Homeowners with detached properties downsizing into a semi-detached house can net a windfall more than four times’ bigger than they could in 2020, experts say.

These movers now typically bank £205,157 – up from £44,226 in 2020, according to Jackson-Stops.

The national estate agency group says there has been a 21 per cent increase in downsizing enquiries since 2019.

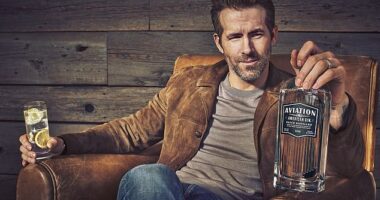

Selling: David and Ann Watney want to release cash from their six-bedroom detached home in Dorking, Surrey, which is now up for sale for £1.275m

More at the top of the ladder are being tempted to list their homes because of large value gains and rocketing energy bills.

Almost £600 billion in equity could be released by Britain’s downsizers by moving to a smaller home, according to Jackson-Stops.

Estate agents predict a spring boom in people with big homes selling up, with mortgage rates now falling.

And Surrey has become the downsizing hotspot. An owner of a four-bedroom detached house moving to a three-bedroom semi-detached home within the county could typically bank £800,000 in equity.

Nick Leeming, chairman of Jackson-Stops, says: ‘Baby boomers are prominent among our housing landscape and hold the key to unlocking property wealth.

‘Selling a much-loved, often large, detached family home, is usually put off until long after the kids have flown the nest.

They might now be facing a cold winter, with many rooms unused. Downsizing can relieve this strain, releasing cash to enjoy life.’

Agents say enquiries from downsizers rose in the final months of last year. One Jackson-Stops agent says this was the highest level of downsizing interest they have ever seen.

The majority of interest is from movers aged between 70 and 90 who want to stay local and move from between four and six-bedroom houses to single-level apartments with low running costs.

Winkworth Estate Agents has seen a similar trend in its country offices. Agents are having conversations with older homeowners who no longer want to pay to heat empty rooms and cannot maintain large homes with acres of land.

Value gains: Almost £600bn in equity could be released by Britain’s downsizers by moving to a smaller home, according to Jackson-Stops

By moving from a draughty five-bedroom house to a two-bedroom energy-efficient home, downsizers could save £5,000 a year in heating bills, according to charity Intergenerational Foundation.

Downsizing rose throughout 2022. Moving services firm, reallymoving.com, saw a 41 per cent rise in the number of people downsizing last year, releasing on average £86,000 by moving to a smaller property.

However, many owners are now waiting out the winter months and plan to list their homes for sale in spring.

Simon Jacobs, managing director of the Winkworth Devizes and Marlborough offices in Wiltshire, says things are starting to move at the top of the housing ladder.

‘We are receiving many invitations to do market appraisals on homes owned by the baby- boomer generation,’ he adds.

‘Having bought their homes in the 1970s and 1980s, many have seen values go up and up.

‘Now, they’re rattling around these big homes with large gardens that were affordable but are less so due to the cost-of-living crisis.’

Growing trend: Moving services firm, reallymoving.com, saw a 41% rise in the number of people downsizing last year, releasing on average £86,000 by moving to a smaller property

Retired professional ballet dancers Ole and Yvonne Dideriksen are downsizing for the second time.

Their two-bedroom period apartment in Tunbridge Wells, Kent, is on the market with Hamptons for £675,000. It is split over two floors and has no stairs.

Yvonne, 82, says they are both fit and healthy but recently they have seen friends and family who have made no plans for their future get dementia or Parkinson’s disease.

‘We want to downsize to a smaller and safer property that will be easier to manage and that doesn’t come with the same high monthly costs we pay now,’ says Yvonne.

The couple say there is a lack of suitable properties for people of their age unless they move to a retirement village. They are looking for a smaller apartment priced between £500,000 to £550,000.

After paying stamp duty and solicitor fees, Yvonne says the remaining cash will allow them to live independently and pay for health and nursing care when needed.

Ann Watney moved into her six-bedroom detached home in Dorking, Surrey, with her three young children in 1985, paying £153,000.

David, 77, her now husband, moved in a few years later with his two children. Their home is now up for sale for £1.275 million.

The property has a tennis court and a heated outdoor pool which the family loved to play in during winter but is no longer used, partly due to the heating bills.

Now in their 70s, their family is scattered across England and as far as Australia. Ann, 75, a retired architect, says: ‘We’ve enjoyed living here but we only use half the house.’

The couple decided to sell before the mini-Budget in September, which unfortunately sent the property market into a spin.

Ann and David have seen several three-bedroom detached houses in the £800,000 to £900,000 range but they cannot make an offer until they find their own buyer.

‘Like a lot of people our age we’re equity rich, income poor,’ says Ann. ‘By downsizing we’d have more money to spend on ourselves, help our family and improve our new home.’