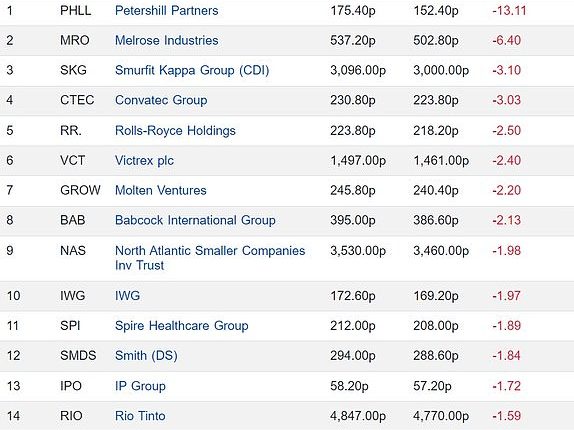

The FTSE 100 is down 0.1 per cent in midday trading. Among the companies with reports and trading updates today are Berkeley Group, The Restaurant Group, Heathrow, Computacenter and Harland & Wolff. Read the Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live