The Fed isn’t the only major central bank expected to raise interest rates this week!

How likely is an ECB rate hike and how may EUR react to the event?

Here are points you need to know if you’re planning on trading the ECB decision:

Event in Focus:

European Central Bank (ECB) Monetary Policy Statement

When Will it Be Released:

July 27, Thursday: 12:15 pm GMT

ECB President Lagarde will conduct a presser 30 minutes later.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- ECB is highly likely to raise its refinancing rates by 25 basis points to 4.25% this week

- ECB will next meet in September, so President Lagarde will likely emphasize the need to address a stubbornly high core inflation but also the need to adjust to lower growth prospects.

Relevant Eurozone Data Since Last ECB Statement:

? Arguments for Tighter Monetary Policy / Bullish EUR

Euro-area annual inflation fell to 5.5% y/y in June 2023 as expected; core inflation strengthened to 5.5% y/y (5.4% y/y forecast; 5.3% y/y previous)

Euro Area Industrial Producer Prices for May: -1.9% m/m (-3.2% m/m previous) and -1.8% m/m in the European Union

Preliminary Germany CPI for June: +6.4% y/y vs. +6.1% y/y in May

ECB Executive Board member Schnabel sees prices rising due to corporate profits and higher salaries

Euro area consumer confidence for June: +1.3 points to -16.1; EU was +1.1 points to -17.2

? Arguments for Looser Monetary Policy / Bearish EUR

French flash manufacturing PMI slipped from 46.0 to 44.5 to signal a sharper contraction vs. the estimated 46.1 figure, and services PMI dipped from 48.0 to 47.4 vs. the 48.5 forecast in July

German flash manufacturing PMI tumbled from 40.6 to 38.8 in July to reflect a faster pace of contraction vs. 40.9 consensus, services PMI down from 54.1 to 52.0 to indicate slower growth

HCOB Flash Eurozone Manufacturing PMI for July: 42.7 vs. 43.4 previous; saw the smallest increase in m/m employment since Feb. 2021; input cost inflation fell for the 10th month in a row

Germany’s producer prices edged up 0.1% y/y in June – the lowest since November 2020 – vs. 0.0% expected, 1.0% y/y in May

Eurozone Sentix Investor Confidence Index fell in July to -22.5 from -17.0

HCOB Eurozone Services PMI Business Activity for June: 52.0 vs. 55.1 in May:

HCOB Eurozone Construction PMI for June: 44.2 vs. 44.6; “marked deterioration in activity in Germany that was the steepest seen since February 2021”

Euro Area Retail Sales for May: 0.0% m/m (0.3% m/m forecast; 0.0% m/m previous); -2.9% y/y (-3.2% y/y forecast; -2.9% y/y previous)

Previous Releases and Risk Environment Influence on EUR

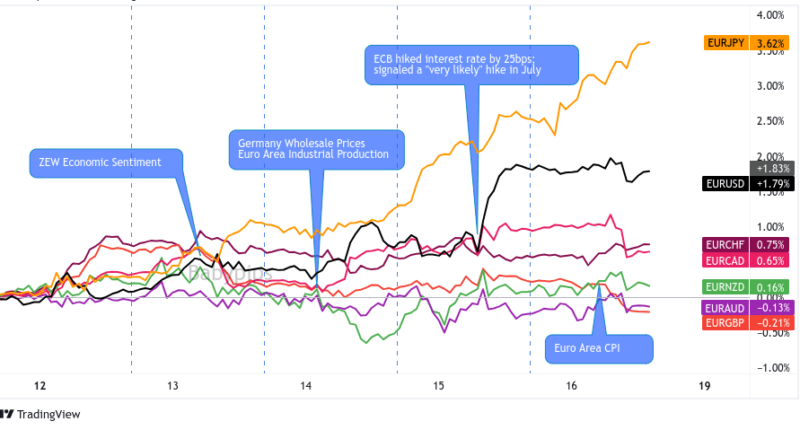

Jun. 15, 2023

Overlay of EUR vs. Major Currencies Chart by TV Charts by TV

Action/Results: As expected, the ECB raised its interest rates by 25 basis points to 4.00%.

In her presser, ECB President Lagarde hinted that she and her crew are widely in favor of another rate hike in July. Lagarde also refrained from talking terminal rates, which pointed to the ECB still being open to multiple rate hikes in the foreseeable future.

The ECB’s hawkish hike highlighted its policy gap with the Fed and helped push EUR higher against USD, JPY, and NZD amidst a risk-friendly trading environment.

Risk environment and Intermarket behaviors: A less-hawkish-than-expected FOMC decision the day before the ECB’s event set the tone for risk-taking in the markets.

Strong U.S. and corporate earnings data, and a non-event BOJ decision enabled traders to maintain the pro-risk, anti-USD sentiment until the end of the week.

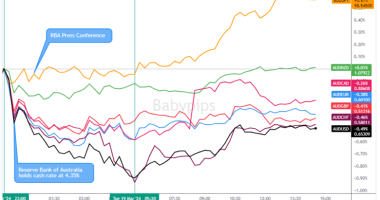

May 4, 2023

Overlay of EUR vs. Major Currencies Charts by TV

Action/Results: The ECB raised its main refinancing rate by 25bps to 3.75%, disappointing those who priced in a 50bps rate hike.

In her presser, Lagarde noted that some members did vote for a 50bps hike and that there’s room for further rate hikes.

She also shared that the central bank will stop its Asset Purchase Programme (APP) reinvestments in July, a move that would reduce the ECB’s portfolio by an average of 25B EUR per month.

Choosing to raise rates by 25bps instead of the “usual” 50bps shortly after reports of slower inflation and bank lending were released smelled a lot like “almost end of tightening cycle” to many traders.

Despite Lagarde’s hawkish remarks, EUR fell across the board and stayed near its intraday lows until the end of the day.

The ECB’s decision came a day after what markets considered a “dovish hike” for the Fed, which made it easier for traders to price in another “dovish hike” that week.

EUR had also risen in the days before the decision, so a buy-the-rumor, sell-the-news scenario was on the table.

Risk environment and Intermarket behaviors: Broad risk sentiment leaned negative, likely due to fresh signals of possible peak global growth, most notably Chinese PMI moving into contractionary territory, falling German retail sales, and a spike in job cuts in the U.S.

This may have influenced euro traders to focus more on weakening economic conditions in the Euro area rather than hawkish rhetoric from the ECB that week.

Price action probabilities

Risk sentiment probabilities: As mentioned in the July FOMC Statement Event Guide, traders are mostly staying on the sidelines ahead of the top-tier economic events this week.

The sentiment is slightly tilted to the downside, though, as weak global PMIs revived concerns over low growth and high interest rates.

The Fed’s decision on Wednesday could provide a clearer intraweek direction for the euro and other major currencies. Until then, we’re unlikely to get much help from this week’s price movements.

Euro scenarios

Base case: In the June release, the euro found support from Lagarde hinting at further hikes in July (and beyond), and possibly finding some support in an anti-dollar environment.

The ECB will still likely raise its rates again this week but, unless Lagarde convinces the markets that more rate hikes are coming, it will likely be hard for EUR to see a burst of bullish momentum if all we get is the expected rate hike.

Of course, positioning matters and with the euro currently trending lower against the majors at the moment, there’s a possibility of potential short covering or “buy-the-rumor, sell-the-news” situation playing out if that trend continues. EUR could pop short-term on just a 25 bps rate hike, with the best currencies to play against dependent on how the market reacts to the FOMC event on Wednesday.

With all of the factors discussed above in play, positioning ahead of the event raises the risk of being caught off guard on the wrong side, so this may be a situation where it’s better to wait-an-see the event outcome first and the prevailing risk sentiment narrative before planning out your risk management strategy.

Alternative Scenario 1: A decidedly hawkish ECB decision is still a possibility as inflation rates are still well above most central bank target ranges despite signs of deceleration across many economies, including the Euro area.

If we see another hawkish ECB event in a risk-friendly trading environment, then EUR could gain pips and even gain bullish momentum against relatively weak currencies like NZD, JPY, and GBP. EUR/USD may be in play as well if the FOMC statement sparks a bearish reaction in the Greenback on Wednesday.

Alternative Scenario 2: Recent consumer and business survey data is pointing to weakness growing in the Euro area, and with inflation rates decelerating and credit conditions tightening, there’s a very small possibility the ECB waves off a September hike completely. This would be a surprise to traders and likely spark broad short-term euro weakness against all of the major currencies.

In this low probability scenario, it would more likely be a “pause” rather than the definitive end to the hiking cycle, with the latter situation likely sparking a more intense reaction than the former. In either case, risk of whipsaw price action is high, so unless you’re a skilled day trader, it might be best to massively limit risk or avoid the event all together until volatility settles down.