I’ve rounded up FOUR mechanical forex strategies right here to see how they performed recently. Take a look!

I’ve got a neat systems snapshot table for their latest performance down below, but keep in mind that the time periods and some trading assumptions vary among my fellow FX-Men.

HLHB Trend-Catcher System

The “Huck Loves Her Bucks” mechanical system uses a simple EMA cross method, combined with the RSI and ADX indicators, to catch short-term trends on the 1-hour charts of EUR/USD, GBP/USD, and USD/JPY.

In this week’s update, Huck is celebrating the lack of fakeouts across the major dollar pairs. A single valid trade enabled her to lock in 152 pips (+0.51%) and now two of her open trades have either locked in pips or further limited their maximum losses. Read more.

SMA Crossover Pullback

Robopip’s newbie-friendly SMA Crossover Pullback trading system is as simple as its name suggests.

This strategy features an SMA crossover method to gauge the trend and a Stochastic pullback entry signal on the 1-hour charts of EUR/USD, GBP/USD, and EUR/JPY.

This strategy snagged a bunch of early exits but still managed to catch some pips on new crossovers.

There was a bit of choppy price action on Cable that led to tiny losses, but the system still managed to cap the week off with a nice 195-pip or 1.30% gain. Read more.

Inside Bar Momentum Strategy 2.0

Another tried-and-tested system is Robopip’s Inside Bar Momentum Strategy 2.0 which monitors purely candlestick price action, free of any technical indicators, on the 4-hour charts of GBP/JPY and USD/JPY.

This mech system carried on with its positive streak, but the gains weren’t all that impressive compared to previous weeks. USD/JPY ended up with a 20-pip loss on a couple of positions while Guppy scored a 21-pip win on a long play. Read more.

Short-Term Bollinger Reversion Strategy 2.0

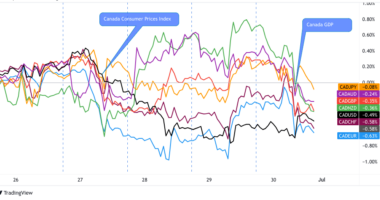

This Short-Term Bollinger Reversion Strategy 2.0 is one of Robopip’s newest creations and is currently being tested on range-bound pairs like CAD/CHF and USD/CAD.

USD/CAD managed to avoid losses on a trending market thanks to RSI while CAD/CHF wound up with a dent on an open position from the other week.

The strategy closed out with a 14.5-pip or 0.29% loss for the week and still has one long CAD/CHF position open. Read more.

Forex Systems Summary

| Mechanical Trading System | Time Period | P/L in pips | P/L in % |

|---|---|---|---|

| HLHB Trend-Catcher System | Feb. 8 – 12 | +152 | +0.51 |

| SMA Crossover Pullback System | Feb. 2 – 9 | +195 | +1.30 |

| Inside Bar Momentum Strategy 2.0 | Feb. 5 – 11 | +1 | – |

| Short-Term Bollinger Reversion Strategy 2.0 | Feb. 4 – 11 | -14.5 | -0.29 |

Check out how these trading systems fared in 2020: This post first appeared on babypips.com