Risk appetite and strong domestic data pushed the Aussie higher last week.

Can the Aussie pull another positive week this week?

I’ve listed down the market themes you should keep your eyes on!

Labor market numbers (Dec 17, 12:30 am GMT)

- The economy had added a net of 178,800 jobs (vs. -30,000) in October, with full-time additions (97,000) outpacing part-time employment (81,800)

- The unemployment rate edged higher to 7.0% in October

- The strong numbers were no match against overall market uncertainty at the time

- Analysts see the economy adding a net of 60,000 jobs in November

- The unemployment rate is expected to remain at 7.0%

- AUD probably won’t react as much to the news as the results aren’t expected to change the RBA’s policy plans

Lower-tier economic reports

- Reserve Bank of Australia (RBA)’s meeting minutes (Dec 15, 12:30 am GMT) to reaffirm the central bank’s optimism as well as plans to keep rates low “for at least three years”

- Markit’s manufacturing PMI (Dec 15, 10:00 pm GMT) seen slipping from 55.8 to 55.1 in December

- Markit’s services PMI could dip from 55.1 to 54.7

- MI leading index (Dec 15, 11:30 pm GMT) expected to accelerate from 0.1% to 0.3% in November

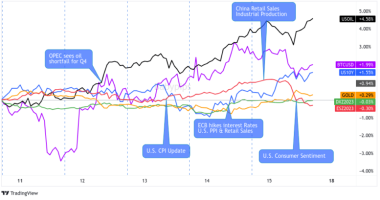

China’s data releases (Dec 15, 2:00 am GMT)

- Indicators from the world’s second-largest economy can give clues on the overall global recovery trend

- Fixed asset investment (ytd/y) to accelerate from 1.8% to 2.7% in November

- Industrial production seen improving from 6.9% to 7.0%

- Retail sales (y/y) to speed up from 4.3% to 4.4%

- Unemployment rate to inch higher from 5.3% to 5.5%

Overall AUD demand

- Increased tensions or positive developments on the Chinese-Australian trade relations will continue to cause intraday volatility among major AUD pairs

- Policy decisions by major central banks (Fed, BOE, SNB, BOJ) can influence the market’s appetite for high-yielding bets like the Aussie

- Vaccine rollout developments, stimulus deals, and Brexit negotiations can also affect comdoll demand

Technical snapshot

- Bollinger Bands put the Aussie in “overbought” territory against the pound and the dollar

- AUD is broadly overbought on the daily time frame

- SMAs show the Aussie’s short and long-term bullish trends against most of its major counterparts

- Watch out for retracement or reversal opportunities on AUD/NZD

- Like the Kiwi, the Aussie saw the most volatility against the pound and the safe-havens in the last seven days

Missed last week’s price action? Read AUD’s price recap for Dec. 7 – 11!