With FX volatility likely to see some life tomorrow, the tight range in CAD/JPY is one to watch for both short and longer-term setups.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at an opportunity forming on USD/CAD as it retests support, so be sure to check that out to see if there is still a potential play!

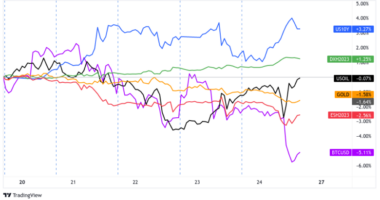

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14557.58 +0.66% FTSE: 6803.61 +0.80% S&P 500: 39362.71 -0.16% NASDAQ: 13471.57 +0.09% |

US 10-YR: 1.618% +0.011 Bund 10-YR: -0.335% +0.002 UK 10-YR: 0.792% +0.002 JPN 10-YR: 0.105% 0.00 |

Oil: 64.94 -0.69% Gold: 1,729.90 +0.041% Bitcoin: 56,260.00 -0.45% Ethereum: 1,796.77 -0.41% |

Fresh Market Headlines & Economic Data:

Dow retreats from record, falls nearly 130 points ahead of Fed rate guidance

U.S. retail sales declined in February as weather impeded demand

Factory production in the U.S. unexpectedly declines on weather

U.S. Homebuilder confidence drops as interest rates and lumber prices rise

U.S. import prices rise strongly in February, boosted by crude oil, commodities

Biden wants corporate tax hike, help for families making $110K, Aide says

German Economic Expectations Rise Again in March, ZEW Survey Says

Upcoming Potential Catalysts on the Economic Calendar

API Crude Oil change at 8:30 pm GMT

RBA Kent speech at 11:30 pm GMT

Japan Trade Balance at 11:50 pm GMT

Australia Leading Index at 12:30 am GMT (Mar. 17)

Spain Trade Balance at 9:00 am GMT (Mar. 17)

Euro area Inflation, Construction output at 10:00 am GMT (Mar. 17)

What to Watch: CAD/JPY

FX markets were relatively quiet once again, and likely to continue to be quiet in the upcoming Asia and London sessions as traders anxiously await the latest monetary policy statement from the Federal Reserve (Mar. 17, 6:00 pm GMT). The markets have been sitting on the sidelines, likely basing their decision on whether the Fed will take action on rising bond yields, i.e., potentially tighten monetary policy.

So, we’ve got markets trading sideways at the moment, forming consolidation breakout setups across the FX landscape. And the Fed’s statement tomorrow is so highly anticipated that it’s likely they don’t need to surprise traders with fresh actions to get the markets moving after the event, which means the odds of legit breakouts are likely better than even.

So, we’re looking to play a burst in volatility, and the price action in CAD/JPY (which has been trading in a tight 40-pip range so far this week) fits the bill for a potential short-term straddle play.

We like this pair also for its potential to be a swing / longer-term position given its longer-term trend higher and the Loonie’s recent run of better-than-expected economic updates (e.g., Canada sees blockbuster February job gain, Canada GDP Bests Expectations With 9.6% Climb in 4Q).

If the market does break down from the range and retests the previous swing (around 86.40), we’ll be on the look out for bullish reversal patterns for a potential longer-term position long trade.

If the market breaks higher and if the market reacts positively to the Fed’s monetary policy statement on Wednesday, then a play for an upside move makes sense for all ranges of time frames.

Of course, the risk management strategy would be different for whatever time frame you’re playing, and since we’re looking to do swing / position moves, an upside break may make sense to start scaling into a position, with potential entry points both above and below the current tight consolidation.