After a parade of central bank decisions, traders can take a chill pill this week with only two major economic data releases.

Planning on making pips from these top-tier reports?

Check out what markets are expecting:

Major Economic Events:

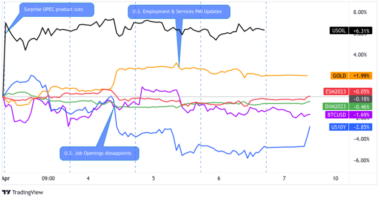

U.S. CPI reports (Feb 10, 1:30 pm GMT) – Capacity constraints in both the goods and services industries are expected to have pushed consumer prices 7.1% higher from a year ago in January. That’s the highest since 1982! Core inflation – which excludes volatile items such as food and energy – is seen rising from 5.5% to an annual rate of 5.7%.

High prices, combined with surprisingly strong labor market numbers last Friday, would put more pressure on the Fed to raise its rates in March. On the other hand, weaker-than-expected price growth would fuel talks that U.S. inflation has peaked.

U.K. preliminary GDP (Feb 11, 7:00 am GMT) – The U.K. economy grew by 0.2% in October and 0.9% in November before Omicron hit economic activity in December.

How much impact did Omicron have on the economy’s momentum? Traders project a 1.1% uptick after a similar pace in Q3 and a 5.4% jump in Q2.

Oh, and keep your eyes peeled for December’s industrial production and trade balance data released at the same time!

Major central banker speeches – Speeches by major central bank leaders may extend or pull back trends this week especially as traders in China come back from the holidays.

ECB President Lagarde will testify at a virtual hearing on Feb 7, 3:45 pm GMT; RBNZ Gov. Orr will talk at a summit on Feb 8, 2:15 am GMT; BOC Gov. Macklem will answer audience questions on Feb 9, 5:00 pm GMT; BOE Gov. Bailey will speak at an online event on Feb 10, 8:15 pm GMT, and RBA Gov. Lowe will testify at a virtual hearing on Feb 10, 10:30 pm GMT.

Forex Setup of the Week: GBP/USD

Cable showed its first red candlestick on Friday after a five-day streak of bullish candles.

Stochastic isn’t playing favorites right now but it looks like the bulls are finding support from the 100 SMA.

I’m looking at GBP/USD this week because it’s testing the top of a descending channel that hasn’t (really) been broken since mid-2021.

And then there are the U.S. inflation and U.K. GDP releases.

Expectations of a strong U.S. inflation could bring the bulls back to the dollar’s yard and drag GBP/USD back inside the channel.

The 1.3400 and 1.3200 previous support levels will make for good targets if we see sustained pound selling.

Meanwhile, risk-taking or expectations of a relatively strong U.K. economy in Q4 could extend the pound’s February upswing.

The 1.3700 psychological handle near the 200 SMA is the first barrier, but the pair could reach the 1.3800 inflection point if there’s enough buying momentum.