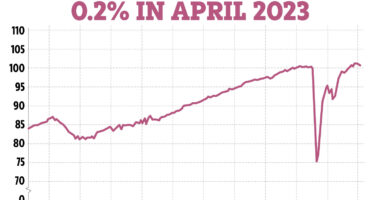

Private investors have outdone the professionals as they held fast to their strategies and defied market volatility, according to new data.

Investors with at least £20,000 in their portfolio have generated a cumulative average return of 8.2 per cent between January 2020 and October 2023, figures from broker Interactive Investor reveal.

That lags returns from the top market indices, but beats professional fund managers. The IA Mixed Investment 40-85% Shares sector returned just 7.7 per cent over the same period.

Beat the experts: Private investors have outperformed professional fund managers since January 2020

Over the past three years, II customers with at least £20,000 made an average return of 18.2 per cent, well ahead of the 10.3 per cent returned by the professionals. They were down 2.9 per cent over two years, but fund manager returns were off 5.5 per cent.

In fact, private investors have beaten the professionals across every time period since 2020, as seen in the table below, even in periods of volatility.

| Cumulative returns since 1 Jan 2020 – End Sept 2023 | 3 Years | 2 Years | 1 Year | 9 Months(year-to-date) | 6 Months | 3 Months | |

|---|---|---|---|---|---|---|---|

| Average ii customer (ii performance index methodology) | 8.20% | 18.20% | -2.90% | 7.90% | 2.80% | 0.60% | 0.80% |

| 18 – 24 | 10.30% | 12.60% | -6.10% | 6.40% | 2.60% | 1.00% | 0.70% |

| 25 – 34 | 10.60% | 14.30% | -4.80% | 7.00% | 3.20% | 1.10% | 0.60% |

| 35 – 44 | 10.70% | 15.40% | -3.30% | 7.10% | 3.90% | 1.20% | 0.60% |

| 45 – 54 | 9.30% | 16.40% | -3.60% | 7.40% | 3.30% | 0.90% | 0.60% |

| 55 – 64 | 7.60% | 17.10% | -3.60% | 7.50% | 2.60% | 0.50% | 0.70% |

| 65+ | 7.60% | 20.60% | -1.80% | 8.70% | 2.40% | 0.30% | 0.90% |

| IA Mixed Investment 40-85% Shares (GBP) | 7.72 | 10.3 | -5.54 | 5.27 | 2.21 | -0.04 | -0.21 |

| FTSE 100 (GBP) | 15.72 | 45.04 | 15.7 | 14.66 | 5.5 | 1.88 | 2.19 |

| FTSE All Shares (GBP) | 11.93 | 39.78 | 9.29 | 13.84 | 4.54 | 1.42 | 1.88 |

| S&P 500 (GBP) | 53.14 | 41.56 | 13.56 | 11.23 | 11.43 | 6.55 | 0.75 |

| Source: Interactive Investor Private Investor Performance Index to 30 September 2023. Income reinvested. | |||||||

Over the last year, investor returns have languished below market indices, returning 7.9 per cent in 12 months, but still ahead of the professionals who returned 5.27 per cent.

II customers have eked out a 2.8 per cent average return in the year to date, lagging the FTSE All Share index which gained 4.5 per cent and well below the S&P 500’s 11.4 per cent.

But they still remained ahead of fund managers who have returned 2.2 per cent since January.

Richard Wilson, chief executive of II, said: ‘In an ever-changing world, customers are sticking with solid long-term strategies, avoiding knee-jerk reactions, and patiently building long term wealth.

‘But they are also open to potential new opportunities, with bonds looking more interesting as yields have risen.’

What have investors been buying?

Investors have backed both active and passive strategies while also diversifying their portfolios by investing across the UK and US, says II.

Once one of the most bought investment trusts, Scottish Mortgage has fallen out of favour following significant share price falls.

Its highest ranking is currently second place amongst the 55 to 64-year-old age bracket, although it still remains in the top 10 across all age ranges.

In its place is Alliance Trust, which is the most held investment for the two youngest age brackets and for investors over the age of 65 following a period of strong performance.

Fundsmith Equity remains a staple for II’s investors, followed by Vanguard LifeStrategy 80% Equity, as investors increase their exposure to passive funds.

An emerging theme from II’s report is the growing popularity of bonds, following the recent surge in yields as markets price interest rates staying higher for longer.

Two UK government bonds, or gilts, made it into the top 10 most held investments among customers aged 25-34 and 35-44 in the third quarter of 2023.

‘Some investors are taking advantage by moving money into the bond market, where they are finally being rewarded with attractive yields – with gilts, where the risk of default is effectively zero, now paying between 4.5 per cent and 5 per cent a year,’ said II’s bonds specialist Sam Benstead.

‘Gilts come with the added bonus of being capital gains tax free, which has boosted the appeal of low coupon bonds set to mature soon, where the vast majority on the total return comes from capital appreciation when the bonds mature.’

> How to invest in gilts: Read our guide

Younger investors outperform their seniors

Another theme that emerges from II’s private investor index is the outperformance of younger investors compared to their seniors over the long term.

The oldest cohort – investors aged 65 plus – posted the best three-year return (up 20.6 per cent) as well as two and one-year returns.

However, this age group performed worst over the longest time frame of three years nine months, returning 7.6 per cent.

By comparison, the 18-24 cohort generated an average return of 10.3 per cent from January 2020 to the end of September 2023, while 25 to 34-year-olds and 35 to 44-year-olds have gained 10.6 per cent and 10.7 per cent respectively.

This can be partially explained by younger investors’ higher exposure to cash and bonds, which can pay off in a high interest rate environment.