Rising oil prices pushed the Loonie into a slow and steady uptrend last week.

Can the bulls maintain their momentum this week?

I’ve listed the potential catalysts that might affect CAD’s price action:

Lower tier releases

- New motor vehicle sales (Oct 16, 12:30 pm GMT) seen inching higher from 158K to 163K?

- ADP non-farm employment change (Oct 15, 12:30 pm GMT) seen improving from -205K to -50K in September

- Manufacturing sales (Oct 16, 12:30 pm GMT) to print a 2.0% decline after a 7.0% increase in July

- U.S. crude oil inventories (Oct 15, 3:00 pm GMT) last printed an increase of 500K barrels, way more than the 1.2 million-barrel drawdown that analysts had expected

Market risk appetite

- Coronavirus updates (stimulus negotiations, second wave concerns, lockdown prospects, and vaccine updates) will affect global oil demand and the appetite for the oil-related and high-yielding Loonie

- Stimulus negotiations in the U.S., in particular, has been affecting CAD’s intraweek trend for weeks now

- Brexit and other EU Summit updates can also influence the Loonie’s intraday volatility

- Top-tier reports from major economies like Australia (jobs), China (CPI, PPI, trade data), U.K. (jobs), and the U.S. (retail sales) are also events that can affect overall risk appetite and CAD demand

Technical snapshot

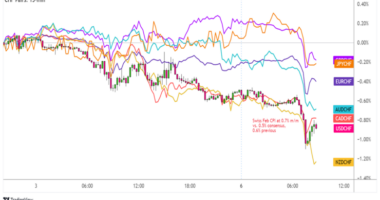

- Stochastic is flagging CAD’s “overbought” conditions against NZD, JPY, USD, CHF, and EUR

- GBP/CAD is in neutral territory on the daily time frame

- CAD saw the most volatility against NZD, JPY, GBP, and AUD in the last seven days

- The Loonie is on short and long-term bullish trends against the dollar and the yen

- Watch out for retracement or reversal opportunities on GBP/CAD

- CAD is seeing short-term bearish pressure against its fellow comdolls

Missed last week’s price action? Read CAD’s price recap for October 5 – 9!