EUR/USD hits the top of the watchlist today as risk sentiment sours to lift the Greenback, and we potentially get a pop in euro volatility with European PMI data ahead.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at GBP/USD ahead of U.K. employment data, so be sure to check that out to see if there is still a potential play!

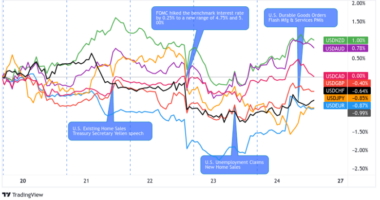

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14662.02 +0.03% FTSE: 6699.19 -0.40% S&P 500: 3910.52 -0.76% NASDAQ: 13377.54 -1.12% |

US 10-YR: 1.624% -0.058 Bund 10-YR: -035% -0.008 UK 10-YR: 0.753% -0.011 JPN 10-YR: 0.077% +0.003 |

Oil: 57.52 -6.56% Gold: 1,726.40 -0.673% Bitcoin: 54,842.75 +0.58% Ethereum: 1,698.58 +0.56% |

Fresh Market Headlines & Economic Data:

Germany to go into hard Easter lockdown as Covid-19 infections soar

Dow closes 300 points lower as Caterpillar leads afternoon slide

Powell expects bump in inflation, says it won’t get out of hand

Bank of Canada concerned about FOMO in Canada housing market

Fed’s Kaplan said he expects an interest rate hike in 2022

U.S. new home sales plunge amid harsh weather

The Richmond Fed manufacturing index rose from 14 in February to 17 in March

ECB official Lane: Eurozone facing difficult quarter but central bank will do its part

UK unemployment falls for first time in Covid-19 pandemic

UK manufacturing shows new signs of life in March: CBI

Upcoming Potential Catalysts on the Economic Calendar

Australia Manufacturing & Services PMI at 10:00 pm GMT

Bank of Japan Monetary Policy Meeting Minutes at 11:50 pm GMT

Japan Manufacturing & Services PMI at 12:30 am GMT (Mar. 24)

U.K. Inflation Rate, Retail Prices, PPI at 7:00 am GMT (Mar. 24)

France Manufacturing & Services PMI at 8:15 am GMT (Mar. 24)

Germany Manufacturing & Services PMI at 8:30 am GMT (Mar. 24)

Euro area Manufacturing & Services PMI at 9:00am GMT (Mar. 24)

U.K. Manufacturing & Services PMI at 9:30 am GMT (Mar. 24)

What to Watch: EUR/USD

On the one hour chart above of EUR/USD, we can see that Greenback bulls had a solid session against the euro, likely the outcome of broad risk sentiment souring during the U.S. session today. Potential U.S. tax hike speculation may have been the catalyst, as well as rising covid cases in Europe may slow down the global recovery.

It was a one way drop for EUR/USD on the session, bringing the pair to retest the major swing low around the 1.1850 minor psychological handle. Today’s move was more than the daily ATR of around 70 pips, so is it overextended and are EUR/USD ready for a bounce?

Well, whether we see a break of support or a bounce from here may depend on the upcoming European business sentiment data. The flash manufacturing and service PMI numbers from Europe will be released tomorrow, and if you’re a bear on EUR/USD, a net weaker-than-expected round of numbers is what you’re looking for.

The odds of this scenario playing out is likely better than 50/50 given the expectations of lockdowns to extend into April, so if we see a break lower on that news, that may draw in a fresh round of selling, especially if broad risk sentiment continues to lean negative as it did in today’s U.S. trading session.

Of course, there’s a possibility we may see improvements in business sentiment, but that’s an extremely low probability situation at the moment. But if it does occur, it might be a big enough surprise to lift the euro, and if global risk sentiment is leaning positive at the time, that swing low may hold for a short-term bounce to the upside.

This post first appeared on babypips.com