The Bank of Japan (BOJ) is up in the next few trading sessions!

Will the central bank’s projections and policy decisions push the yen higher against its counterparts?

Before moving on, ICYMI, I’ve listed the potential economic catalysts that you need to watch out for this week. Check them out before you place your first trades today!

And now for the headlines that rocked the markets in the last trading sessions:

Japan’s core machinery orders up by 3.4% vs. 1.4% expected in November

U.K. property asking prices increase 7.6% from a year earlier – the quickest pace since 2016

China GDP growth slows from 4.9% to 4.0% in Q4 amid COVID, property woes

China posts record trade surplus in Dec ($94.46B) and 2021 ($676.43B) on robust exports

China cuts one-year medium-term lending facility (MLF) rate from 2.95% to 2.85% and 7-day reverse repo open market operation rate from 2.20% to 2.10%, the first rate cuts since April 2020

China injects 200B yuan worth of medium-term cash into the system

Japan weighs state of quasi-emergency for Tokyo

U.S. markets out on Martin Luther King Day holiday

Canada’s manufacturing sales at 1:30 pm GMT

BOC’s business outlook survey at 3:30 pm GMT

BOJ’s policy announcement during the Asian session (Jan 18)

U.K.’s average earnings at 7:00 am GMT (Jan 18)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: EUR/JPY

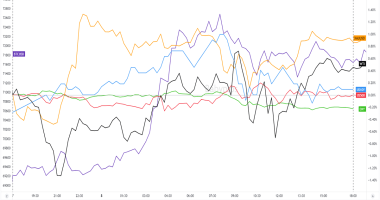

I don’t know if you’ve noticed but EUR/JPY has been on a slow and steady downtrend since the start of the year.

EUR/JPY’s 1-hour chart got more interesting today when the pair hit the 130.60 zone that lines up with the channel resistance AND the 100 and 200 simple moving averages.

Traders who are looking at EUR/JPY’s trend will want to know what the BOJ has to say in tomorrow’s policy announcement.

While no one is expecting policy changes from the BOJ, they’re expected to drop higher growth AND inflation forecasts.

Will the optimistic numbers translate to a less dovish policy plan?

Any whisper of interest rate hikes could drag EUR/JPY from the channel resistance down to previous support levels like 130.30 or 129.75.

If BOJ members disappoint, however, or if we see rounds of risk-taking and anti-safe-haven sentiment in the markets, then EUR/JPY could head for the 131.50 previous highs if not new 2022 highs.