Investment trust BlackRock Frontiers goes where few other asset managers venture in the pursuit of returns for shareholders – investing in companies that serve the needs of three billion of the world’s poorest people.

It’s a strategy that means the trust shuns investments in the big emerging markets of Brazil, China, India, Mexico, Russia, South Africa, South Korea and Taiwan. The result is stock market-listed investment trust which, according to manager Sam Vecht, invests in ‘all the markets and companies that most other fund managers do not look at’.

Vecht has run the £267 million trust with Emily Fletcher since it was launched nearly 13 years ago. Sudaif Niaz, who joined the investment team nine years ago, completes the line-up.

The trust’s country holdings highlight its breadth. It has stakes in 54 companies – operating in countries not noted for their equity prowess: such as Bangladesh, Cambodia, Chile, Colombia, Egypt, Kazakhstan and Peru.

‘The common bond is that all the trust’s holdings are listed,’ says Vecht, who has spent the last few weeks travelling to meet companies in Abu Dhabi (capital of the United Arab Emirates), Cambodia and Thailand. ‘We don’t invest in unlisted companies as a matter of principle. There are no fun and games, just positions in companies listed on normal stock exchanges. And we’re not beholden to any one country.’

With the corporate governance of many companies in these frontier markets far lower than those listed on more established stock exchanges, on-the-ground research is essential.

‘Before you invest in a company, you need to speak to suppliers and customers and do due diligence,’ says Vecht. ‘It’s also good to meet up with trade unionists and journalists to get other perspectives.’

Irrespective of the forensic work that Vecht and his team do – supported by the vast resources provided by BlackRock – there will be failures along the way.

‘Most companies we buy into move in the right direction and we make a return on our investment. But sometimes, managers of businesses fail to deliver on their promises,’ says Vecht. ‘Occasionally, politics gets in the way and makes it difficult for some companies we have invested in to thrive. Also, fraud will rear its head from time to time. The key is to ensure the successes outweigh the failures.’

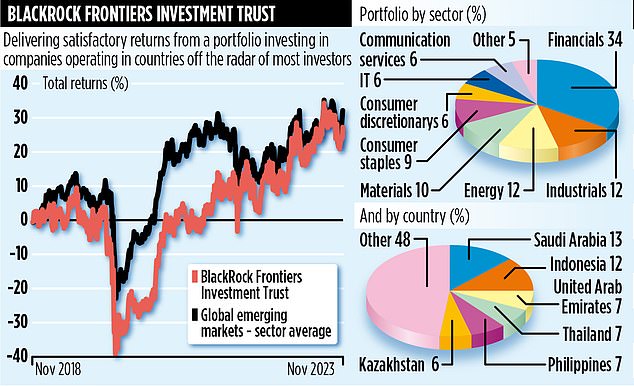

The trust’s overall performance suggests the managers get things right more times than they get them wrong.

Over the past five years, the trust has generated a return of 25 per cent, below the gains made by the average global emerging markets fund (32 per cent). Shorter term, its results have been more impressive with one and three-year returns of 14 and 47 per cent respectively. Vecht is reluctant to talk about individual companies even though the trust issues regular monthly updates on the top ten holdings – and a list of all its investments is available via BlackRock’s website.

Its latest factsheet, issued a couple of days ago, provides commentary that Vecht refused to give in person – for example, a new position in gas pipeline business OQ Gas, based in Oman.

The holdings will not be to everyone’s investment liking with Saudi Arabia being the trust’s biggest country position.

Among the trust’s biggest stakes are positions in commercial bank Saudi National Bank and chemicals giant Saudi Basic Industries Corporation. Vecht says the country has undergone massive societal change in the past decade.

The trust produces annual income of 4 per cent. Ongoing charges are reasonable at just under 1.4 per cent a year. Its stock market ID code is B3SXM83 and ticker BRFI.