The Swiss franc took the top spot this week as traders juggled risk against the backdrop of continued rising pandemic concerns, the Fed, and a regulatory crackdown in China.

Notable News & Economic Updates:

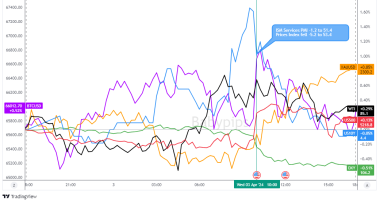

Intermarket Weekly Recap

Markets were in mostly in standby mode to start the week as trader awaited the highly anticipated monetary policy statement from the Federal Reserve. There was a bit of a risk-off vibes, though, due to the crackdown in China on tech companies, and likely on continued pandemic concerns as the number of new covid-19 cases continues to accelerate around the world. With both themes as the main drivers ahead of the Fed, it looks like all asset classes had trouble staying in the green through the Wednesday session.

We finally get to the Fed event during the Wednesday U.S. trading session, and as expected, they held off on any policy changes despite citing the continued economic recovery and rising inflation conditions. They did disappoint some though as their rhetoric on tapering wasn’t as strong as expected given the strength of inflation and the economy. This is likely why we saw the U.S. dollar and U.S. Treasury yields dip after the event, which was likely the catalyst for gold and oils initial rally through Thursday.

Crypto was a volatility outlier at the start of the week as Amazon bitcoin adoption rumors hit the wires on Monday, sparking a short squeeze in bitcoin, which pulled up the rest of the crypto space. It wasn’t too long that those same rumors were denied, leading to swift pullback at the end of the Monday session. Based on price action, this didn’t sway the crypto bulls as this apparently was another buying opportunity, taking the space back to Monday highs and beyond. Bitcoin traded 12% over the Sunday open at the close of the U.S. session on Friday.

In the forex markets, the majors were almost as mixed as the rest of the financial space due to individual catalysts and drivers, but there was a reflection of the broad risk-off sentiment as the comdolls underperformed (with exception of the Canadian dollar) against the “lower risk” European currencies. The biggest loser was the Australian Dollar (likely on Australian lockdown measures and expectations that the RBA may hold off on bond tapering), while the Swiss franc took the top spot being the most attractive “safe haven” for the week.

USD Pairs

GBP Pairs

EUR Pairs

CHF Pairs

CAD Pairs

NZD Pairs

AUD Pairs

JPY Pairs