Australia reported net 6.6K job losses in March 2024 instead of the estimated 7.2K increase in hiring, far below the earlier 117.6K gain, bringing the unemployment rate up from 3.7% to 3.8%.

Underlying data showed that the losses were mostly due to declines in part-time employment, which fell by 34.5K, offsetting the gains in full-time hiring of 27.9K.

- Net employment change: -6.6K (+7.2K forecast, +117.6K previous)

- Unemployment rate: 3.8% (3.9% forecast, 3.7% previous)

- Full-time employment up by 27.9K

- Part-time employment down by 34.5K

- Labor force participation rate down from 66.7% to 66.6%

Although the jobless rate was still a notch lower than the 3.9% consensus, components of the figure revealed that labor force participation dipped from 66.7% to 66.6% to reflect weaker confidence in the jobs market.

Link to Australia’s employment change report for March 2024

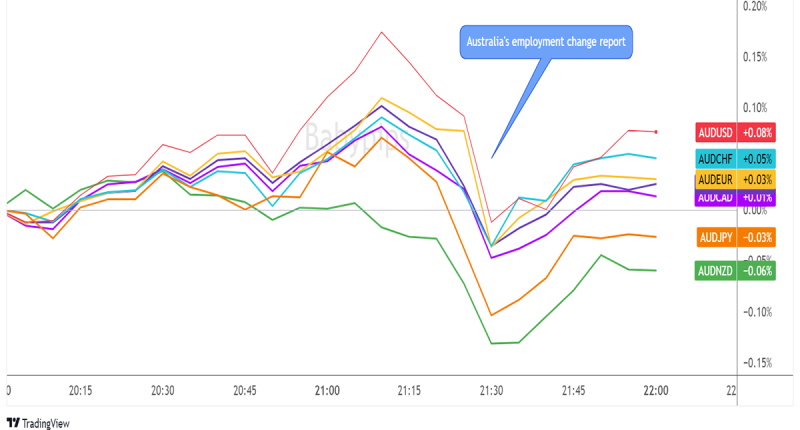

Market Reactions

Australian Dollar vs. Major Currencies: 5-min

The Aussie was already starting to sell off prior to the release of the actual jobs figures, as market players were likely pricing in a disappointing read.

Interestingly enough, AUD pulled higher upon seeing the actual numbers, possibly due to profit-taking off the earlier short positions.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

This post first appeared on babypips.com