With traders leaning positive in risk and potential catalysts ahead from New Zealand, we’re checking out this short-term uptrend in NZD/USD for a potential short-term pullback opportunity.

Before moving on, ICYMI, today’s Daily London Session Watchlist looked at an opportunity forming on GBP/JPY ahead of the Bank of England’s latest monetary policy statement, so be sure to check that out to see if there is still a potential play!

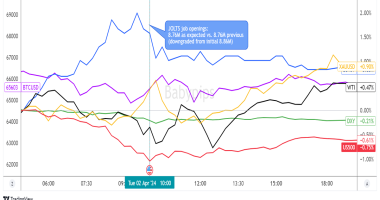

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 13695.08 +0.95% FTSE: 6565.43 -0.08% S&P 500: 3717.84 +0.45% NASDAQ: 12723.59 +0.52% |

US 10-YR: 0.90% -0.02 Bund 10-YR: -0.583% -0.015 UK 10-YR: 0.252% -0.018 JPN 10-YR: +0.005% +0.003 |

Oil: 47.50 +1.09% Gold: 1,854.60 +1.22% Bitcoin: 23,318.39 +9.47% Ethereum: 665.50 +3.05% |

Fresh Market Headlines & Economic Data:

S&P 500 and Nasdaq rise, hit record highs as stimulus hopes remain elevated

Bitcoin hits new all-time high above $23,000, extending its wild 2020 rally

Oil prices hit nine-month high after inventory draw

Congress closes in on a $900 billion Covid relief deal as Americans await aid

U.S. Housing starts rose for a third-straight month in November

885,000 people filed for U.S. unemployment benefits last week

Annual inflation stable at -0.3% in the euro area in November; Down to 0.2% in the EU

Bank of England holds rates steady as coronavirus outlook remains uncertain

EU Parliament issues 3-day ultimatum for post-Brexit deal

UK parliament will need time to approve any trade deal, says Gove

Swiss central bank chief rejects ‘currency manipulator’ label from the U.S.

Upcoming Potential Catalysts on the Economic Calendar

ECB Guindos speech at 5:30 pm GMT

New Zealand Trade Balance at 9:45 pm GMT

Japan Inflation rate at 11:30 pm GMT

Australia Business Confidence at 12:00 am GMT (Dec. 18)

U.K. Consumer confidence at 12:01 am GMT (Dec. 18)

Bank of Japan Interest Rate decision at 3:00 am GMT (Dec. 18)

What to Watch: NZD/USD

On the one hour chart above of NZD/USD, we can see forex traders were bullish on the pair after the FOMC meeting yesterday, which confirmed low interest rates in the U.S. for the next couple of years.

After an initial spike lower on the event, the bulls took firm control at the rising “lows” pattern, and pushed NZD/USD to the minor resistance area around 0.7120 and beyond.

With the stochastic indicator now showing potentially short-term overbought conditions after a more than one daily ATR move higher, the rally may have run out of steam and could be in for a pullback.

With no major catalysts expected to potentially shift the overall trend in NZD/USD (U.S. stimulus seems to be the major driving factor right now, with expectations for a deal this week), a pullback could draw in more bulls to play the trend higher.

We will get a potential catalyst from New Zealand in the form of the latest trade balance data, but it’s likely to not be a major market mover unless there is a big surprise.

So, for all of you NZD/USD bulls out there, if the NZ data draws no reaction and NZD/USD does pullback, watch out for bullish reversal candles on a retest of the broken minor resistance area / rising “lows” area marked on the one hour chart above.

If we do see a major catalysts shifting broad risk sentiment negative (e.g., failure to reach U.S. stimulus deal), that could turn the tone on NZD/USD towards negative. In that low probability event, look for a break below the rising “lows” pattern before considering a short position for a swing or short-term play.