ENERGY bosses and the Government are in talks over soaring bills – with £600 hikes due in weeks. But some good news is also on the way.

Some 16 million households on average £1,277-per-year price cap deals are braced for mega increases to around £1,900 to be announced on February 7, kicking in from April.

And amid sky-high wholesale gas costs, future price cap changes could happen more regularly – every three months, not six as currently.

Better news is that the Government is considering loans to suppliers to reduce both price cap increases and extra bill charges covering costs stemming from energy firms which went bust.

Bigger payouts to support more lower-income families are also expected.

There are also calls to cut green levies from bills, to axe VAT on bills and to wallop North Sea gas producers with a windfall tax.

Chris O’Shea, chief executive of British Gas owner Centrica, said: “Deferring energy suppliers’ extra costs and taking VAT and green levies off bills could reduce price increases.”

The Government, set to announce financial help for bills in weeks, said: “Ministers are working to protect consumers from high costs.”

Sun Money today guides you through the options as the energy crisis hits boiling point.

Bills may rise if…

PRICE CAP RISES

Over half the population – people on variable tariffs – will see bills rocket, as the price cap is set to soar from an average of £1,277 to close to £1,900 from April 1. High wholesale gas prices are to blame.

CHANCE OF THIS HAPPENING: Certain. But hike could be reduced by Government loan scheme below.

IMPACT ON BILLS: £600 increase for 16million households. People on fixed deals are unaffected.

PRICE CAP CHANGES EVERY 3 MONTHS

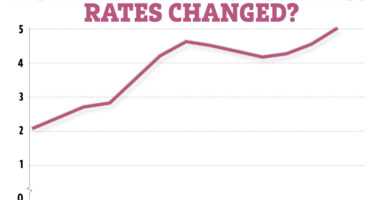

Regulator Ofgem is considering allowing the price limit on variable-rate deals to be adjusted more regularly than the current six-month review system, starting from October.

CHANCE OF THIS HAPPENING: Likely.

IMPACT ON BILLS: Will increase more regularly when wholesale energy prices are high but decrease more quickly when prices eventually drop.

Bills may fall if…

GOVT OFFERS LOANS TO SUPPLIERS

Ministers are considering loans to suppliers covering part of homes’ increased bills – meaning firms can charge customers less.

It would reduce price-cap spikes and the £100-per-household levy due in October, to repay suppliers’ extra costs for taking on customers of bust companies.

CHANCE OF HAPPENING: Likely.

IMPACT ON BILLS: Potentially hundreds off – but possibly only for lower earners.

LOWER-EARNERS GET MORE HELP

The Warm Home Discount scheme will be expanded. It currently sees a million pension credit recipients and a million families on other benefits receive £140 a year.

Government plans will see more people receive the payout, amid calls for it to increase to £300.

CHANCE OF HAPPENING: Almost certain.

IMPACT ON BILLS: Up to £300 cut for some.

GREEN LEVY IS SCRAPPED

Some £195 – 15 per cent – of the average household’s bill is ring-fenced to fund green schemes, including renewable energy. Ditching the levy would hamper reducing carbon emissions.

CHANCE OF HAPPENING: The levy is unlikely to be totally removed but could be reduced instead, for all households or just low earners.

IMPACT ON BILLS: £195 off.

VAT IS AXED

The tax bumps up power bills by five per cent. Getting rid of it would cut £64 off the average bill. But wealthy households as well as the hard-up would save money, making the Government less keen.

CHANCE OF HAPPENING: Low.

IMPACT ON BILLS: £64 cut.

NORTH SEA OIL AND GAS FIRMS ARE WINDFALL-TAXED

The Government face calls to hit North Sea oil and gas producers with an extra tax payment, providing a fund to help cut bills.

But imported gas providers would dodge the charge. The North Sea produces around 40 per cent of UK gas consumption.

CHANCE OF HAPPENING: Low.

IMPACT ON BILLS: Reduction of £100-plus.

Power posers

CAN I BEAT PRICE CAP INCREASES BY SWITCHING?

No. All fixed deals cost hundreds more than the price cap. And all providers’ variable tariffs cost the same as the price cap – £1,277 for an average customer.

MY FIXED DEAL IS ENDING. WHAT SHOULD I DO?

Nothing. Do not sign up for a rip-off fixed tariff. Revert to the variable rate, which is the cheapest price at the moment.

WHAT SHOULD I DO IF I MOVE HOUSE?

Make sure your new supplier gives you a variable rate deal. Some sneaky firms have forced movers onto pricey fixed tariffs.

FOR HOW LONG WILL ENERGY PRICES BE HIGH?

Another two years, energy industry insiders say.

I’ll pay almost double but green levy is vital

MARK Wallage’s energy costs are set to almost double – but the father of one reckons scrapping green levies to cut bills would be crazy.

The 42-year-old airline crew member bagged one of the last cheap fixed deals on the market, 11 months ago, before prices rocketed.

He uses more energy than average but pays £1,200 for the E.ON deal for his three-bedroom house in Windsor, Berks.

However, the contract expires in weeks – with price-cap hikes set to send his new variable rate tariff above £2,000.

Mark said: “The Government need to prioritise helping people who will struggle to pay their bills. But it would be short-sighted to get rid of the green levy, as that helps cut carbon emissions.”

He added: “I’d support a windfall tax on gas producers, although a VAT cut would not save people enough money to make any real difference.”