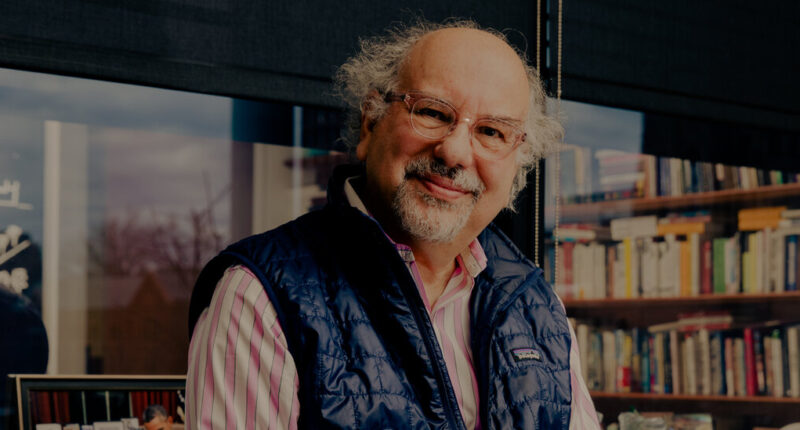

In 2018, Barry Nalebuff’s 89-year-old father entered the hospital for hip surgery and came out a daily drinker of the nutritional shake Ensure, which his doctor recommended. Mr. Nalebuff, a professor at the Yale School of Management and a founder of Honest Tea, blanched when he read the back of the bottle: After water, the first two ingredients were corn maltodextrin and sugar.

With Honest Tea, Mr. Nalebuff and his co-founder, Seth Goldman, had challenged sugary drinks like Snapple and Arizona, and their Honest Kids juices took aim at Capri Sun and Hi-C. Now he wondered: Could he do something similar for seniors, with a better-for-you challenger to Boost and Ensure?

Mr. Nalebuff teamed up with James Murphy, who he met through Yale, and David Perlmutter, a neurologist and author of several books on the relationship between diet and chronic disease, to develop Choose Health, a shake intended to promote longevity. It was to be organic, low in sugar and a better provider of fiber, probiotics and omega-3s than existing offerings. But four years later, it has yet to hit shelves.

“We brought Honest Tea to market within six months, and we thought we could do something similar here,” Mr. Nalebuff said. “Turns out, this is so much more complicated.”

In recent decades, upstarts have invaded practically every aisle of the grocery store, wearing away at powerhouse brands with products that were sustainable, organic, plant-based, gluten-free and whole grain. Chobani overtook Yoplait with its low-sugar, high-protein yogurts. Popchips and Pirate’s Booty now sit alongside Lay’s potato chips. In the baby food aisle, pouches of puréed blueberries and spinach are in; Gerber’s glass jars of stewed pears are out.

There is one product category, however, that has remained stubbornly unchanged: When it comes to grandma’s nutritional shake, Ensure and Boost still rule the market.

Mr. Nalebuff and his colleagues are beginning to understand why. The complexity of their product and supply chain issues have factored into the difficulty of starting Choose Health. But Ensure and Boost’s deep ties within the health care system also make unseating them an exceptional challenge.

From Hospitals to Health Drink

Ensure was developed in 1973 by Abbott — the maker of Similac infant formula, pharmaceuticals, diabetes monitors and Binax Covid testing kits — as a solution for patients suffering malnourishment as they recovered in hospitals. Patients unable to eat solid food had previously subsisted on concoctions blended up in hospital cafeterias, but the process was cumbersome, and the liquefied foods were not very tasty.

Abbott already had a baby formula business, and realized it could produce an adult version in the same facilities from many of the same sugars, proteins, oils, vitamins and minerals. Ensure’s milky drinks were calorie-dense, inexpensive, convenient and able to serve as a sole source of nutrition for vulnerable patients, which turned them into a commercial success.

By the 1990s, however, hospitals were driving harder bargains, and Abbott went searching for new avenues for growth. Since then, the company has marketed Ensure to healthy older consumers searching for ways to gain longevity.

Today, Abbott’s adult nutrition business — Ensure, plus a diabetes-friendly formulation called Glucerna and a handful of specialized clinical nutrition brands — generates $4 billion in revenue annually, and is growing at a steady clip: U.S. sales increased 6 percent in 2021, the most recent period for which data is available. There are now almost a dozen different varieties of Ensure.

Boost, a smaller competitor that was developed by the infant formula company Mead Johnson in 1995 and has been owned by Nestle since 2007, has its own suite of products to match.

To what extent these drinks provide benefits to adults capable of eating solid food is a matter of some debate. “I looked at the ingredient list of these things and I wouldn’t consume them,” said David Katz, a preventive medicine specialist and the founder and former director of Yale’s Prevention Research Center. “They’re extremely concentrated in added sugar.”

Advertisements for Ensure and Boost have been cited by the Center for Science in the Public Interest for what it calls misleading claims about their benefits, from their ability to help rebuild muscle mass to their role in supporting immune function. In 1997, Abbott settled on Federal Trade Commission charges that it made false and unsubstantiated claims in a national advertising campaign by saying doctors recommended Ensure as meal replacement for healthy, active adults.

Josh Anthony, a nutrition scientist and physiologist who worked on the Boost brand while it was still owned by Mead Johnson and currently runs a nutrition consultancy called Nlumn, sees a disconnect between the drinks’ original purpose and the role some consumers want them to fulfill.

“These products are well designed for what they were originally intended to do, which is to help support nutritional needs for patients who couldn’t get enough energy from food alone,” Mr. Anthony said. “But are they optimized for a wealthier Boomer seeking performance benefits? No.”

New Products Meet Roadblocks

Entrepreneurs want to fill that gap. Older Americans hold a majority of the country’s wealth, which helps make a nutrition drink aimed at seniors appealing.

But Ensure and Boost have a leg up on reaching older customers, who are often first exposed to the brands in a hospital, where a doctor or dietitian recommends them. Retail sales are more profitable, but a presence in hospitals is critical to acquiring customers and driving brand credibility.

Steve Allen, who worked at Nestle while it looked at developing a rival product, recalls the halo effect of a doctor’s recommendation. “If you showed people a product identical in nutrition to Ensure at 50 percent lower cost and asked them if they would buy it, they’d say no,” said Mr. Allen, who is now a partner at the venture capital firm Digitalis Ventures.

Abbott also employs hundreds of sales representatives who call on doctors to educate them about the benefits of its products, and the companies also typically keep hospitals and doctors offices stocked with free samples for patients.

Brent Taylor, a co-founder of the alternative protein company Beyond Meat, describes Ensure and Boost’s relationships with hospitals as a major roadblock in starting Perennial, a plant-based nutrition drink geared toward seniors, in 2019. “You’re competing against ‘the No. 1 doctor recommended brand,’” Mr. Taylor said, referring to Ensure’s pervasive marketing message. “That’s a real challenge, and very capital intensive.”

Recommendations from health professionals are especially valuable in a market where the typical playbook for a consumer product start-up — rely on digital marketing to drive direct-to-consumer sales, then encourage retailers to stock the product in stores — may not be as effective. Seniors are less willing to buy something online than the younger consumers.

“When we would sample at pickleball courts, the question that always came up was, ‘Where can I go buy this?’” Mr. Taylor said. “They meant physical stores, not online.” He and his co-founder, Sara Bonham, shuttered Perennial in 2021, after failing to secure additional capital.

For an upstart brand, cracking into hospital distribution amounts to a moonshot. Hospitals typically enter multiyear contracts with either Abbott or Nestle to provide a broad portfolio of clinical nutrition products — and, in Abbott’s case, a host of other medical supplies. In some cases, these contracts are exclusive; the hospital must use Abbott or Nestle for its clinical nutrition needs to maintain special pricing. In others, volume discounts or rebates discourage new products from competitors.

When Andrew Abraham started an organic nutrition company called Orgain in 2009, he discovered early on the power that incumbents wield.

“I would go into these hospitals with a case of Orgain to give to nutritionists, and I was so proud that I could do it, because it was a big expense for me,” he said. “I’d turn the corner in the hospital and see a pallet of Ensure. ”

Mr. Abraham instead expanded the brand through a mix of retail and online sales, eventually adding plant-based protein powders, as well as a nutritional shake for children. Nestle recently bought a controlling stake in Orgain, and is helping it expand in the health care system.

A nutrition brand called KateFarms that makes organic, plant-based shakes has managed to find a toehold after more than $100 million of fund-raising. Brett Matthews, the company’s chairman and chief executive, said that after investing behind extensive clinical research, navigating the complex process of qualifying for insurance reimbursement and building a large portfolio to fill a hospital’s needs, the drink is in 800 hospitals.

Many within the industry expect more new products geared toward older adults. Science on which dietary interventions may slow physical decline is developing rapidly, and a consumers are more nutritionally savvy.

Just look at what has happened with infant formula. Here Abbott also remains the category leader, but has had to defend against competitors like Earth’s Best, Happy Family Organics, and Bobbie, which appeal to millennial parents who are looking for ingredients like grass-fed dairy and organic coconut oil. As those same consumers become caregivers for their aging parents — and then become aging parents themselves — it stands to reason they will take the same approach.

In the meantime, absent major breakthroughs, those who can chew and swallow enough food to maintain a healthy weight may be better off just skipping the shake, said Mr. Katz, the preventive medicine physician.

“We have vivid evidence of what works, from places in the world where people live to be a hundred or more with their cognition intact,” Mr. Katz said. Those subjects are physically active and maintain a proper diet and sleep habits, he said, adding, “They’re not drinking nutrition shakes.”

Source: | This article originally belongs to Nytimes.com