Today we’re checking AUD/JPY as an upside break-and-retest pattern forms for a potential bullish, or even bearish, setup ahead.

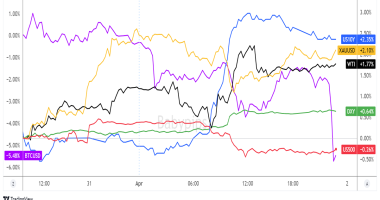

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 13112.17 +0.47% FTSE: 6010.23 -0.11% S&P 500: 3512.49 +1.02% NASDAQ: 11760.73 +1.56% |

US 10-YR: 0.779% +0.012 Bund 10-YR: -0.544% -0.01 UK 10-YR: -0.269% -0.013 JPN 10-YR: +0.03% +0.002 |

Oil: 39.49 -2.73% Gold: 1927.30 +0.05% Bitcoin: 11472.46 +0.85% Ethereum: 382.95 +2.55% |

Fresh Market Headlines & Economic Data:

People’s Bank of China lowers its reserve requirement policy

Oil prices fall as supply concerns ease

U.K. struggles to build support for new lockdowns as Covid-19 cases rise sharply

Bank of England asks banks about readiness if interest rates go to zero or negative

German Wholesale prices in September 2020: +0.0% m/m, -1.8% y/y

Japan machinery orders extend gains in August as business spending stabilizes

Kuroda says BOJ ready to ease more, has tools to cushion pandemic pain

BOJ Governor Kuroda does not see need for negative income tax

Kuroda says BOJ will start experiments on CBDC next spring

In August 2020, the annual net migration in New Zealand is up 71K vs. 56K previous

Coronavirus can last 28 days on glass, currency, study finds

Upcoming Potential Catalysts on the Economic Calendar

Japan Tankan Index at 11:00 pm GMT

New Zealand Food prices at 9:45 pm GMT

U.K. Retail sales at 11:01 pm GMT

Japan M2 Money stock at 11:50 pm GMT

China Trade Balance, Foreign Direct investment (tentative)

What to Watch: AUD/JPY

On the one-hour chart above of AUD/JPY, we can see the pair easily broke above a minor resistance area last week, flowing with the broad risk-on sentiment vibes on U.S. stimulus hopes.

In today’s session, the pair has pullback to that broken resistance area, and even fallen back a bit below that area, which brings on the usual question of, “where to next?”

Well, with potential stimulus possibly on the way from the U.S. and more action recently announced from China, the risk vibe is in favor of risk-on assets. And with no likely catalysts coming at this time to shift that focus, the odds are still in favor of AUD/JPY bulls, especially if the upcoming data from China and Japan is better-than-expected.

In that scenario, if you’re a bull on AUD/JPY, watch out for bullish reversal patterns from the current levels, down to the bottom of the Fibonacci retracement range (61% Fib at 75.50) before considering going long on the pair for a possible short-term or swing position.

If you’re a bear on AUD/JPY and you think the upcoming data may disappoint / we’ll get risk aversion headlines (likely related to pandemic themes of lockdowns, vaccines, and therapies), then this fall back below the broken resistance level could be a upside fake out in the making.

Consider scaling into a short position up to the 76.50 swing high, or waiting for a bounce back above the 76.00 handle before shorting the pair. If we do get notable global risk catalysts, that could be enough to take the pair all the way back down to the next swing support area (around 75.00) based on the daily ATR of around 70 – 80 pips.