The Fed is expected to drop the first of its last two interest rate hikes this year!

How could the dollar react to a rate hike without updated economic projections?

Here are major points you need to know if you’re planning on trading the event:

Event in Focus:

Federal Open Market Committee (FOMC) Monetary Policy Statement

When Will it Be Released:

July 26, Wednesday: 6:00 pm GMT

Fed Chairman Powell will conduct a presser 30 minutes later.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Fed is expected to raise its interest rates by 25 basis points to the 5.25% – 5.50% range (CME Fed Watch tool sees 99.8% probability as of Jul. 24)

- Chairman Powell will likely acknowledge recent easing inflation data but also communicate the Fed’s readiness to address further labor market tightening or reversals in the current price trends.

Relevant U.S. Data Since Last FOMC Statement:

? Arguments for Tighter Monetary Policy / Bullish USD

NY Manufacturing Index for July: 1.1 (-6.0 forecast; 6.6 previous); employees index popped to 4.7 from -3.6 previous; prices paid index fell to 16.7 vs. 22.0 previous

NAHB Housing Market Index ticked up in July to 56 vs. 55; “The lack of resale inventory means prospective home buyers who have not been priced out of the market continue to seek out new construction in greater numbers”

Initial jobless claims for week ending July 15: 228K (242K forecast; 237K previous); the less volatile four-week moving average also fell 9.25K to 237.5K

Existing Home Sales for June: -3.3% m/m (-1.2% m/m forecast; 0.2% m/m previous); the downturn is mainly due to extremely low inventory of pre-owned homes

NFIB Small Business Index for June: 91.0 (89.9 forecast; 89.4 previous); “42 percent of owners reported job openings that were hard to fill”

University of Michigan Consumer Sentiment Index for July: 72.6 (64.5 forecast; 64.4 previous)

Preliminary U.S. Consumer Sentiment for July: 72.6 (64.5 forecast; 64.4 previous); short-term inflation expectations ticked up from 3.3% to 3.4%

? Arguments for Looser Monetary Policy / Bearish USD

Industrial Production in June: -0.4% y/y (0.5% y/y forecast; 0.2% y/y previous)

CB Leading Index in June: -0.7% m/m vs. -0.6% m/m decline in May; “The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession.”

CPI for June: 3.0% y/y (3.2% y/y forecast; 4.0% y/y previous); core CPI was at 4.8% y/y (5.0% y/y forecast; 5.3% y/y previous)

Import and export prices fall in June (-0.2% m/m & -0.9% respectively)

S&P Global US Manufacturing PMI for June: 46.3 (as forecasted) vs. 48.4 in May

ISM Manufacturing PMI for June: 46.0 (48.0 forecast; 46.9 previous); Employment Index fell by -3.3 to 48.1; Prices Index fell -2.4 to 41.8

Factory Orders for May: +0.3% m/m (+1.5% m/m forecast; +0.3% m/m previous)

Non-Farm Payrolls for June: 209K (250K forecast; 306K previous); unemployment rate dips to 3.6% vs. 3.7% forecast/previous; Average Hourly Earnings: 0.4% m/m (0.3% m/m forecast; 0.4% m/m previous)

Previous Releases and Risk Environment Influence on USD

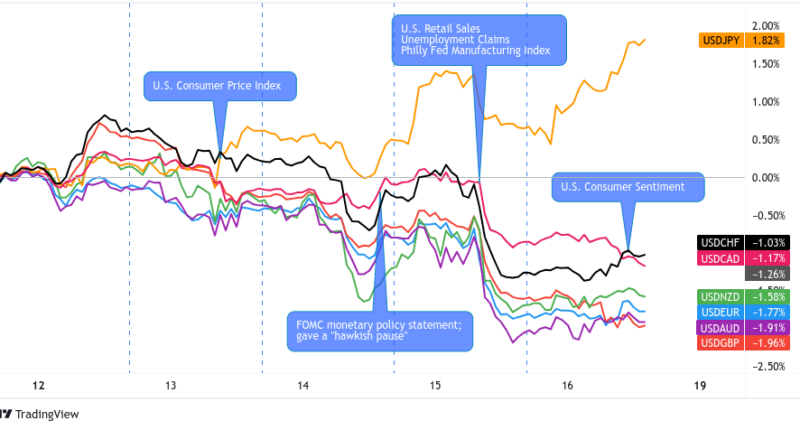

Jun. 14, 2023

Overlay of USD vs. Major Currencies Chart by TV Chart by TV

Action/results: For the first time since March 2022, the Fed did not raise its interest rates and kept its Federal Funds rate steady at the 5.00% – 5.25% range.

USD gained ground at the release, partly because the move was widely communicated ahead of the event. Not only that, but the dot plot projections that came with the statement showed that members are expecting at least two more rate hikes in 2023 and that not one is expecting a cut throughout the year.

The “hawkish pause” bumped USD higher in the first 15 minutes of the release. A bit of profit-taking dragged it to at least 50% pullbacks before ending the day near its intraday highs.

Risk Environment and Intermarket Behaviors: The combo of weak global demand concerns and expectations of looser monetary policies kept the major currency pairs in tight(ish) ranges early in the week.

It wasn’t until China dumped a bunch of top-tier reports and the U.K. printed its labour data when traders made more decisive moves that contributed to increased volatility later that week.

May 3, 2023

Overlay of USD Pairs: 1-Hour Forex Chart by TV

Action/results: As expected, the Fed hiked its rates by 25 bps to the 5.00% – 5.25% range, which is the “terminal rate” FOMC members marked on their March dot plot projections.

Chairman Powell also shared that the Fed will be data-dependent going forward, which traders took as dovish.

USD spiked higher at the release but then started trading lower in the next 15-minute candlestick. The Greenback eventually made new intraday lows against all of its major counterparts but the Japanese yen.

Risk Environment and Intermarket Behaviors: A combination of mixed labor market numbers, regional bank contagion fears, and recession concerns were dragging the dollar into a downtrend for most of the week.

The actual rate hike initially gave the dollar a boost, but the dovish nature of the decision gave USD traders the license to extend the dollar’s intraweek downtrend until Friday.

Price action probabilities

Risk sentiment probabilities: Similar to our risk sentiment outlook discussed in our Australian CPI Event Guide, we think broad risks sentiment is currently leaning slightly negative, but individual asset drivers are muddying up the picture.

And with the FOMC event being THE event to watch this week, it’s likely we’ll continue to see limited volatility and weak risk sentiment biases until the Fed speaks on Wendesday (barring any major surprises of course).

U.S. Dollar scenarios

Base case: As in the last releases, the Fed could do what the markets are expecting. In this case, the FOMC gang could raise their interest rates by another 25 basis points to the 5.25% – 5.50% range.

With such a widely telegraphed move, USD’s extended reaction to the release will likely depend on Powell’s hawkishness during the presser.

And with the Fed not printing new dot plot projections and the members only in the mood for one more rate hike until the year ends, it’s likely that we’ll see more USD selling than sustained buying after the event. Positioning may be a factor (i.e., if USD rallies ahead of the event and the event sparks a sell-off, the selling pressure may be more intense than if USD fell ahead of the FOMC statement.

Of course, the overall risk sentiment during the event would play in the degree and duration of USD’s weakness. Unless we see risk-friendly economic themes and data releases outside of the FOMC driving biases, USD could dip against high-yielding bets like AUD, NZD, and GBP but also recover by the end of the day.

Alternative Scenario: If the markets start discounting the Fed and ECB’s rate hikes and start pricing in higher probability of looser monetary policies (e.g., concerns on future growth more elevated than expected / expectations of inflation rates decelerating quickly), then USD could weaken against its counterparts and accelerate its downswings after the Fed raises its interest rates.

In the event of a risk-friendly, anti-USD environment, the dollar could see more consistent losses against AUD, JPY, CHF, and CAD.

Whatever scenario you choose to do more work on and risk management, keep in mind that unless we get a major surprise from the Fed on Wednesday, the FOMC statement’s influence may be short-lived as the latter half of the week’s calendar is loaded with top tier events to likely re-direct traders’ focus.