The U.S. Consumer Price Index (CPI) rose by 0.4% m/m in March, inline with February’s inflation rate but a tick above the 0.3% m/m forecast.

On an annualized basis, the headline CPI read was up 3.5% y/y, mainly driven by shelter and gasoline increases. Energy costs rose for the first time in a year (up 2.1% over the last 12 months, while food prices increased modestly at 0.1% m/m. Grocery prices were flat while dining out costs ticked upwards (0.3% m/m vs. 0.1% m/m previous).

Excluding food and energy, the Core CPI still rose by 0.4% m/m in March, again consistent with the prior month read and above the 0.3% m/m forecast.

This was driven largely by shelter costs and a rapid rise in transportation services. Other increases were seen in categories like motor vehicle insurance, apparel, medical care, personal care, education, and household furnishings.

Countering this trend, used car/truck prices, recreation costs, new vehicle costs, and airline fares saw decreases.

Link to Consumer Price Index Summary from the U.S. Bureau of Labor Statistics

Market Reactions

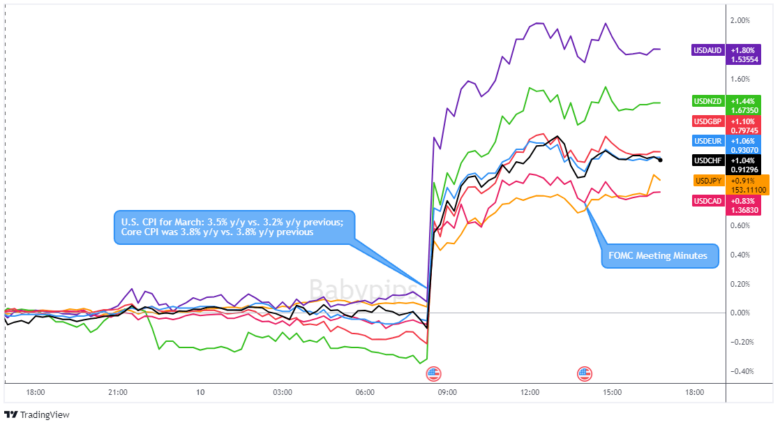

U.S. Dollar vs. Major Currencies: 15-min

Overlay of USD vs. Major Currencies 5-min Forex Chart by TradingView

Global Market Reaction to U.S. CPI

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

As expected with a hotter-than-expected U.S. read inflation, this read pushed back expectations of the next Fed cut to possibly September, where the current odds of a 25 bps cut currently stands at 44.9% (vs. 33.7% odds just yesterday according to CME FedWatch Tool).

The U.S. dollar and bond yields quickly popped higher in reaction to the event, and was very likely the reason why we saw a fall in equities, crypto and gold.

Roughly half of the U.S. dollar rally came within the first 5 minutes, giving traders an opportunity to catch the second half of the rally through the rest of the London session before the momentum died out, right before the latest FOMC meeting minutes were released.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!