The Japanese central bank kept interest rates on hold at <0.10% as expected while mostly maintaining forecasts for next year’s growth and inflation figures.

- Bank of Japan (BOJ) benchmark rate steady at <0.10%

- Annual CPI projected to stay within 2.5-3.0% range in 2024 and around 2% for 2025 to 2026

Link to Bank of Japan’s April monetary policy statement

In their quarterly Outlook Report, the BOJ cited that the Japanese economy “is likely to keep growing at a pace above its potential growth rate.”

In terms of inflation, they outlined that the cost increases from earlier gains in import prices is expected to wane but that underlying inflation might still pick up due to output gap improvements.

Link to Bank of Japan’s Quarterly Outlook Report

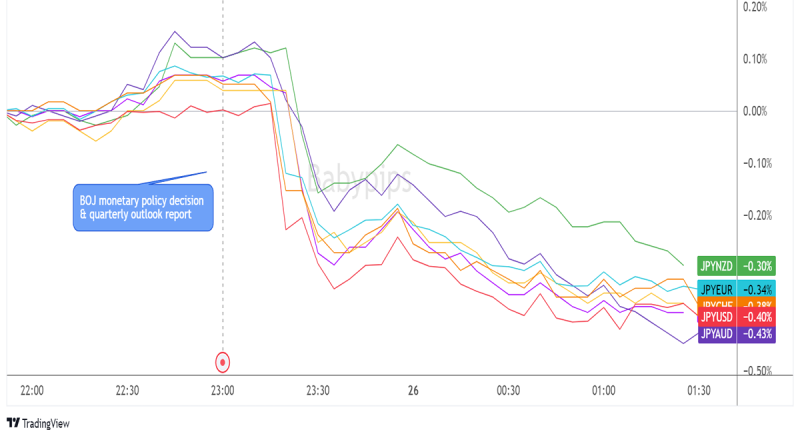

Market Reactions

Japanese yen vs. Major Currencies: 5-min

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese currency was cruising gradually higher against its counterparts leading up to the BOJ decision, as traders appeared to be wary of potential FX intervention.

However, the official statement did not contain any remarks concerning rapid yen moves nor did it have major changes to growth and inflation forecasts for the current year and the next. With that, the yen tumbled across the board minutes after the announcement and continued to edge lower while waiting for Ueda’s press conference.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!