The U.S. is under the spotlight today with mid-tier data releases!

How will today’s calendar events influence USD demand? Let’s take a closer look at one of the closely-watched USD pairs: Bitcoin (BTC/USD!)

Before moving on, ICYMI, yesterday’s watchlist looked at AUD/CHF’s short-term consolidation ahead of Australia’s labor market report release. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. Retail Sales in October: -0.1% m/m (0.0% m/m forecast; 0.9% m/m previous)

U.S. Producer Prices Index for October: -0.5% m/m (0.1% m/m forecast; 0.4% m/m previous); core PPI at 0.0% m/m (0.2% m/m forecast / previous)

Weekly U.S. Mortgage Applications rose by 2.8% vs. 2.5% previous; the average 30-yr mortgage rate held at 7.61%

NY Empire State Manufacturing Index for November: 9.1 (-3.9 forecast; -4.6 previous); employment index fell -8 to -4.5; prices paid index lower 3.0 to 22.2

EIA Crude Oil Inventory for the week ending Nov. 10: +3.6M barrels vs. +13.9M barrel increase the previous week

Japan’s core machinery orders rose by 1.4% m/m in September (0.9% m/m forecast, -0.5% m/m previous); Core orders dropped by 2.2% y/y (vs -3.6% y/y forecast)

Australia’s jobless rate ticked higher from 3.6% to 3.7% as expected in October; Economy added a net of 55.0K jobs (22.8K forecast, 7.8K previous) for the month

Price Action News

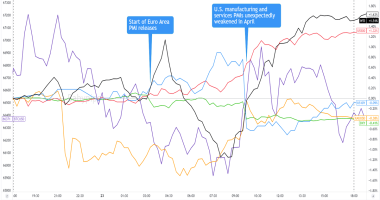

Overlay of NZD vs. Major Currencies Chart by TradingView

A bit of profit-taking from the previous days’ risk-taking took a toll on “risky” bets like AUD and NZD earlier today. It also didn’t help that Australia’s unemployment rate rose a bit in October and that a bigger chunk of the job gains came from part-time employment.

AUD and NZD both fell sharply during the Asian session before market bears took a chill pill. The comdolls had a stronger showing in the early European session as traders cautiously took on risks again.

NZD is currently in the red across the board and is showing the biggest losses against JPY, USD, and EUR.

Upcoming Potential Catalysts on the Economic Calendar:

ECB President Lagarde to give pre-recorded opening remarks at 11:30 am GMT

U.S. initial jobless claims at 1:30 pm GMT

U.S. Philly Fed manufacturing index at 1:30 pm GMT

U.S. industrial production at 2:15 pm GMT

U.S. NAHB housing market index at 3:00 pm GMT

New Zealand’s input and output prices at 9:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

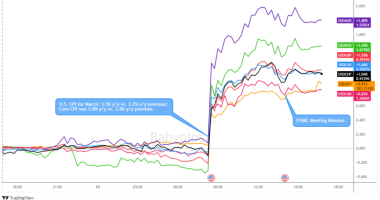

BTC/USD 15-min Forex Chart by TradingView

Like other USD pairs, bitcoin (BTC/USD) pulled back from its intraweek highs as some traders thought financial assets may be hitting extreme (overbought/oversold) levels following the previous days’ moves.

BTC/USD turned lower from just under the $38,000 mark and has hit the $37,250 levels.

Will the pair continue to see lower highs and lower lows in the 15-minute time frame? Or are the bulls just taking a breather?

Traders will be waiting for today’s U.S. initial jobless claims, industrial production, and Philadelphia Fed manufacturing data to see if the markets aren’t overreacting to their bets that the Fed won’t raise its interest rates any further this year.

Reports that point to a soft landing – like slightly higher unemployment claims but not-so-bad business activity numbers – may refuel the pro-risk, anti-USD themes that we’ve seen this week.

BTC/USD, which is facing potential technical support from a trend line, 100 SMA, Pivot Point, and previous area of interest, could extend its intraweek uptrend.

The OG crypto may attract enough buying pressure to revisit its highs above $37,500 if not make new weekly highs ahead of the weekend.

Don’t discount an extension of yesterday’s retracements though!

Strong U.S. economic data points support the Fed’s hawkish stance and may keep December rate hike hopes alive enough to support USD demand.

If we see more USD strength, coupled with BTC/USD breaking below its technical support zone, then bitcoin may retest lower areas of interest like $36,750 or $36,500.