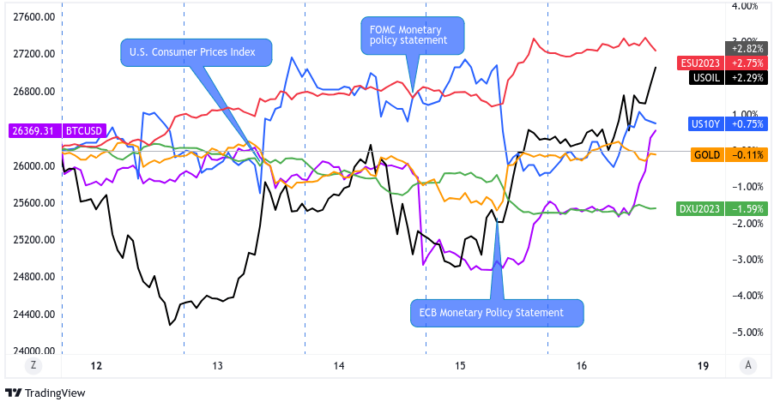

Central bank developments, particularly the FOMC statement, hogged the spotlight for most traders the majority of the week.

Downbeat data from China also garnered some attention, lifting expectations for more policy stimulus, keeping risk assets like commodities and equities supported.

Ready to hear what happened this week? Better check these market-moving headlines first!

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

People’s Bank of China cut 7-day reverse repo rate from 2.0% to 1.9% and lowered onshore reference rate by 200 points

Chinese industrial output slowed from 5.6% y/y in April to 3.5% y/y in May while retail sales rose by 12.7% y/y in May, lower than the expected 13.6% and April’s 18.4% growth, propping up stimulus hopes

Preliminary U.S. consumer sentiment read for June rose to 63.9 vs. 59.2 in May – University of Michigan

? Broad Market Risk-off Arguments

FOMC kept the Fed Funds rate range at 5% to 5.25% with a unanimous vote, but did signal further tightening (maybe two more hikes) still needed; no member signaled a cut in 2023

ECB hiked interest rates by 0.25% as expected and confirmed that reinvestment of bond purchases through Asset Purchase Program to end next month, with Lagarde hinting at another hike in July

API private oil inventories in the U.S. rose by 1.024 million barrels for the June 9 week instead of declining as expected while EIA crude oil inventory jumped by 7.9 million barrels instead of falling by 510K barrels as expected in the same period

U.S. Initial jobless claims: 262K (275K forecast; 262K previous); continuing claims rose to 1.775M

New Zealand is now technically in a recession with a -0.1% GDP q/q print in Q1 2023 after a 0.7% decline in Q4 2022

Global Market Weekly Recap

Equities kicked the week off on a positive note, as traders appeared to be pricing in expectations for a May U.S. CPI miss and an FOMC decision to pause tightening.

Gold and crude oil struggled to take part in these early risk rallies, though, as the latter was still reeling from demand outlook concerns and doubts that Saudi Arabia’s voluntary cuts would bear fruit. The precious metal stumbled due to higher bond yields leading up to the week’s central bank decisions.

Even gilt yields were able to draw support from upbeat U.K. jobs data and indicators of strong wage growth, as these fueled expectations for another BOE interest rate hike next week.

Commodities managed to regain their footing when the People’s Bank of China surprised the markets with their decision to cut the 7-day reverse repo rate from 2.0% to 1.9% and lower the onshore reference rate by 200 points.

Downbeat Chinese industrial production and retail sales data released later in the week also reinforced expectations of more stimulus for the world’s second largest economy, keeping risk-on vibes present. Strong numbers from Oracle and Nvidia also helped sustain the AI-fueled tech rally from the previous week.

However, crude oil returned some of its midweek gains when the API and EIA both printed inventory gains, reminding investors of global demand woes.

Even U.S. equities and the dollar wobbled when the FOMC dropped strong hints about resuming their tightening cycle on Wednesday during the U.S. session. Still, Fed head Powell downplayed the certainty of the dot plot projections suggesting two more rate hikes down the line, allowing equities to get their bearings back.

Initial jobless claims data came on Thursday, and once again caused a sharp decline in U.S. bond yields and the dollar as the figure came in at 262K – their highest level since October 2021. Headline U.S. retail sales surprised to the upside, but core data and underlying components still reflected weak spots in the consumer economy.

Meanwhile, strong earnings figures from Adobe and upgraded EPS projections on upbeat forecasts for its generative AI software allowed equities to shrug off bleak U.S. economic data ahead of the so-called “triple witching day” for U.S. stocks.

On Friday, the Bank of Japan released its latest monetary policy statement, holding policy ultra-loose as widely expected. It was essentially a non-event for broad market sentiment (arguably it provided some support for risk-on players), and after quiet Asia and London sessions, risk sentiment moved convincingly in favor of risk-on players during the U.S. session. The moves were most notably in oil and crypto prices, as well as bond yields.

The likely catalyst was the better-than-expected preliminary U.S. consumer sentiment read from the University of Michigan, adding fuel to rising speculation that a soft landing is the likely scenario ahead. And it’s possible too that there may be even some out there making moves who see a non-zero chance of the U.S. avoiding recession all together.