CHINESE fashion giant Shein is ramping up its assault on the UK by buying Missguided from Frasers Group.

The deal, for an undisclosed sum, only covers Missguided’s trademarks and intellectual property.

Frasers will keep the brand’s real estate and employees, integrating them into its empire.

Shein, pronounced “She-in”, has rapidly become the world’s largest fast-fashion firm but is still relatively unknown to the over-30s.

Originally a wedding dress firm, it now churns out 6,000 items a day, six times more than rivals, for an average price of £5.70.

Described by an industry source as “Asos or Boohoo on steroids” it makes £1.1billion in UK sales and is regularly linked to a US stock market listing.

READ MORE MONEY NEWS

The Sun can reveal that Shein is doubling down on the UK since setting up an office in Hackney, east London, with 40 employees.

It is boosting its brand awareness with pop-ups which attracted tens of thousands of shoppers.

It has recruited Gemma Dunne who left Boohoo’s PrettyLittleThing brand as buying director in April.

Missguided collapsed into administration last June before being bought by Mike Ashley’s Frasers Group for £20million.

Most read in Business

Shein, which said it would continue working with Missguided’s founder Nitin Passi, could also be eyeing another British fashion asset, amid reports that Asos is considering offloading Topshop.

Asos fought off competition from Shein, Next, JD Sports and US group Authentic Brands to buy the brand for £300million from administrators after the collapse of Philip Green’s Arcadia in 2021.

Despite hopes Asos would revive Topshop, it has failed to attract younger shoppers and the Topman men’s brand has barely been promoted.

Asos bosses are having to raise cash to weather a tough market and slumping sales.

Authentic Brands, which owns Ted Baker and Reebok, is thought to also want Topshop, so it can launch the brand back on the high street.

Summers boss: We’ll stay sexy

THE new boss of Ann Summers is relaunching the lingerie brand for the social media age.

But Maria Hollins, who took over from company founder Jacqueline Gold in 2022, says she has no plans to tone down the firm’s raunchy advertising.

In her first interview since taking charge of the firm, she said: “We have been talking to women about sex for 50 years, so we know what we are doing.”

Unlike Victoria’s Secret, the company won’t adopt a more wholesome look to woo younger customers.

Ms Hollins said: “I don’t think that’s what people come to Ann Summers for. We’ve tried to do everyday styles before and it hasn’t really worked.

“People come to us to be sexy.”

With that in mind, Ann Summers has launched a sizzling Halloween campaign fronted by Love Island’s Tasha Ghouri.

And Ms Hollins now plans a reinvention of the retailer’s “Party Plan”, introduced by Ms Gold in 1981.

The Party Plan was a twist on Tupperware parties, where women gathered to buy sex toys and underwear from brand ambassadors.

At its peak in the early noughties, when Sex And The City bolstered the popularity of vibrators, there were over 4,000 Ann Summers parties a week.

Ms Hollins is relaunching the Party Plan concept online as AS Connect, with ambassadors — or consultants — selling Ann Summers’ wares to social media followers.

Sellers can earn between 20 per cent and 35 per cent commission on sales and 2,000 have already signed up.

Ms Hollins said the parties had been a way for women to gain financial independence.

And she believes the new, more flexible scheme could give people “the opportunity to earn a bit of extra cash in the run-up to Christmas”.

Doubled profits at HSBC

PROFITS at HSBC have more than doubled to £6.3billion despite the Asia-focused bank taking a hit on Chinese property woes.

HSBC, which has kept its headquarters in London’s Canary Wharf, said that its profits in the past three months had been boosted by higher interest rates because it can charge its borrowers more.

Lenders have been under political pressure to also raise returns for savers.

HSBC said it had taken a $500million (£411million) hit that was related to China’s property crisis.

But boss Noel Quinn said he thought the real estate crisis had bottomed out.

The bank said that it expects the UK to dodge a recession next year and grow by 0.4 per cent, while house prices will fall by another 4.7 per cent.

It estimates it will take until 2026 for inflation to fall to the Bank of England’s target of 2 per cent from the current rate of 6.7 per cent.

Jobs out window

AROUND 750 jobs will be lost after the collapse of windows and doors firm Safestyle.

Administrators at Interpath said customers halfway through installation will need to find another fitter as Safestyle will not finish the job.

Customers who have paid deposits must contact their credit card firm for a refund.

Rick Harrison at Interpath Advisory said: “These are really challenging times across home improvement.”

Big Mac, bigger prices

SALES jumped 14 per cent to £5.5billion in three months at fast-food outlet McDonald’s, as it said diners were still willing to pay higher prices.

The Big Mac-maker said pre-tax profits rose 17 per cent to £1.89billion in the third quarter.

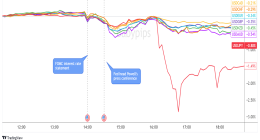

Interest rates ‘to stay put’

THE Bank of England is expected to hold interest rates at 5.25 per cent on Thursday, as fresh figures show lending is already drying up.

Interest rates are at their highest since 2008 but the Bank is balancing the impact on mortgage-holders with its desire to slow inflation.

The Bank’s figures yesterday show approved mortgages fell to 43,300 last month — the lowest since the start of the year.

Read More on The Sun

The number of remortgages tumbled to the lowest level since 1999, as homeowners are happy to wait and gamble that repayment rates will soon fall.

Capital Economics said the lending slump and dent to the property market suggested a mild recession is under way.