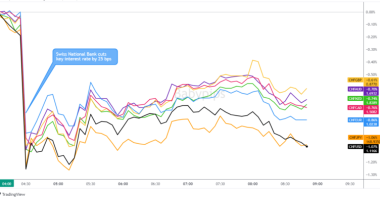

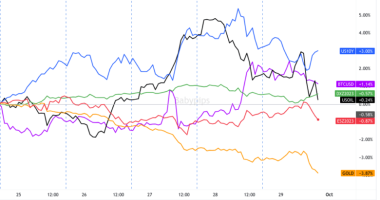

The euro sees red at the Friday close while the Swiss franc beats out most of the major in a subdued week of trading.

Economic updates were better than expected from Europe, so it’s likely the Brexit drama had traders shying a away from the euro and moving towards the franc for safety ahead of a potential Brexit finale this weekend.

The Euro

European Headlines and Economic data

Monday:

Sentix investor confidence index improves to -2.7 in December vs. -10.0 in November – “The surprisingly strong increase is based on the hope that the corona pandemic can soon be brought under control

through the use of vaccines.”

Michel Barnier offers downbeat take on Brexit talks to diplomats and MEPs

Michel Barnier says Brexit talks will not go beyond Wednesday

German Industrial Production Rose for Sixth Month in October – “Output increased 3.2%, twice as much as economists predicted, driven by investment goods. Rising orders, which have now surpassed pre-crisis levels, suggest manufacturing could sustain growth in the months ahead.”

EU tells Johnson to decide as time runs out for Brexit deal

Tuesday:

German investor sentiment rises in December, boosted by vaccines – “The ZEW economic research institute said its survey of investors’ economic sentiment moved up to 55.0 from 39.0 in the previous month. That compared with a Reuters poll for a reading of 45.5.”

EU shifting from compromise to no-deal preparations – Coveney

German leaders to discuss tighter COVID-19 measures this week – RBB

No substantial progress in Brexit trade talks, Germany’s Roth says

UK and EU reach agreement on Northern Ireland border issues

French trade balance in October 2020: -4.845B euros; “In October 2020, exports continue their recovery that began in June. They thus rose to 91% of their average level for 2019 (+3 points compared to September).”

GDP up by 12.5% and employment up by 1.0% in the euro area – “These were by far the sharpest increases observed since time series started in 1995, and a rebound compared with the second quarter of 2020, when GDP had decreased by 11.7% in the euro area and by 11.3% in the EU.”

Wednesday:

German Exports in October 2020: +0.8% m/m; Imports +0.3% m/m; Foreign trade balance: 19.4 billion euros October 2020; Current account: 22.5 billion euros

Statement by European Commission President Ursula von der Leyen following her meeting with UK Prime Minister Boris Johnson – “We will come to a decision by the end of the weekend.”

Thursday:

ECB Boosts Crisis Stimulus With Caveat on Not Using It All Up -The European Central Bank added 500 billion euros ($607 billion) and nine additional months to its bond-buying program as expected. There was little reaction to the event in the euro as it traded mixed, likely on broad risk sentiment drivers.

In October 2020, French manufacturing output slowed down to +0.5% vs +2.3% in September

Friday:

ECB’s Villeroy says financing conditions focus of latest stimulus decision

German inflation rate: -0.8% m/m in November 2020; -0.3% y/y

Italian Industrial production rises by 1.3% in October 2020; The unadjusted industrial production index decreased by 5.1% compared with October 2019.

The Swiss Franc

Swiss Headlines and Economic data

Volatility was relatively light this week for the Swiss franc as there was a lack of major events to move the global markets.

We did get a couple of headlines from Switzerland (The Swiss unemployment rate rose from 3.2% in October 2020 to 3.3% in November, Swiss government plans nationwide Covid-19 restrictions), but they didn’t garner much reaction from forex traders.

Instead, the franc was likely driven by a continuous flow of Brexit negotiation updates, which were mostly negative all week, and likely the reason why we saw a positive lean (hence the oversized gains against Sterling relative to the other majors). It’s arguable that traders were de-risking out of euros and Sterling and into francs ahead of what could be the final weekend of Brexit negotiations.

Its gains were limited, though, on Thursday and Friday, with no apparent direct catalyst. We did see some positive risk sentiment vibes on the latest vaccine-related headlines (e.g., rollout in the U.K., FDA working to quickly issue emergency authorization for Pfizer vaccine) that could have taken traders a bit away from safe havens, or its possible we could have seen general movement out of the European currencies like the franc ahead of this weekend Brexit meeting.