In a few days, we’ll get a sneak peek of the manufacturing activity in the U.S., a top tier leading economic indicator!

Will the numbers ease or feed into U.S. recession fears?

Here are points you need to know if you’re planning on trading the event:

Event in Focus:

U.S. Flash Manufacturing PMIs for June 2023

The purchasing managers index (PMI) comes from a survey conducted among a few hundred purchasing managers in major business sectors, such as the manufacturing and services industries.

An index reading of 50.0 and above hints at optimism and industry expansion, while a reading of 49.9 and below denotes pessimism and possible industry contraction.

This is most often viewed as a leading signal to top tier economic indicators, most notably inflation and employment metrics, thus tends to draw in noticeable market reactions.

When Will it Be Released:

S&P final manufacturing PMI – July 3, 2023 (Monday), 1:45 pm GMT

ISM manufacturing PMI – July 3, 2023 (Monday), 2:00 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

S&P final manufacturing PMI: 46.3 forecast vs. 48.4 previous

ISM manufacturing PMI: 49.0 forecast vs. 46.9 previous

Previous Releases and Risk Environment Influence on the U.S. Dollar

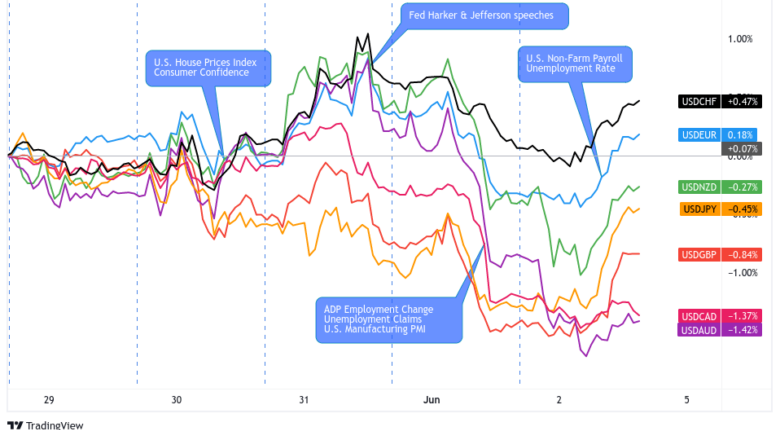

June 1, 2023

Event results / Price Action: ISM’s manufacturing PMI slowed down from 47.1 to 46.9 in May as easing demand and increased business uncertainty helped put the sector at a faster rate of contraction. Meanwhile, S&P’s manufacturing PMI was revised slightly lower from 48.5 to 48.4.

The numbers didn’t matter much for USD traders, who were more focused on the U.S. passing a bipartisan bill to suspend the U.S. debt ceiling and the Fed possibly “skipping” a rate hike in June.

The combo of risk-taking and repricing of the Fed’s policy direction dragged the dollar lower across the board and to new intraday lows where the currency capped its day.

Risk Environment and Intermarket Behaviors: Debt ceiling and global growth concerns dominated the markets early that week. The tides turned mid-week, however, thanks to “June skip” talks from Fed members and optimism over the passing of the debt ceiling bill.

The repricing of Fed rate hike expectations caused a reduction of U.S. dollar longs and a general move toward risk assets until a strong U.S. NFP report on Friday encouraged some profit-taking.

May 1, 2023

Overlay of USD vs. Majors Chart by TV Chart by TV

Event results / Price Action: The April PMIs came in mixed, with the S&P manufacturing PMI’s final reading revised lower from 50.4 to 50.2 while the ISM manufacturing PMI improved from 46.3 to 47.1. Details of the ISM report also showed increases in prices and employment activity, which probably contributed to hawkish Fed expectations.

The dollar already received a boost from JP Morgan acquiring the ailing First Republic bank but the better-than-expected ISM reading helped push the currency to new intraday highs against its major counterparts.

Risk environment and intermarket behaviors: The manufacturing PMIs came out on a Monday so there were not a lot of fresh market themes to compete with a direct reaction to the releases.

At the time, news of the JP Morgan acquisition and U.S. Senator Manchin reassuring the markets that the U.S. won’t default on its debts helped improve dollar demand and overall risk-taking.

Price action probabilities:

Risk sentiment probabilities: This week’s risk-friendly reaction to upbeat U.S. data releases and continued hawkish commentary from central banks suggests that, much like in the June release, traders are less worried about global growth, especially in the U.S.

Monday’s risk sentiment vibes may continue to lean positive on those themes, but that may shift quickly during the London session as the China and Europe will release their on business sentiment survey updates ahead of the U.S. Manufacturing PMI events. What those for risk sentiment direction, and as hints for what we may see in the U.S. updates.

U.S. Dollar scenarios:

Potential Base Scenario: Like in the May 1 release, the manufacturing PMIs will be printed on a Monday. This means that we have a better chance of seeing a more direct correlation between the PMI results and USD’s price reaction.

If the PMIs print weaker monthly readings as the markets are expecting and as the initial S&P manufacturing PMI printed, then concerns over Uncle Sam’s growth could drag USD against counterparts like JPY and CHF. Remember to take profits during the trading session, though, as fresh market themes could change the tides for USD demand.

Potential Alternative Scenario: If manufacturing activity turns out to be stronger than what traders are expecting in June, then the dollar could gain briefly against the majors as it plays into the idea that the Fed can stay hawkish for longer.

Depending on the degree of the upside surprise and the prevailing demand for safe havens, USD may see gains against counterparts like EUR, AUD, and NZD, especially if Chinese or European PMI’s print weaker-than-expected updates earlier in the session.