King Dollar reigned this week as traders anticipated and reacted to a pretty hawkish monetary policy statement from the Federal Reserve.

And based on the moves between the different markets, traders were in risk aversion mode, likely due to continued headlines of rising COVID-19 cases and this week’s round of not-so-bright economic data and survey data.

Notable News & Economic Updates:

The People’s Bank of China cut its rate on the 14-day reverse repo by 10 bps on Monday from 2.35% to 2.25%

Hong Kong confirmed the most daily new coronavirus cases on Monday in 18 months (to 140) despite restrictions, fueling rising pandemic fears

Singapore central bank tightened monetary policy on Tuesday on inflation risks; its first out-of-cycle move in seven years

On Tuesday, the International Monetary Fund downgraded its 2022 global growth forecast to 4.4% the the 5.9% read in 2021

China’s December industrial profits slows to +4.2% y/y vs +9% y/y in November, raising the case for support from the PBOC

Bank of Canada holds interest rates at 0.25% on Wednesday, sees growth in 2022 around 4%, 3.5% in 2023

The Federal Open Market Committee held interest rates in the 0.00 – 0.25% range on Wednesday; no changes to Taper schedule or pace

China’s December industrial profits slows to +4.2% y/y vs +9% y/y in November, raising the case for support from the PBOC

The U.S. economy expanded at 6.9% annualized rate in Q4 2021, beating expectations

The omicron subvariant (known as BA.2) is 1.5x more transmissible than the original omicron strain – Statens Serum Institute

Intermarket Weekly Recap

The high inflation environment and a global monetary policy tightening regime continued to dominate the markets, with this week’s focus being on what the next moves are from the Federal Reserve.

The broad markets were pretty quiet up until this event, and as expected, the Fed re-iterated their hawkish stance on interest rate hikes, which some in the market took as a potential 50 bps hike as soon as March or even five rate hikes this year.

U.S. Treasury yields spike higher on the event, along with the Greenback. And as usual, a spike in U.S. dollar strength meant weakness in pretty much everything else as gold, crypto and equities took a quick turn lower into the Thursday session.

Risk currencies did not farewell either with the Kiwi and Aussie fading lower through the rest of the week, as expected on USD strength & risk-off vibes, the latter likely being driven by continued rising pandemic concerns and a not-so-rosy round of flash business survey data/economic forecasts.

USD Pairs

Flash US Manufacturing PMI at 55.0 in January vs. 57.7 in December, a 15-month low

Richmond Fed Manufacturing Index fell from 16 in Dec. to 8 in January

U.S. Home Prices rose 18.8% year over year on the S&P CoreLogic Case-Shiller National Home Price Index.

Q4 GDP: US economy expanded at 6.9% annualized rate, topping expectations

U.S. pending home sales dropped 3.8% last month to 117.7

U.S. durable goods orders fell by 0.9% in December after soaring by an upwardly revised 3.2% in November.

University of Michigan’s final Consumer Sentiment Index for January came in at 67.2 vs. 70.6 in December

Core PCE price index (the Fed’s preferred inflation metric) rose 4.9% from a year ago; the fastest gain since 1983

GBP Pairs

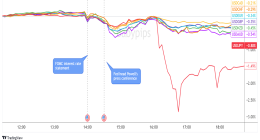

Overlay of GBP Pairs: 1-Hour Forex Chart

Flash UK Manufacturing PMI January: 56.9, 11-month low (December final: 57.9)

UK factory costs rising at fastest pace since 1980, CBI says

UK borrows less than expected in December as COVID impact eases

The latest Confederation of British Industry (CBI) Industrial Trends survey said U.K. output volumes in the previous quarter to January grew at a slower pace.

EUR Pairs

French flash services PMI tumbled from 57.0 to 53.1 vs. 55.3 forecast; flash manufacturing PMI dipped from 55.6 to 55.5

German flash manufacturing PMI climbed from 57.4 to 60.5; flash services PMI up from 48.7 to 52.2 vs. 47.9 consensus

Flash Eurozone PMI Composite Output Index falls to an 11-month low of 52.4 vs. 53.3 in December

Annual growth rate of broad monetary aggregate M3 decreased to 6.9% in December 2021 from 7.4% in November (revised from 7.3%); Annual growth rate of adjusted loans to households stood at 4.1% in December, compared with 4.2% in November

German economy likely shrunk in Q4: Bundesbank

Euro area Economic Sentiment Indicator falls to 112.7 in Jan.

Economic Sentiment Indicator (ESI) eased in both the EU (-1.4 points to 111.6) and the euro area (-1.1 points to 112.7) in January 2022

CHF Pairs

Switzerland’s Credit Suisse economic expectations index moved up from 0.0 to 9.5

Swiss trade balance: CHF 3.69B in December vs. 6.16B previous

Swiss KOF economic barometer up from 107.2 to 107.8 vs. 106.0 forecast

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

The Bank of Canada surprisingly kept interest rates at 0.25% but signaled future rate hikes

NZD Pairs

The BNZ Business New Zealand Performance of Services Index for December was 49.7 vs. 47.5; still below expansionary conditions

Fonterra raises farmgate milk price forecast to a range of NZ$8.90 – NZ$9.50

New Zealand credit card spending rebounded by 1.2% after previous 0.4% dip

New Zealand consumer prices up by 5.9% from a year ago in Q4 2021, the highest in 30 years and much faster than the RBNZ’s 1.0% – 3.0% target range

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australian flash manufacturing PMI down from 57.7 to 55.3; Australian flash services PMI slipped from 55.1 to 45.0

AU NAB business confidence slides 24 points to -12 in Dec. as surge in coronavirus cases hits consumer spending and staffing

AU quarterly CPI accelerates from 0.8% to 1.3% (vs. 1.0% expected) in Q4 2021

AU annual inflation closer to middle of RBA’s 2% – 3% target range at 2.6% (vs. 2.3% expected)

AU trimmed mean CPI – RBA’s preferred inflation gauge – jumps from 0.7% to 1.0% (vs. 0.7% expected)

JPY Pairs

BOJ’s Kuroda vows easy policy as wage talks begin

BOJ Core CPI for December: +0.9% vs. +0.8% previous

BOJ Summary of Opinions: Seeing higher inflation but unlikely to go past target

IMF urges Japan to scale back emergency pandemic support and consider raising taxes after the recovery