The Reserve Bank of Australia will give its next monetary policy decision next week!

Could this week’s Australian CPI report influence the central bank’s decision?

Here are points to know if you’re planning on trading Australia’s annualized CPI data:

Event in Focus:

Australia Consumer Price Index (CPI) and inflation data for May 2023

When Will it Be Released:

June 28, 2023 (Wednesday), 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI y/y: +6.2% y/y forecast vs. +6.8% y/y previous

Relevant Data Since Last Event/Data Release:

- Australia’s unemployment rate dipped from 3.7% to 3.6%, with net employment +75.9K (vs. 18.6K expected, -4.0K previous) on increased vacancies and high demand for skilled labor

- Ai Group’s Australian industry index showed Employment, Input Prices, Sales Price Index, and Average Wages Index all fell in May

- Judo Bank Australia Services PMI for May: 52.1 vs. 53.7 previous; “The rate of input cost inflation was at its lowest since October 2021“

- Melbourne Institute inflation gauge jumped from 0.2% to 0.9% in May

- Melbourne Institute’s consumer expected inflation rate accelerated from 4.6% to 5.0% in May

- Judo Bank Australia Manufacturing PMI for May: 48.4 vs. 48.0 in April; third straight read of contractionary conditions

- Australia’s flash manufacturing PMI was unchanged at 48.0 in May, and flash services PMI dipped from an upgraded 53.7 reading to 51.8 to reflect slower industry expansion

- RBA May meeting minutes kept the door open for rate hikes, as policymakers remain wary of upside risks to inflation

- In its May outlook, RBA lowered its end-of-year 2023 forecasts for inflation to 4.25% compared to its March 4.0% estimates

Previous Releases and Risk Environment Influence on AUD

May 31, 2023

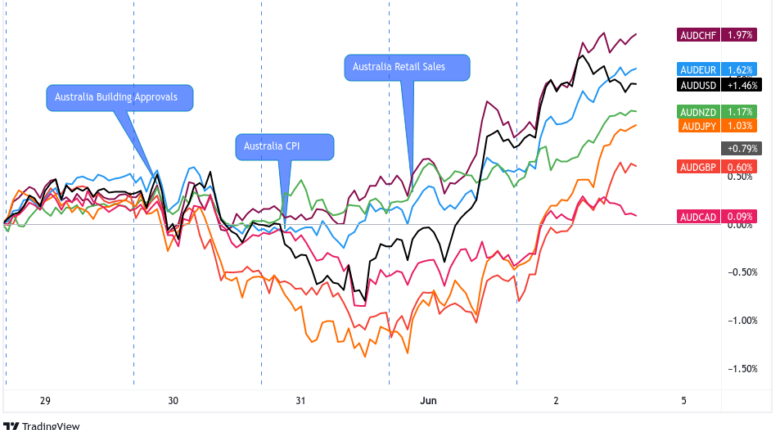

Overlay of AUD vs. Major Currencies Charts by TV

Event results / Price Action: Australia’s monthly CPI shot back up to 6.8% y/y in April after slowing down to 6.3% in March. Turned out, faster growth in transport prices contributed to the CPI printing its first acceleration since December 2022.

AUD initially spiked higher at the news. However, hawkish RBA bets were tempered by global growth concerns when China dropped not one, but TWO disappointing PMI reports.

The Aussie made new intraday and intraweek lows until some optimism in the second half of the U.S. session inspired risk rallies. Much like in the April 26 release, AUD’s intraday lows marked the week’s bottom for the comdoll.

It wasn’t until RBA Gov. Lowe emphasized their seriousness in addressing high inflation and China released a strong Caixin PMI report that AUD saw a bullish intraweek reversal.

Risk Environment and Intermarket Behaviors: Risk assets like AUD had trouble gaining traction in the first half of the week when traders were worried that the debt ceiling deal made over the weekend would pass a Congress vote. It also didn’t help that China printed weak PMI reports and cast doubts on global economic recovery.

Sentiment shifted positive in the back half of the week, likely due to several influences including “June rate hike skip” speculation, better-than-expected Chinese PMI update, and the U.S. passing its debt ceiling bill which lowered the risk of U.S. debt default.

April 26, 2023

Event results / Price Action: The monthly CPI indicator came in at 6.3% from a year ago in March, easing from February’s 6.8% increase and lower than the expected 6.5% reading. A 6.3% CPI also marked the smallest increase since May 2022 and the third consecutive month of cooler inflation.

Traders who were already expecting a weaker CPI – and had been pricing in a less hawkish RBA decision scheduled the following week – were given another momentum burst.

AUD dropped to new intraday (and intraweek) lows until halfway through the Asian session when the comdoll ranged and found intraday bottoms against its major counterparts.

Risk Environment and Intermarket Behaviors: Global banking sector jitters and concerns over the possible U.S. debt default and recession already got traders selling high yielding, “risky” bets like AUD even before the report was released.

Upbeat earnings and positive reports from European banks helped pull AUD back from its intraweek lows, but the prospect of the RBA being less hawkish the following week limited AUD’s retracements.

Price action probabilities:

Risk sentiment probabilities: Based on today’s Asian and European price performances, it looks like traders are still worrying about a possible recession in the Eurozone and China, political unrest in Russia, and the impact of aggressive rate hikes on global growth prospects.

On Tuesday, the risk tone and volatility may change ahead of the Australian CPI event as we get a pick up on potential catalysts from the economic calendar. ECB President Lagarde is due to speak at the ECB Forum on Central Banking, Canada will release its latest CPI update, and the U.S. release updates on durable goods, housing prices and consumer confidence.

With such a wide range of catalysts, there’s low confidence on what to anticipate the risk environment will be around the Aussie CPI update, but our best guess is that U.S. consumer confidence data may be the biggest catalyst in that bunch. Keep an eye on that to set the tone going into the Asia session.

Australian dollar scenarios:

Potential Base Scenario: We know from the last two releases that AUD’s initial reaction directly correlates with the data release. Higher-than-expected CPI would encourage hawkish bets and AUD buying while slower inflation would encourage short-term selling.

Based on some leading indicators and current market expectations, it’s possible to see slower CPI growth in May.

Be more mindful of overall risk sentiment, though. A faster CPI and the prospect of more RBA rate hikes may feed into global growth fears and maybe weigh on AUD.

If the markets’ interpretation of the CPI release fits their global growth concerns, then it’s probably best to look for setups in AUD against safe havens like USD and JPY, especially if risk sentiment continue to lean risk-off

Potential Alternative Scenario: I don’t know if you noticed but AUD’s selloff started gaining ground in mid-June when we found out that RBA’s June rate hike decision was “finely balanced” and not decisively hawkish.

If traders get over their global growth fears, and if Australia’s May CPI came in higher than expected, then we could potentially see AUD regain some pips on short covering and fundamental biases, especially against fellow comdolls like NZD and CAD.

Just take note that, as in the last two releases, AUD’s reaction to the CPI report may be limited to the end of the Asian and European sessions.