Anyone intending to either save more or kickstart a savings habit in 2023 should aim to earn the highest interest rate possible.

Inflation is at a 40-year high, which is eroding the value of money in real terms. While there is not a single account with an inflation-beating rate, earning as much interest as you can will help to protect the pounds in your pocket.

Savings rates can vary all the way from 0 per cent to 7 per cent depending on the provider and the type of account.

But a worryingly large proportion of Britain’s savings is sitting in accounts at the lower end of that spectrum, paying little or nothing in terms of interest.

New Year’s resolution: Savers should be looking to make their cash work as hard as possible for them in 2023

We know this thanks to Caci data of deposits held with more than 30 major savings providers.

There is a total of £396billion held in non-Isa savings accounts paying 0.5 per cent interest or less, according Paragon’s Bank’s latest analysis of these figures.

Out of the total £632billion of deposits held with these 30-plus providers, it suggests that 62 per cent of savers are allowing their cash to idly sit in low-paying accounts.

A new year’s resolution to save more will require discipline and perseverance given higher living costs, but finding the best rate is relatively simple.

However, whilst avoiding the worst paying accounts should be an imperative for every saver, the very best rate won’t always the best option either.

There may be minimum balances, restrictions on how often you can access your money, or rules about how and when the interest is paid.

This is Money decided to search out the best rates on the market for every type of account and ask whether it is in fact the best account to go for.

The best easy-access account

It’s worth having money in an easy-access account in case of a sudden loss of income, or in case of any large unforeseen costs such as a boiler breaking down and needing to be replaced.

Anyone who may need to rely on their savings during the next year would always be sensible to keep some money in an easy-access account as a type of emergency fund.

Certain banks such as Barclays, HSBC and Santander grant their banking customers access to exclusive easy-access savings rates which are higher than the top rates on the open market.

These could be worthwhile options to explore for those that are already eligible.

For example, Barclays banking customers who sign up to its Blue Rewards scheme will be able to benefit from an exclusive easy-access savings deal.

The Barclays Rainy Day Saver account pays 5.12 per cent interest on balances up to £5,000. That could equate to more than £250 in interest after one year.

The drawback is that savers will need to pay £5 a month to become a Blue Rewards members, but it does come with other advantages such as £5 monthly cashback for having two direct debits paid out of the bank account.

Exclusive club: Barclays banking customers can access a deal paying 5.12 per cent interest on balances up to £5,000

Yorkshire Building Society currently offers 3 per cent on balances up to £5,000.

However, anything above that level will earn a 2.5 per cent rate, so it won’t necessarily be the best option for those with more than £5,000 to put away.

It also only allows two withdrawals each year, which makes it rather restrictive for anyone hoping to rely on these savings at any given time.

Instead savers might want to consider Zopa Bank, which pays 2.86 per cent and doesn’t limit savers to a certain number of withdrawals each year.

Savers can also boost their rate all the way up to 3.26 per cent by locking money away for longer via a selection of linked notice accounts.

It is a fully authorised and regulated bank and offers savers FSCS protection up to £85,000 per person.

A spokesperson for savings consultancy The Savings Guru says: ‘Zopa offers a quick and easy online application, with savers able to manage their money online, via Zopa’s mobile app.

‘It has one of the highest Trustpilot scores for any bank from customer feedback.

‘Its easy-access account comes with up to 20 savings pots with the ability to boost the rate by locking some of those away for 7, 31 or 95 days’ notice.’

– Find and compare the best easy-access savings rates

Best accounts for long-term savers

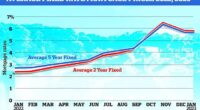

For those with a lump sum who are saving towards a certain goal over the next year or two, then a fixed rate account will offer more bang for their buck.

These pay better interest, but any money put into a fixed rate account will not be accessible until after the fixed term ends.

Fixed rate savings deals tend to range between one and five years, although it is possible to find shorter and longer terms.

Those looking to fix for one-year might want to consider SmartSave Bank, which pays 4.26 per cent. However, savers will need to have £10,000 to hand to open the account.

A £10,000 deposit in this account would result in a £426 return after one year.

A new dawn: The start of 2023 could be a perfect time to reassess your savings and move your cash to a better paying account

The Savings Guru warns that savers cannot contact the bank by telephone – although they can message them and request a call back.

Alternative options are offered by Zopa Bank, Cahoot and Atom Bank – all of which pay 4.25 per cent.

Those looking to fix their savings for two or three years can do slightly better.

The best two-year fix is offered by Investec via the savings platform Raisin and pays 4.46 per cent, while the best three-year fix is offered by Gatehouse Bank, paying 4.55 per cent.

>> Best fixed rate savings deals

Best cash Isa accounts to avoid savings tax

Millions more savers face a tax bill on their savings thanks to higher rates putting them at risk of surpassing their Personal Savings Allowance.

This allowance means that each year the first £1,000 of savings interest is tax-free for basic-rate taxpayers, while higher-rate taxpayers get £500. Additional rate payers receive no allowance.

But any money saved into an Isa up to the £20,000 annual limit is tax-free. For an additional rate taxpayer, this means that saving into an Isa account may be a no-brainer, unless of course they are already making full use of their £20,000 annual Isa allowance elsewhere.

For basic rate and higher rate taxpayers it will depend on how much they have saved. In the best easy-access account paying 3 per cent, a basic-rate taxpayer would need to save £32,900 to breach their annual interest allowance, and a higher-rate taxpayer would need to save £15,385.

The best-buy one-year deal paying 4.26 per cent will mean a basic rate payer will breach their allowance with just over £23,000 saved, while a higher rate taxpayer would do so with just over £11,500 saved.

Tax free: Those saving into a cash Isa will shield any interest they earn from the taxman

Virgin Money is offering a 3 per cent exclusive easy-access cash Isa account to anyone with a Virgin Money current account.

Savers can take money out of their account whenever they want and there is no need to give Virgin notice.

However, it’s worth noting that any money taken out of this account will no longer benefit from the tax treatment an Isa receives.

In terms of the best one-year fixed cash Isa, Barclays recently became a surprise market leader in this category, with a 4 per cent rate.

Its account also offers greater flexibility than other fixed rate deals, with three withdrawals permitted during the 12-month term.

However, the maximum value per withdrawal is 10 per cent of the balance at the time the withdrawal is made.

Best regular savers for those starting out

For those looking to kickstart a savings habit in 2023, a great way to begin is by using a regular savings account linked to a current account.

However, only some banks and building societies offer regular savings accounts, so switching or setting up a new bank account may be required in order to take advantage of these deals.

A regular savings account is effectively a monthly saver which allows savers to set aside cash each month up to a certain amount.

The market leading deal is currently offered by First Direct paying 7 per cent on deposits of between £25 and £300 a month for the first year.

Someone putting away the maximum £3,600 over the course of the year could earn about £136.50 in interest.

However, the account doesn’t allow savers to withdraw their money until the end of the 12 month term. The deal is only available to customers with a current account at the bank.

That said, if savers need an extra incentive to switch, it just so happens First Direct is currently offering a £175 switching offer to new joiners.

Money spinner: First Direct is offering £175 to new joiners and a 7% rate on its regular savings account

Lloyds is offering a fixed 5.25 per cent regular savings deal to its Club Lloyds current account customers, with savers able to stash away between £25 and £400 a month.

Unlike with First Direct, it allows customers to withdraw as and when they like.

Someone depositing the maximum £400 each month – £4,800 over the course of the year – will earn £126 in interest.

In terms of other notable deals, NatWest and RBS pay 5.12 per cent, while HSBC pays 5 per cent.

For someone looking for a regular savings account without needing to bank with a specific provider, Principality and Nationwide Building Society pay 5 per cent, while Halifax pays 4.5 per cent. These are open to all.

It’s worth noting that regular savings account will be of limited benefit to savers who already have a pile of cash, due to the fact they limit customers to maximum deposits each month.

However, they are great options for those looking to get into the habit of saving for the first time.

Looking for something more exciting?

For those looking for a bit more excitement when it comes to their savings, NS&I’s Premium Bonds could be the answer.

The Premium Bond draw has been running since 1956 and there are roughly 21 million Premium Bond holders holding 119 billion eligible £1 bonds between them.

Instead of earning any interest, savers are entered into a draw each month for the chance to win a cash prize ranging from £25 to £1million.

This month’s draw saw Government-backed provider NS&I increase the Premium Bonds prize fund rate rise from 2.2 per cent to 3 per cent, with an extra £80 million injected into the prize pot compared to December.

The changes mean that the prize fund rate has now tripled from 1 per cent to 3 per cent since May, with the odds of each £1 bond number winning a prize improving from 34,500 to 1 to 24,000 to 1.

Although the majority of prizes are worth £25, the chances of securing a bigger prize have greatly improved this month. Albeit, the £1million jackpot remains at two wins per month.

There are now 56 prizes of £100,000, up from 18, while the number of £50,000 prizes went up from 36 to 111.

The total of £25,000 prizes increased from 71 to 224 and the number of £10,000 prizes rose from 178 to 559.

In addition, the number of savers who win the £5,000 payout went up from 359 to 1,116.

Highly prized: Premium Bonds are the UK’s most popular savings product, with more than 21 million people saving a total of £119billion in them

The magic of Premium Bonds was shown this month with one lucky Premium Bonds holder from Yorkshire scooping the top £1million prize with just a £4,625 holding. The maximum possible holding is £50,000.

Premium Bonds can be considered akin to easy access savings accounts, as they allow savers to withdraw their money on-demand and without penalty.

However, savers must remember that it does take time to withdraw money out of Premium Bonds – although this is much quicker than it once was – meaning they aren’t truly instant access.

With the prize fund rate at 3 per cent, savers with a lump sum of between £25 and £50,000 could well see Premium Bonds as a good place to leave their cash.

It’s also worth remembering that another benefit with Premium Bonds is that any prizes awarded are tax-free.

#bcaTable .footerText {font-size:10px; margin:10px 10px 10px 10px;}