Interest rate cut speculations and economic recovery concerns kept comdolls like the Kiwi in the backseat last week.

Will we see some buying in the next few days?

Here are potential catalysts that might affect your comdoll trades:

NZIER business confidence (Oct 19, 9:00 pm GMT)

- Traders pay attention to busines surveys because the Reserve Bank of New Zealand (RBNZ) considers them in its policy decisions

- The last report showed business activity dropping sharply in Q2 2020

- NZD dropped around the time of the release but soon took its cues from overall market sentiment

- The Reserve Bank of Australia (RBA) will print its meeting minutes three hours after the report’s release, so NZD’s reaction to this week’s data could be limited

Quarterly inflation (Oct 22, 9:45 pm GMT)

- Consumer prices dipped by 0.5% in Q2 2020 as expected, while annual inflation slowed down from 2.5% to 1.5%

- NZD dropped across the board during the Asian session

- Analysts see a 0.9% consumer price increase in Q3 2020

- A much faster than expected inflation could cool down interest rate cut speculations and support NZD against its major counterparts

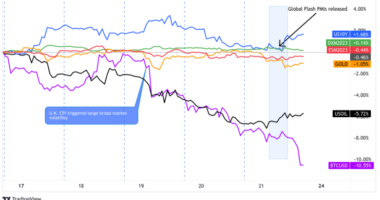

Market risk sentiment

- COVID-19 headlines will continue to influence risk-taking. Watch out for updates on lockdowns, stimulus, and vaccine production

- The final debate between President Trump and former VP Biden on Thursday could inspire volatility across the major currencies

- China’s data dump today at 2:00 am GMT can affect NZD’s trends as China is one of New Zealand’s biggest trading partners

- PMI reports from the European region can also paint a picture of global economic recovery and can affect overall risk-taking

Technical snapshot

- Stochastic considers the Kiwi “overbought” against the Aussie

- NZD/CAD looks ready to hit “oversold” territory

- NZD/USD and NZD/JPY remain at neutral levels on the daily time frame

- EMAs show a short-term demand for the Kiwi

- NZD/CHF remains mostly bearish on the daily time frame

- Watch out for a potential reversal on EUR/NZD

- NZD saw the most volatility against GBP, JPY, CHF, and USD in the last seven days

This post first appeared on babypips.com