small proportion of firms increased their headcount in the June quarter, indicating that hiring remained fairly robust”

Previous Releases and Risk Environment Influence on NZD

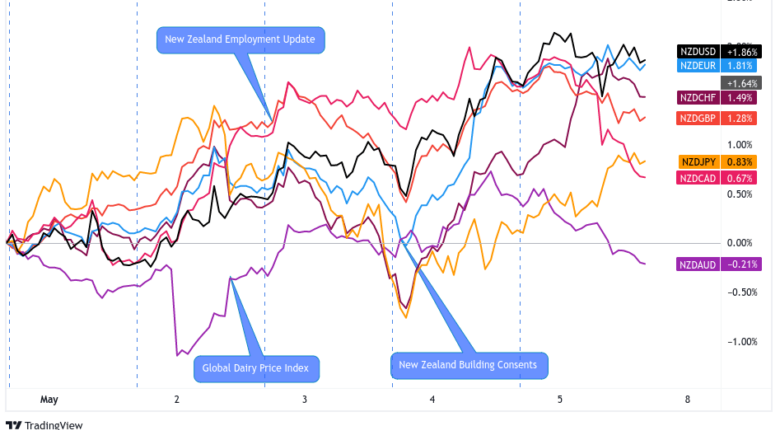

May 2, 2023

Event results / Price Action:

New Zealand’s quarterly employment change was up by 0.8% in Q1 2023 vs. 0.5% expected. The previous reading enjoyed an upgrade from the initially reported 0.2% increase to a 0.5% gain.

Meanwhile, the unemployment rate held steady at 3.4% instead of rising to the projected 3.5% figure.

The Kiwi already got a bit of a lift from the RBA interest rate hike earlier in the week plus a relatively confident RBNZ Financial Stability Report, leading to expectations that the RBNZ might soon announce another tightening move as well.

These bullish vibes got stronger when the jobs figures were released, bringing the Kiwi to the top of the weekly rankings.

Risk environment and intermarket behaviors:

A handful of top-tier data releases and major central bank decisions kept traders on edge for the most part of the week, along with banking sector jitters and recession fears.

Risk assets were off to a rough start, as market watchers kept close tabs on JPMorgan’s First Republic Bank takeover and U.S. debt ceiling negotiations.

Fortunately for the higher-yielding Kiwi, the Fed’s “dovish hike” announcement led to a bit of a pickup in risk-taking on Wednesday, followed by stronger than expected U.S. jobs data later on.

January 31, 2023

Event results / Price Action:

New Zealand’s Q4 2022 jobs figures turned out weaker than expected, as the economy printed a meager 0.2% uptick in hiring versus the estimated 0.3% gain and the earlier 1.3% jump.

This brought the jobless rate up from 3.3% to 3.4% for the period instead of holding steady, triggering a wave of intraday losses for NZD, before other intermarket factors took hold during the latter part of the week.

Risk environment and intermarket behaviors:

The markets started the week on a mixed note as traders started pricing in expectations for the FOMC decision coming up.

Expectations that the U.S. central bank could signal a pause in hiking led to a bit of an uptick in risk-taking ahead of the event, although the Kiwi struggled to take advantage of these moves. The not-so-hawkish FOMC announcement spurred an even stronger rally among risk assets, including NZD this time.

However, higher-yielding assets had no choice but to return all those gains and more on Friday when the NFP came in much hotter than expected, once again increasing the odds of more Fed rate hikes.

Price action probabilities:

Risk sentiment probabilities:

This week is one of those busy ones again, which suggests that traders could sit on their hands while waiting for the top-tier market catalysts to be released.

So far, a bit of risk-on vibes can be observed even after China printed mixed official PMI readings, but that seems to be souring a bit through the Monday U.S. session.

Risk sentiment on Tuesday going into the NZ jobs release will likely be dictated by a round of global PMI data and job openings data from the U.S. These are all top tier events with mixed expectations, so it’s likely a better move to see the numbers first and the market’s reaction rather than anticipating what risk sentiment may be going into the NZ event.

New Zealand dollar scenarios:

Potential Base Scenario:

Leading indicators are pointing to subdued employment growth for the quarter, as businesses had to grapple with hiring constraints and higher cost pressures.

In that case, a weaker than expected read could reinforce views that the RBNZ would be sitting on its hands possibly for the remainder of the year, likely triggering losses for the Kiwi.

In this scenario, look out for potential NZD losses against currencies with more hawkish central banks (GBP, USD) or against lower-yielding rivals (CHF, JPY) if risk-off flows pick up.

Don’t forget that the BOE has its policy decision lined up later in the week, so tightening expectations might keep GBP strongly supported.

Potential Alternative Scenario:

A significant upside surprise in hiring might be enough to raise RBNZ rate hike bets in their next policy decision, which might lead to a sharp rally for the Kiwi.

If that happens, be ready to buy NZD against currencies with central banks shifting to a less hawkish stance (EUR) or against safe-haven bets (USD, JPY) if risk-taking extends its stay.

Also keep in mind that the RBA has its policy decision lined up earlier in the day, so a downbeat policy lean might also make the Australian dollar a viable counterpart for a long NZD setup.