The Government’s £21 billion package to help households cope with soaring energy bills, unveiled on Thursday by Chancellor Rishi Sunak, has received widespread approval. Yet it won’t bring instant financial relief, especially to many pensioners reliant on the state pension and those struggling on low incomes. Most of the measures, such as the £400 discount on energy bills and one-off payments (£300) to pensioner households, will not kick in until this autumn at the earliest. So it’s essential that you remain on the front foot by identifying ways of saving money. Here are seven steps you can take NOW to cut your costs – without becoming hermits and forgoing some of life’s pleasures, such as going out for a meal or seeing a movie.

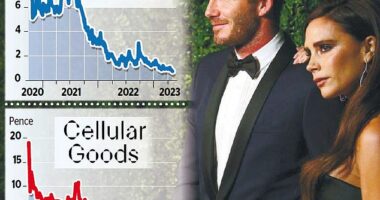

1 LOOK TO LOCK IN A CHEAP MORTGAGE RATE

Interest rates are only going one way this year and next – and that is up. So if you have a home loan where the interest rate is variable, it’s time to remortgage to a deal where the rate is fixed. The quicker, the better, I say.

By fixing, you will lock down probably one of your biggest monthly household expenses, giving you financial certainty in an uncertain world.

The fixed rate you secure will depend on the amount of equity in your home. The more you have, the better the rate. It will also depend on how long you want to fix for.

It’s time to remortgage to a deal where the rate is fixed. The quicker, the better, I say.

By way of example, someone with a £150,000 repayment home loan on a variable rate will be paying about 4.34 per cent interest – resulting in an overall monthly payment of just over £820. Taking out an average priced five-year fixed-rate deal, the monthly payment will fall to just under £670 – an annual saving of more than £1,800.

For those on an existing fixed-rate home loan where the deal has less than six months to go, you can book a new fixed rate now to kick in when the current one expires. A shrewd move, given that mortgage prices are rising all the time.

Brokers such as L&C Mortgages (landc.co.uk) will do the hard work for you.

2 SCOUR BANK ACCOUNTS FOR UNUSED SERVICES

Cancel those direct debits for services and products you no longer use. Households spend an average £500 a year on subscriptions. So if there are TV streaming services, gym memberships, magazine or food subscription services you are not getting good use out of, now is the time to ditch them – or to make a note to ditch them ahead of renewal.

So trawl through your bank statements and credit-card bills to remind yourself of everything you are paying for. Make sure you terminate your subscription with the provider before cancelling any direct debits, otherwise this can be treated as a payment default and impair your credit score.

3 SELL YOUR TREASURE TROVE OF JUNK

The average household has £400 of unused junk lying around their homes or sitting in a spare room or attic. A source of ready income.

Internet auction websites such as eBay provide a marketplace for almost everything.

Selling your unused items can give them new life and you some extra cash

Do not be greedy with the prices you set and always include details of damage or faults. For eBay, you do not need to pay a listing fee but you will typically pay 12.8 per cent of the final cost, including postage, plus a 30p charge.

4 DRIVE DOWN YOUR MOTORING COSTS

Putting your foot down hard on the accelerator is a gas-guzzler. But driving smoothly in a high gear while sticking within the speed limit can knock 25 per cent off your fuel bill, saving £318 a year in petrol or £420 in diesel.

You can also cut fuel costs by making sure your tyres are at the right pressure, turning off the air conditioning and losing extra weight by emptying the boot of stuff you don’t need to carry around.

Download the PetrolPrices mobile app, which will help you find the cheapest stations where you can fill up. It can save you £10 on the cost of a full tank.

Supermarkets tend to offer the lowest prices while motorway service stations are the most expensive, so avoid them like the plague.

5 BARGAIN-HUNTING AT THE SUPERMARKET

When food shopping, swap premium-brand goods for cheaper, own-brand ones. They’re often made by the same manufacturers but can cost up to 50 per cent less. Sometimes the own brands are positioned on the lower shelves and can be easily missed.

Do take advantage of any vouchers that retailers offer you as a regular shopper, although you will probably have to download the store’s app to take advantage.

Loyalty cards from Tesco, Sainsbury’s and Boots are worth their weight in gold. Also, shops will discount perishable goods – by up to 75 per cent – on the day their use-by-date expires.

If you prefer to shop online, websites such as TopCashback and Quidco will reward you with free money when you are shopping online. TopCashback says its members make £345 a year on average.

Before making a purchase online, check whether they feature on your cashback website. If so, click through from that site first, and the cashback will be paid later.

6 HAGGLE FOR A BETTER DEAL ON UTILITIES

When a broadband, mobile phone or insurance (motor or home) deal comes up for renewal, providers rarely offer their customers the most competitive price.

It’s easy to shop around for a cheaper deal using a price-comparison website, and switching is usually painless. But if you want to stay with your existing provider, phone and ask them to give you an improved offer, quoting the deal offered by the comparison website.

Shop around for a cheaper deals on bills using a price-comparison website, and switch if your usual provider fails to offer a competitive rate

More often than not, they will suddenly come up with a better deal to keep your custom.

7 GET A GRIP on any debt you’re ignoring

If you have an arranged overdraft with your bank – or you are not clearing your credit-card balance on a regular basis – don’t bury your head in the sand.

Take action because overdrafts and credit-card debts can attract fierce rates of interest.

Unsecured personal loans are an option. According to Moneyfacts, a £5,000 personal loan from M&S Bank, payable over five years, will cost 3.9 per cent in interest charges.