Partner Center

Find a Broker

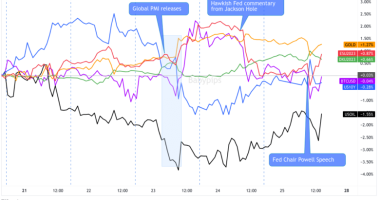

It was a light week of news and catalysts from Canada, but the Loonie was able to come out net green on Friday thanks to rising oil prices and positive risk sentiment.

Canadian Headlines and Economic data

Monday:

Canadian manufacturing growth softens to six-month low, but remains solid – correlates with broad move lower during Monday U.S. session

Oil settles over 2% higher on signs OPEC+ has stuck close to its output-cut pledge – this was likely the catalyst for CAD’s rise all week given the weak economic updates from Canada.

Wednesday:

Oil prices near 1-year highs after stocks drawdown, supply deficit forecast

Thursday:

Crude oil inventories down by 1M barrels vs. projected 0.6M drop

Friday:

Brent near $60 as OPEC+ cuts tighten oil market

Canadian economy sheds 213K jobs in January as lockdowns hit part-time workers – this sparked a big hit to the Loonie as it came in well below expectations of around -43K jobs lost, and far below the previous read of -62.6K jobs lost.

Canada’s Ivey PMI shows activity contracting in January

“The seasonally adjusted index rose to 48.4 from 46.7 in December. A reading below 50 indicates decreasing activity.”

“The gauge of employment fell to an adjusted 41.5 – its lowest since last April – from 45.8 in December, while the prices index surged to 82.8 from 66.9.”