What are traders expecting from the RBA this week?

More importantly, how can the event affect the Aussie’s overall trends?

I’ve got the points you need to remember if you’re trading the comdoll this week!

RBA’s decision (Feb 2, 3:30 am GMT)

- As expected, the Reserve Bank of Australia (RBA) kept its policies unchanged in December

- AUD strengthened along with other high-yielding currencies but also gave up its gains until the early U.S. session

- In days after that, Governor Lowe and some RBA members have shared that the economy has “turned a corner” but that the central bank won’t raise its cash rate “for at least three years”

- Markets don’t see policy changes from the RBA this week

- Members are expected to upgrade their economic projections but also downplay any tapering in the foreseeable future

- Depending on how optimistic the growth forecasts are, AUD traders might price in early tightening anyway

- Governor Lowe has speeches scheduled in the two days after the policy announcement. Take note of clarifications and factors that the RBA is keeping close tabs on

Mid-tier data releases

- AIG’s manufacturing index reflected holiday-related recovery

- AIG’s construction index (Feb 2, 9:30 pm GMT) to dip from 55.3 to 54.0?

- AIG’s services index (Feb 4, 9:30 pm GMT) seen improving from 52.9 to 53.2

- Building approvals (Feb 3, 12:30 am GMT) to print at 2.3% after 2.6% growth in November

- NAB quarterly business confidence (Feb 4, 12:30 am GMT) clocked in at -10 in Q3 2020

- Trade balance (Feb 4, 12:30 am GMT) to reflect tighter trade surplus in December

- Retail sales (Feb 5, 12:30 am GMT) to drop by 4.3% after 7.1% uptick in November

Overall risk appetite

- Doubts on the AstraZeneca vaccine – which makes up the majority of Australia’s orders – limited AUD’s gains compared to comdolls like NZD. The Aussie could catch up this week as European countries put their orders in despite Germany’s findings

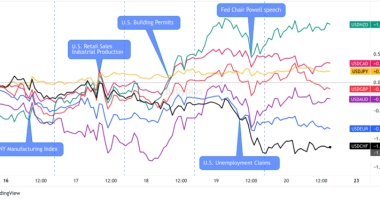

- Closely watched events like the Bank of England’s (BOE) policy decision and Uncle Sam’s labor market numbers can influence risk-taking (and comdoll demand) this week

Technical snapshot

- Bollinger Bands consider the Aussie “oversold” against the Kiwi on the daily time frame

- AUD is also almost oversold against CAD, USD, EUR, and GBP

- Simple moving averages show the short-term bearish pressure on the Aussie across the board

- AUD/NZD remains on short and long-term bearish trends on the daily time frame

- Like the Kiwi, the Aussie was most volatile against the safe-havens in the last seven days

This post first appeared on babypips.com