The BOE decision is coming up this week!

Will they hike interest rates again as expected?

Here’s what the U.K. central bank might have up its sleeve and how pound pairs might react.

Event in Focus:

Bank of England Monetary Policy Statement

When Will it Be Released:

June 22, Thursday: 11:00 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- BOE to hike interest rates by 0.25% from 4.50% to 4.75%

- No changes to asset purchases expected

- MPC meeting minutes to show 7-2 vote in favor of tightening

Pound traders are counting on yet another 0.25% interest rate hike from the folks over at the Bank of England, as the U.K. economy struggles to ward off stubborn inflationary pressures.

This would mark their thirteenth (and counting!) consecutive tightening move, which would bring their benchmark rate up from 4.50% to 4.75% – its highest level since April 2008.

The minutes of their policy meeting due around the same time as the announcement would provide more insight on their decision and whether or not they’d carry on with this pace of tightening in the near-term.

Just as in their May decision, a couple of dovish dissenters (Dhingra and Tenreyro) are expected to vote for no change in the benchmark rate while the rest are likely to push for an increase. Rumor has it that one very hawkish member might even vote for a 0.50% hike this time.

Relevant U.K. Data Since the Last BOE Statement:

? Arguments for Hawkish Monetary Policy / Bullish GBP

Average earnings index accelerated from upgraded 6.1% to 6.5% over the three-month period ending in April vs. 6.1% forecast, keeping wage spiral risks in play

May claimant count showed 13.6K drop in joblessness vs. projected 21.4K increase, April reading revised to show smaller 23.4K increase in unemployment vs. initially reported 46.7K figure

BRC shop price index rose 8.8% year-over-year to 9.1% in May to reflect record increase in retail prices

April retail sales rebounded by 0.5% month-over-month from earlier 1.2% slump vs. estimated 0.3% uptick, indicating resilience in consumer sector

May headline CPI fell from 10.1% year-over-year to 8.7% vs. 8.2% consensus, core CPI up from 6.2% to 6.8%

? Arguments for Dovish Monetary Policy / Bearish GBP

May consumer inflation expectations fell from 3.9% to 3.5%, suggesting slower inflationary pressures over the next twelve months

May services PMI ticked lower from 55.9 to 55.2 and manufacturing PMI down from 47.8 to 47.1, reflecting industry slowdown

April manufacturing and industrial production posted 0.3% declines vs. estimated 0.1% dips

Previous Releases and Risk Environment Influence on GBP

May 11, 2023

Action / results: BOE hiked interest rates by 0.25% as expected, with MPC members maintaining the 7-2 split in voting to increase rates or pause.

The Monetary Policy Report featured upgrades to inflation forecasts from 3.92% in February announcement to 5.12% for the end of 2023 and from 1.42% to 2.28% for the end of 2024.

In addition, BOE Governor Bailey mentioned that “if there were to be evidence of more persistent [inflationary] pressures, then further tightening in monetary policy would be required.”

Sterling tossed and turned during the BOE decision as the central bank also joined the “dovish hike” bandwagon by toning down their forward guidance.

A general bearish GBP direction ensued when Governor Bailey mentioned in an interview after the presser that they are nearing a point when the central bank could “rest in terms of the level of rates.”

Later in the week, the downbeat monthly GDP reading further stoked expectations of a tightening pause and perhaps even the possibility of a rate cut if economic data worsens.

Risk environment and Intermarket behaviors: Positive risk sentiment spilling over from the previous trading week paved the way for a good start among higher-yielders.

It wasn’t long before risk-off flows returned, though, as investors turned their attention back to U.S. debt ceiling woes and relatively cautious central bank announcements.

It didn’t help that downbeat data from China rolled in later during the week, along with yet another U.S. regional bank reporting a drop in deposits, which then contributed to a selloff in risk assets.

Mar. 23, 2023

Action / results: The BOE increased interest rates by 0.25% in a 7-2 vote, although Governor Bailey hinted that the economy might see a decline in price levels for the rest of the year.

Prior to this, the pound managed to pull up from a weak start when the U.K. February headline CPI jumped from 10.1% to 10.4% year-over-year versus the estimated dip to 9.9%.

Cautious hints from the BOE Governor seemed to have stayed in traders’ minds, though, as the pound slumped against the dollar, yen, and franc for the rest of the week.

Still, risk-off flows weighed more heavily on commodity currencies, allowing the U.K. currency to recoup most of its post-BOE losses on Friday.

Risk environment and Intermarket behaviors: Banking sector woes were the dominant theme early in the week, as traders got wind of the failed attempt by central banks to shore up confidence in the financial sector.

Although Treasury Secretary Yellen reassured that regulators are prepared to take steps to avoid a full-blown meltdown, she also clarified that the government is not considering a “blanket insurance” for uninsured deposits.

This triggered on yet another flight to safety midweek, along with the Fed’s “dovish hike” that kept traders worried about a potential recession. Risk-off flows persisted when Deutsche Bank and UBS shares sunk in price, further challenging traders’ confidence in the banking sector.

Price action probabilities

Risk sentiment probabilities: Risk appetite seems off to a wobbly start this week, as equities and commodities are in the red after major financial institutions downgraded their Chinese growth forecasts.

Looking forward, risk sentiment and volatility conditions are likely to be influenced by this week’s central bank events, most notably Fed Chair Powell’s testimony to Congress (IF we see any surprises there). Also, if we see similarity between the SNB, BOE and Fed’s rhetoric on inflation / growth out look this week, that may lead to more sustain risks sentiment directional moves as the uncertainty of those events pass.

British pound scenarios

Base case:

The May U.K. CPI report will be released a day ahead of the Bank of England rate statement, and if the actual numbers vary wildly from expectations, it could change expectations for the June BOE decision, as well as prompt big volatility for Sterling ahead of the event.

Assuming that U.K. CPI comes inline with expectations and sparks little volatility in Sterling, then another 0.25% interest rate hike from the U.K. central bank is the likely event outcome and we may hear rhetoric that policymakers may not be too concerned about stagflation risks this time.

Given that this scenario has likely been price in for a while based on Sterling’s strong performance against the majors so far this month, this scenario may draw in more GBP long profit takers vs. fresh bulls, and potentially push it lower on the session.

Of course, we also do need to pay attention to Governor Bailey’s rhetoric as well as MPC votes, as that would likely have a bigger weighting on sentiment if we see the expected 25 bps hike. A shift back to a more hawkish tone compared to their previous announcements and/or an increase in MPC members voting for tightening (or larger hikes) might draw in fundamental/news traders to buy up Sterling on the session.

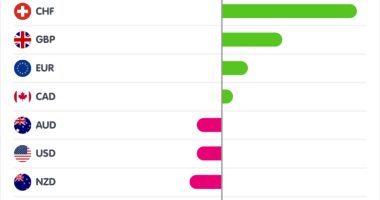

If this happens, solid long GBP setups to study will likely be against currencies with dovish central banks such as JPY and NZD. And a continued environment of risk-off flows could spur gains for the pound against higher-yielding commodity currencies in this case.

Still, the upcoming May U.K. CPI release could set the tone for the June BOE decision, as yet another upside surprise in inflation figures could up the odds of more aggressive tightening moves and push up bullish British pound sentiment ahead of the BOE statement.

Alternative Scenarios: There’s a small possibility that BOE head Bailey could opt to focus on potentially weaker inflationary pressures down the line, setting the tone for a potential tightening pause later in the year.

If this sentiment is reflected in the MPC minutes, the pound could give up ground to currencies with more hawkish policy biases like AUD and CAD. In addition, persistent risk aversion could also mean short-term opportunities for GBP sellers against lower-yielders like USD and CHF.

Also, if the May U.K. CPI update does wildly vary from expectations, short-term volatility will likely rise significantly in the pound and weaken the Base case scenario discussed above. In this situation, a good practice is to wait for the entire BOE monetary policy statement to play out, see the outcome and market reaction. After initial choppiness and volatility, this scenario may potentially lead to a sustained one or two session directional move as traders reprice new information and new expectations.